Intraday. Currencies

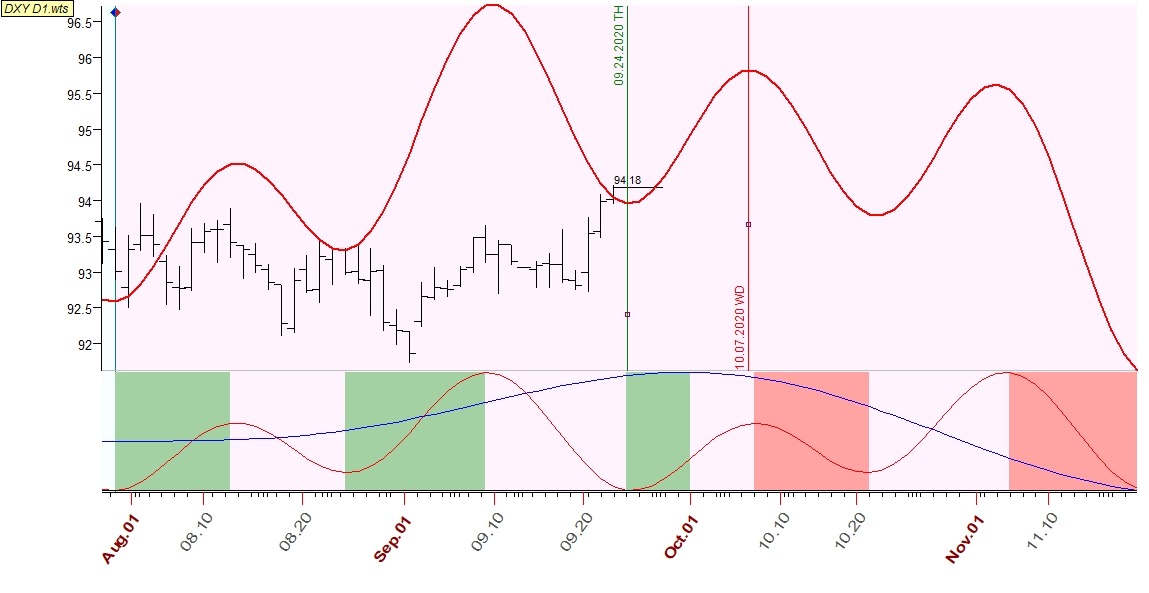

TS Forecasts. Sergey IvanovDX

I have to reduce Ov amount to 2 for dominant 121days cycle. It gives the following projection in a couple with another significant 40 days cycle. This allows to enter bullish phase from current dates, that corresponds to EW structure as well.

Wave 3 of (iii) is in process, so, stay bullish.

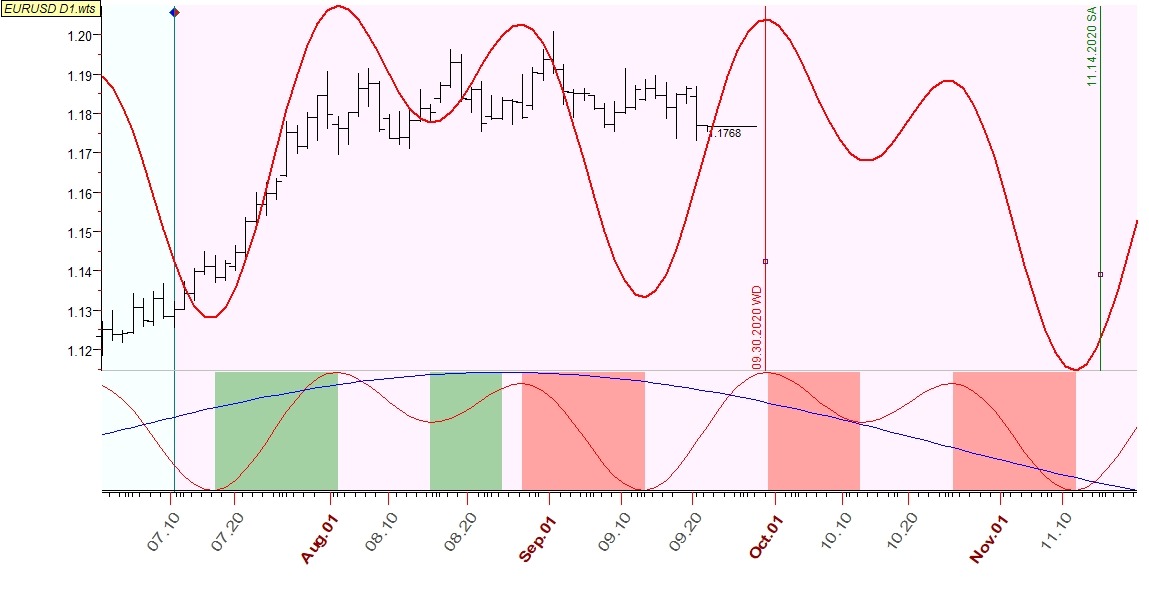

EURUSD

EURUSD is affected by 40 days cycle as well as DX. It gives more significant bearish turning point next WD only.

Wave iii (in circle) of C is in process. Stay bearish unless C wave is accomplished.

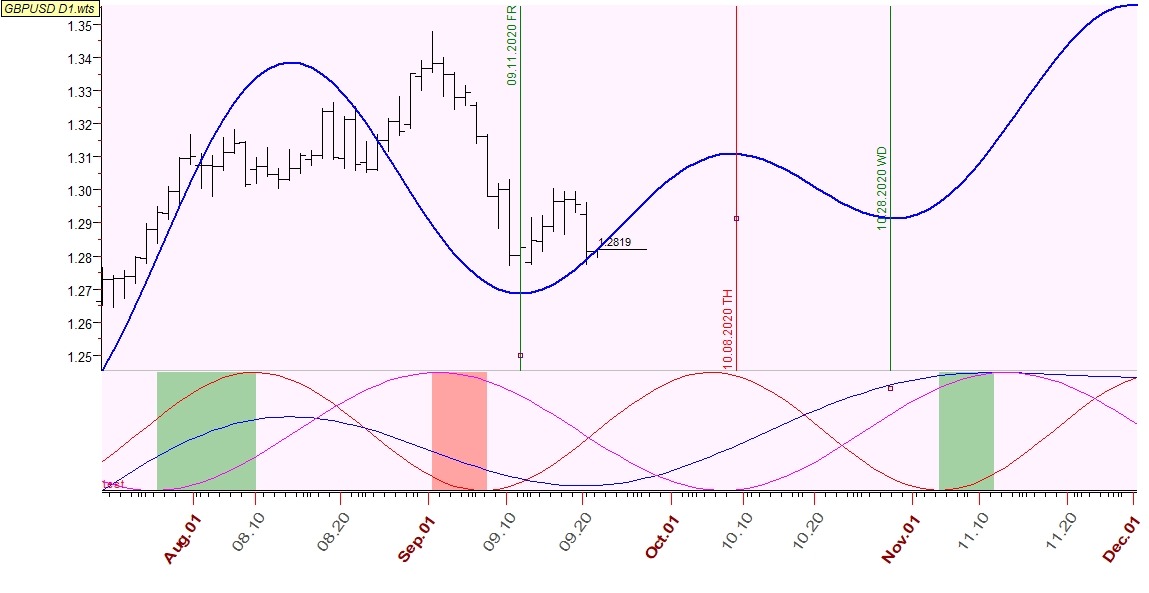

GBPUSD

Bullish phase. Yet, cycles period is quite short for impulse move. It makes more probable development of some consolidation.

The following EW structure of corrective triangle in B wave becomes highly probable.

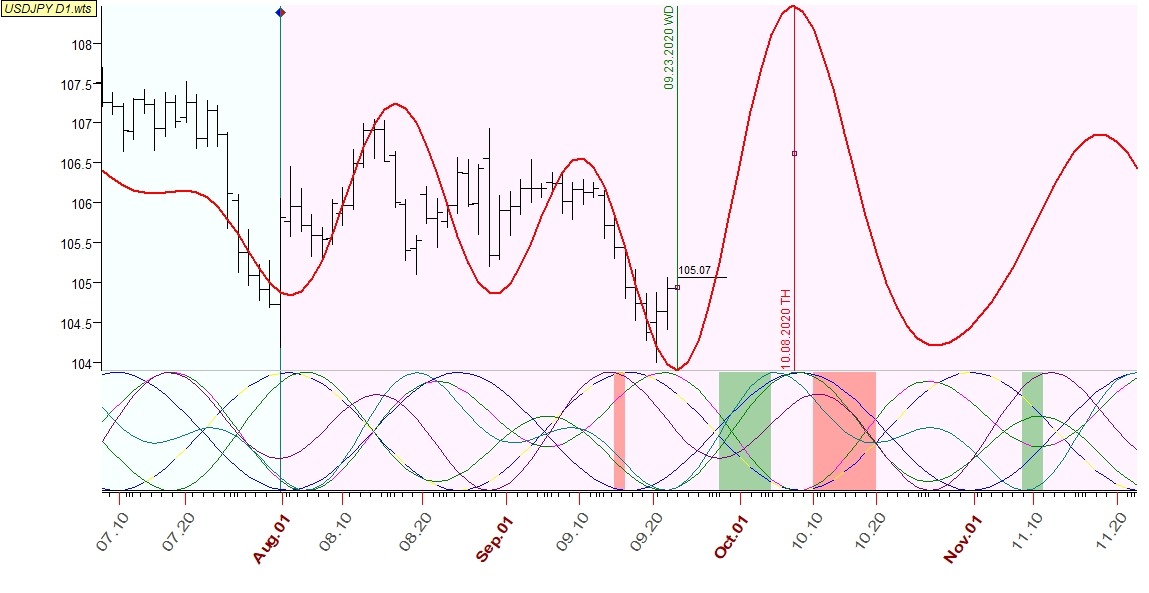

USDJPY

Price reached bullish turning point. Stay bullish for the next two weeks.

Hold on your bullish positions which were recommended to buy yesterday at 104.45 level. Shift SL under wave b low at 104.40.

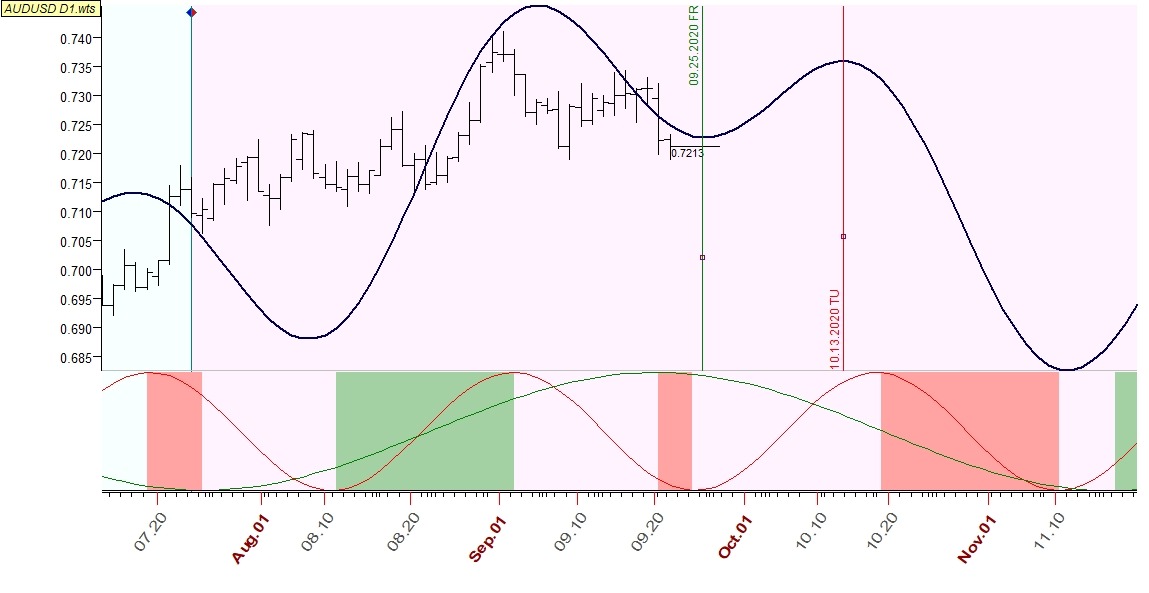

AUDUSD

Stay bearish till the end of the week.

Stay bearish unless wave C of 2 is accomplished.

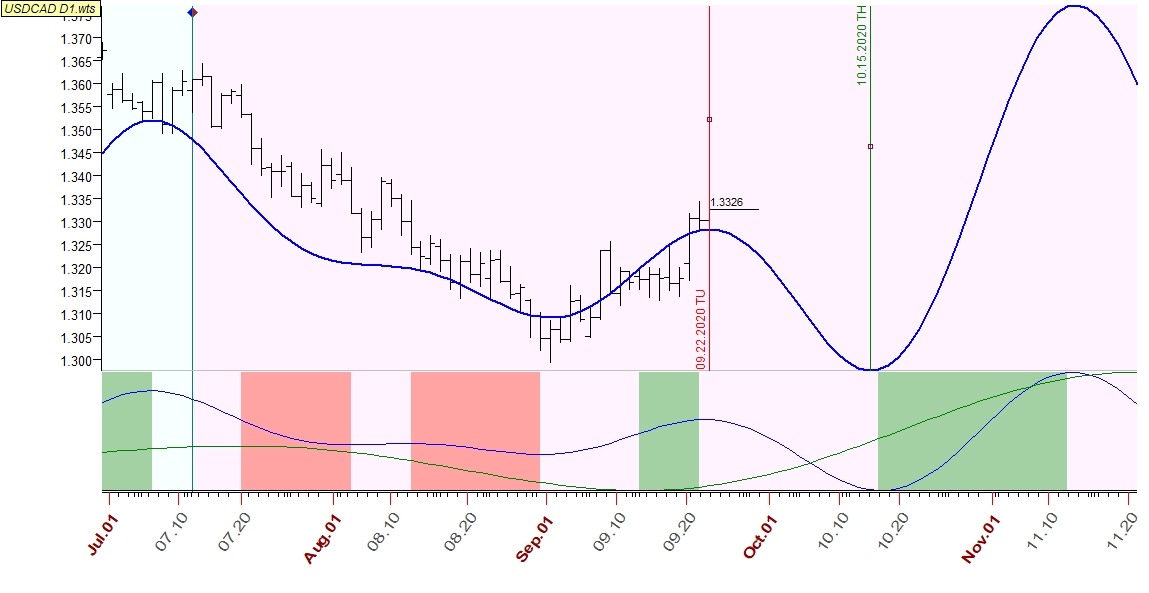

USDCAD

We have bearish turning point today.

Price starts developing wave (iii) of C (in circle). So, it is recommended to enter with order parameters depicted at the price chart. Yet, keep in mind that the whole bullish structure in CAD is too complicated and might be considerably changed if price sharply falls.

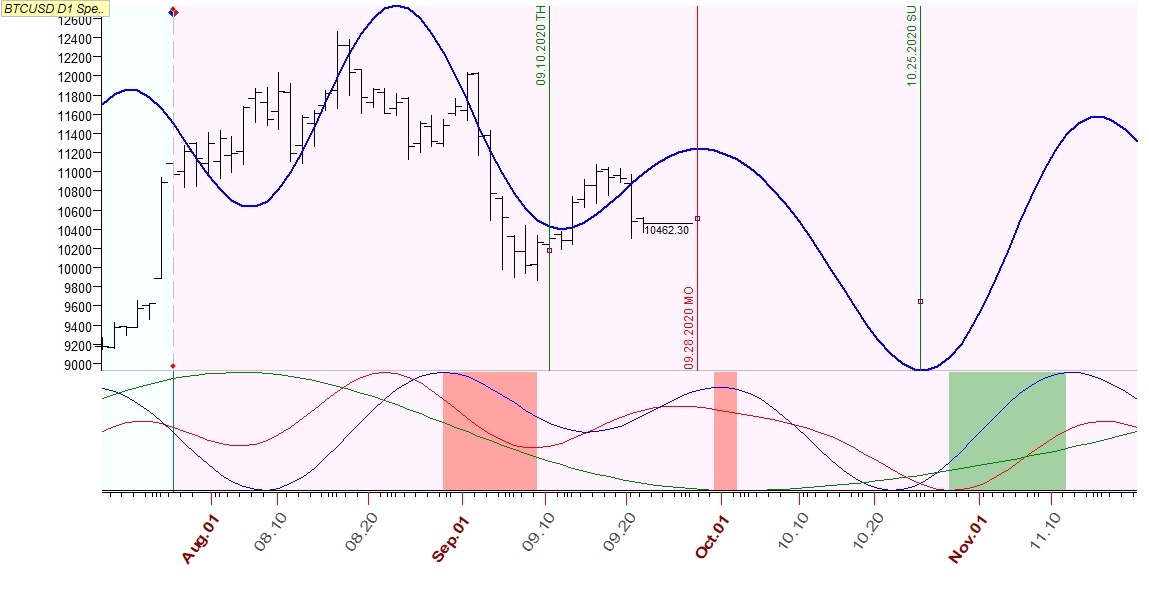

BTCUSD

Look for bearish turning point.

Stay bearish and/or add short position after price breaches trend support line of wave (iv).

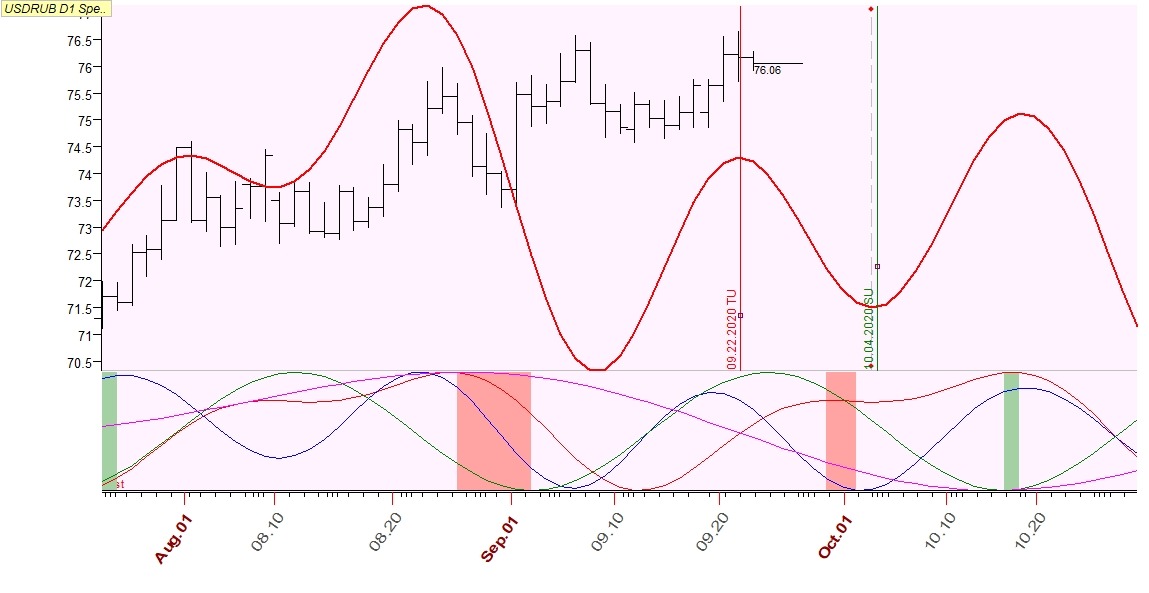

USDRUB

Bearish turning point.

Still one more peak is possible if wave iv (in circle) obtains the form of triangle. So it will become reasonable to look for bearish opportunities only if price drops to 74.80 first.