LEND

PuyooolLEND is a new and innovative multi-chain crypto lending protocol.

Introduction to $LEND

LEND is the future of DeFi. LEND, is our DeFi multi-chain lending platform, designed from the ground up with the aim of creating a fully inclusive decentralized finance ecosystem with no barriers to entry. With LEND, our users will be able to know that they are safely maximizing their crypto asset earning potential and savings. Users can interact with the protocol in a number of ways; Deposit crypto assets to earn competitively high interest, similar to a traditional savings account. Or use their crypto assets as collateral to borrow tokens.

$LEND will connect crypto and fiat lenders, borrowers and lenders together in an open, efficient and decentralized network. $LEND will offer a blockchain-based identity and credit score to the crypto community. The Lend project aims to create a protocol for decentralized loans with collateralized loans. It will provide an open source loan engine that enables trustless loans by maintaining a fully secured loan pool.

Loans — Supply of assets to the protocol to earn interest

Borrowing — Providing assets as collateral for borrowing crypto

Governance — Vote on important future protocol decisions

Earnings — Earn 25% of all platform revenue with $LEND tokens

MultiChain — Launched BNB Chain, Eth & Polygon with complete framework for many other chains. Each chain means an additional stream of revenue that will be earned by the creator of the $LEND token.

How LEND works:

LEND works by creating a Loan pool from stored crypto assets. This lending pool is a collective token of all users who wish to deposit assets and is used to facilitate loan requests from other LEND users. Loan pools are derived algorithmically and have variable floating, but competitive interest rate models, based on the current supply and demand of each asset. If supply exceeds demand, it will have lower rates for both borrowers and lenders.

The $LEND token is a decentralized cryptocurrency. The $LEND token can be used to trade, lend, pay for goods and services, and much more. The $LEND platform is an easy-to-use lending platform built on the Bsc network. The $LEND platform provides a fair, fast and transparent decentralized lending process. Lenders can make money by lending their $LEND Tokens to borrowers who pay them back at interest rates.

Why do you need LEND

The $LEND token will be the native token for the LEND protocol. Within the token structure, tokens will give holders control and a say in important decisions to shape the future of the platform. It doesn't end there though…

The $LEND token is also the key to earning passive income from the protocol. Once the token is launched, holders can provide $LEND to the protocol in exchange for $tLEND which actually qualifies them to claim 25% of the total revenue generated by the protocol! 25% more than the current protocol! Can Venus do that?

$tLEND tokens can also be staked or locked by users to earn additional Platform Reward Fees based on a 90-day vesting schedule. Locking tokens for a full 90 day period means an increased share of the protocol's revenue will be received.

Is LOAN safe?

Sustainability, security and overall longevity of the LEND protocol is something we keep in mind from day one. We don't aim to be successful overnight, we've been building this ecosystem for over a year and aim to last even longer.

With LEND we really want to ensure the security of the protocol from any bad events. To protect our users and ourselves, we have adopted a risk mitigation approach for all aspects of the platform.

LEND Security Features:

Security Audit — Leading industry experts at Peckshield have reviewed and approved LEND smart contracts multiple times.

Collateral Requirements — All borrowers must be provided with excessive collateral for optimal liquidity in the protocol. This means users have to provide more collateral than they can borrow.

Liquid Assets Only — LEND will only support the most liquid assets on the market. This has been done to avoid protocol manipulation which could result in total system failure. (Like Mango)

Automatic Liquidation — Unsound borrower accounts that go into negative equity will be liquidated by the protocol to write off bad debts.

For lenders, this feature means you can provide assets and earn interest without being exposed to a lot of counterparty risk.

How LENDs Operate

Within the LEND ecosystem, each asset supported by the Protocol has a tToken version of that particular asset. So when an investor supplies an asset, they will receive a tokenized version of it. Using USDT as a case study, if an investor provides USDT for a Loan, he will receive $tUSDT. Investors can earn interest automatically because the tToken they own is used to create loan balances by other participants in the protocol. It is also important to note that when supplying tTokens, the base amount of tTokens supplied will increase in value over time much like a savings account. Proprietary tokens are required when dividing collateral to create loan balances.

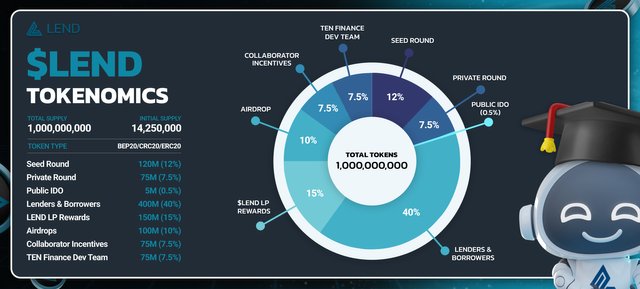

Tokenomics

- TOKEN SYMBOL: LOAN

- TOKEN TYPE: BEP20/ERC20

- TOTAL SUPPLY: 1,000,000,000

- INITIAL SUPPLY: 14,250,000

- INITIAL MARKET CAP: TBA

Token Allocation

- 12% - 120,000,000 LEND Allocated for Seed Round

- 5% at TGE, 4 months cliff with linear vesting from 5 -> 15 months of 8.64% per month

- 7.5% - 75,000,000 LEND Allocated for Private Round

- 10% at TGE, 3 months. bluff with linear vesting from 4 -> 12 months of 10.00% per month

- 0.5% - 5,000,000 LEND Allocated to Public IDO

- 15% at TGE, 1 month cliff with 5 months linear vesting of 17% per month

- 40% - 400,000,000 LOANS Allocated to Lenders & Borrowers

- 15% - 150,000,000 LEND Allocated for LP LEND Rewards

- 10% - 100,000,000 LEND Allocated for Airdrops

- 3 month bluff, 25% released every 90 days, must hold TENFI tokens to maintain airdrop, otherwise defaults to prize pool

- 7.5% - 75,000,000 LOAN Allocated for 3 months Cliff Collaborator Incentive , 25% released every 90 days

- 7.5% - 75,000,000 LEND Allocated to TEN Finance Dev Team

- bluff 24 months, then vesting linearly for 5 years

.jpg)

$LEND utility?

The $LEND token is the key to getting real results from the LEND protocol. Under the $LEND token structure, the token will give the holder control and a say in important decisions to shape the future of the platform. So by holding $LEND you will be able to determine the future direction of the protocol.

The $LEND token is also the key to earning passive income from our ecosystem. Once the token is launched, holders can supply $LEND to the protocol in exchange for $tLEND which actually qualifies them for a significant portion of the total revenue generated by the protocol.

Steve takes his $LEND token, supplies it to the Money Market at app.ten.finance -> Steve then receives his $tLEND token as deposit receipt. Holding $tLEND allows him to also receive additional $LEND tokens as an incentive to supply his tokens to the market.

ROADMAP

Conclusion

This platform is built on top of the LEND token which has several key features that make it unique. Tokens are used as a medium of exchange between investors and borrowers. All transactions are carried out using LEND tokens. This ensures that there will be a limited supply of tokens on the market. This in turn will allow it to appreciate in value over time. Tokens are used to pay for transaction fees on the platform. This fee will be determined by the platform.

For more information:

Website: https://www.lend.finance/

Whitepaper: http://lend.gitbook.io/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com/lend_finance

Github: https : //github.com/tenfinance

Media: https://medium.com/lendfinance

Forum Username:Puyoool

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3496077