Intraday. Currencies

TS Forecasts. Sergey IvanovDear subscribers,

Intraday format includes updates of price chart and projection lines at daily time frames. M30-H1 projection line will be provided additionally in form of screenshots if price comes to projected turning point for this small time frame. At this daily updates intraday changes are mostly depicted by EWA.

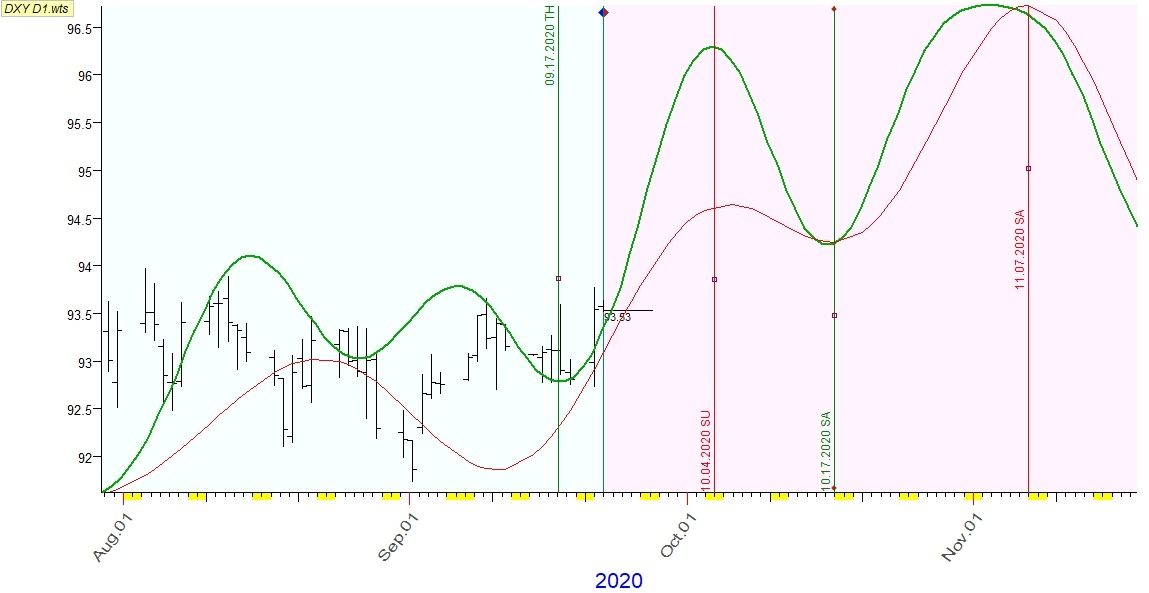

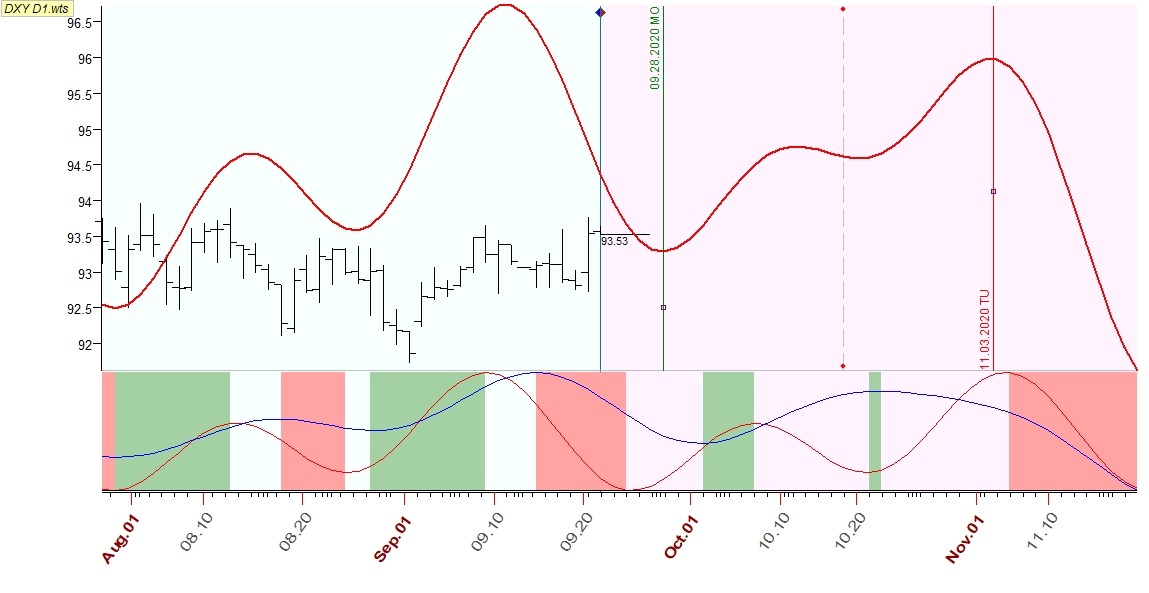

DX

It looks that price starts following annual cycle lines right from MO. If so, it is reasonable to expect further growth for the next two weeks prior the first interim bearish turning point.

However, Q-Sp projection insists on current bearish correction for this week till the next MO when all three lines are aligned.

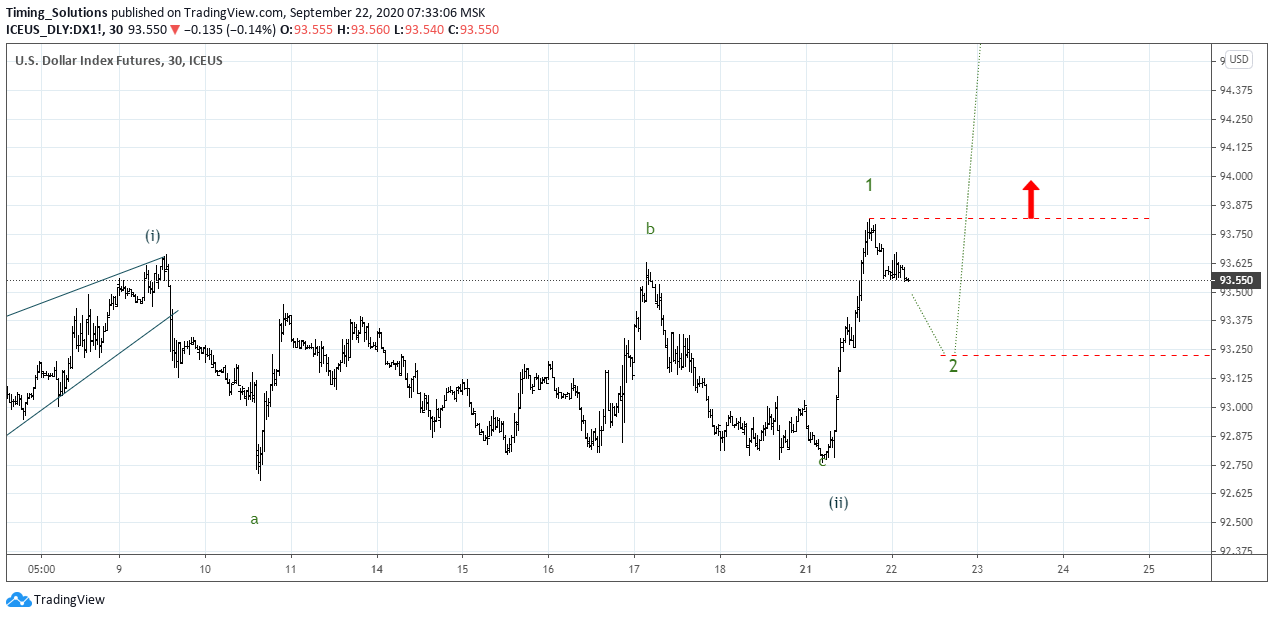

Finally, EWA supports further price development into wave (iii) of C.

Corrective wave (ii) was trancated (wave c wasn't able to renew wave a low) that is quite rare case. So, looking at smaller time frame we may state that corrective wave 2 is going to develop probable for the rest of the week. But we clearly have bullish entry level and SL.

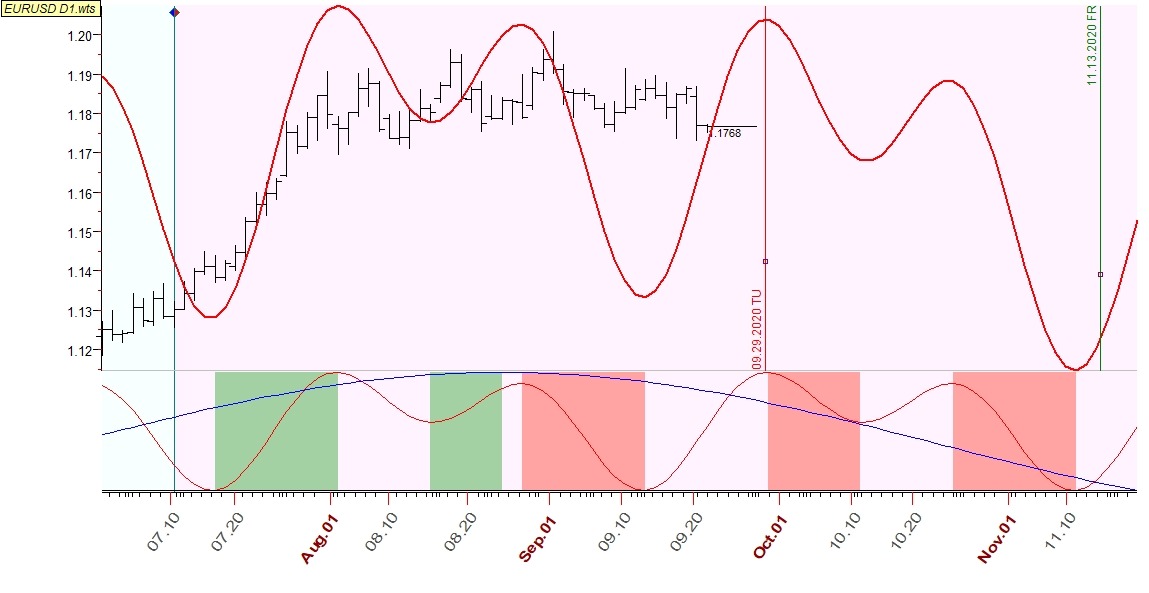

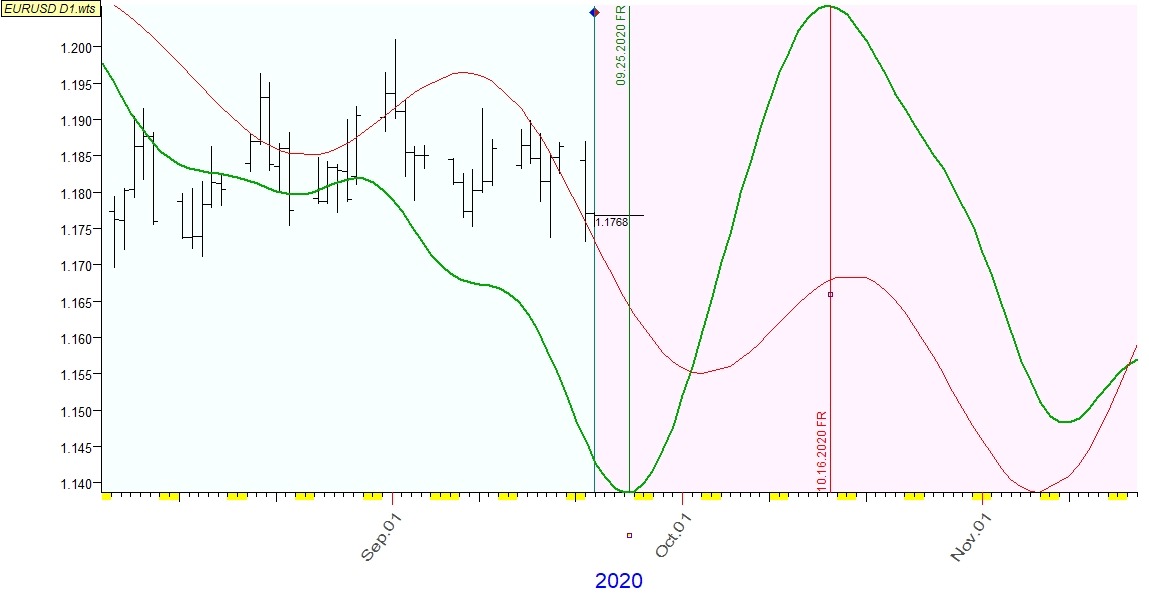

EURUSD

Pay attention that EURUSD along with DX is currently into bullish phase vs USD till the next week MO-TU.

Annual cycle contradicts to bullish projection and stay bearish till the end of the week.

All three lines are aligned from the second half of Oct. From EWA viewpoint and taking into account contradictions between projection lines all this might be resulted into wave B development in a form of triangle.

Yet, it is reasonable to place sell stop order at depicted level.

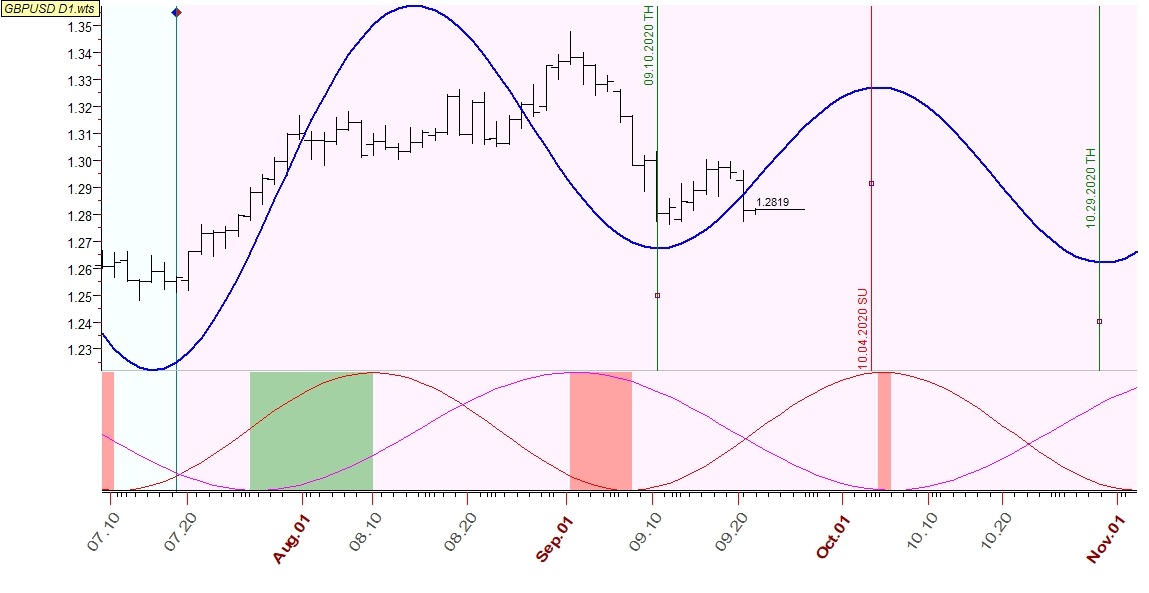

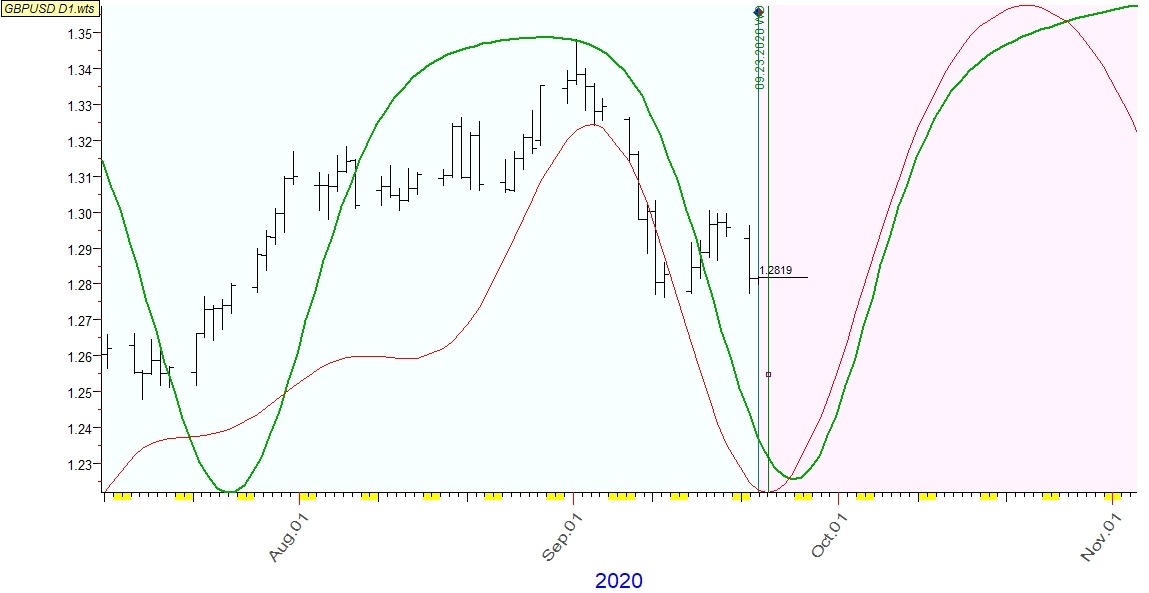

GBPUSD

Pound is into bullish phase till beginning of Oct. Thus, current drop might be corrective.

Annual cycle suggests bullish turn this week.

EWA suggests bullish turn from current levels. If price drop below 1.2763 it will adjust structure, but not expectations of growth to 1.3006 at least.

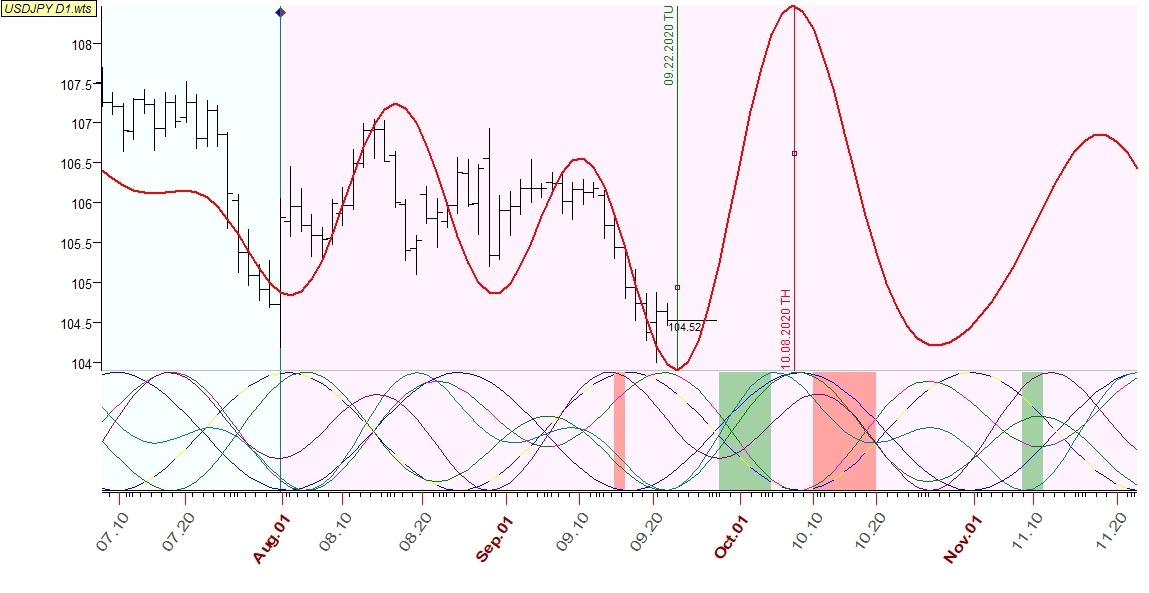

USDJPY

We have bullish turning point today.

EW structure was a little adjusted. Currently we have wave (iv) of ending diagonal under development.

It is reasonable to buy the pair at 50% cutback level at 104.45 and SL below yesterday's low.

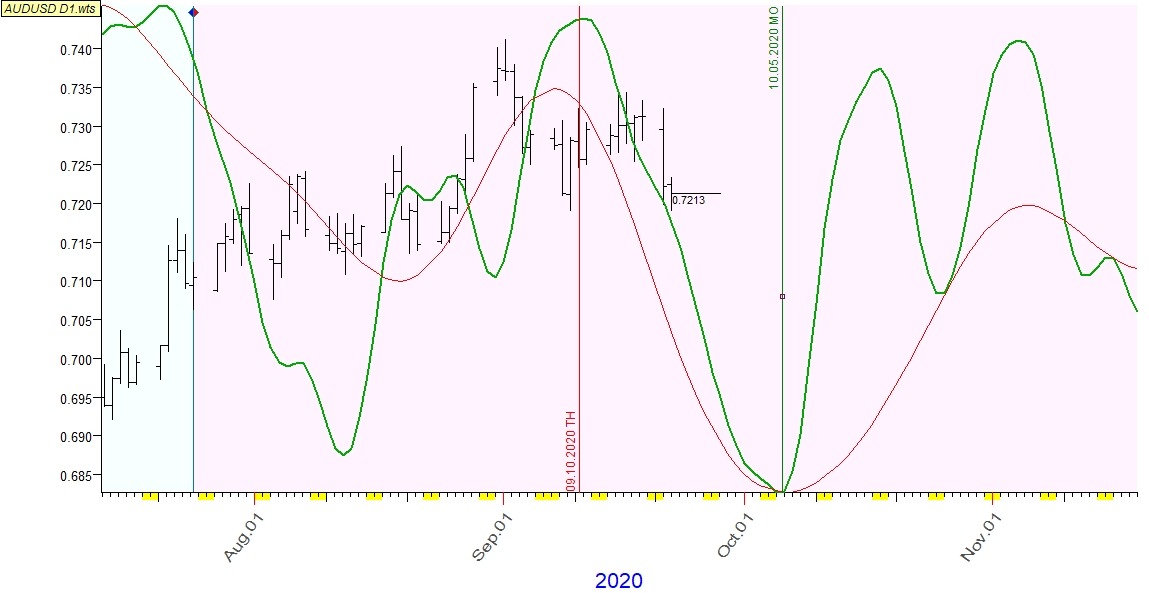

AUDUSD

Price clearly follows annual cycle lines which support decline for the next two weeks.

Price as it was expected declined into wave iii of C. So one more bullish bounce is expected in wave iv prior the final drop to accomplish the whole corrective wave 2.

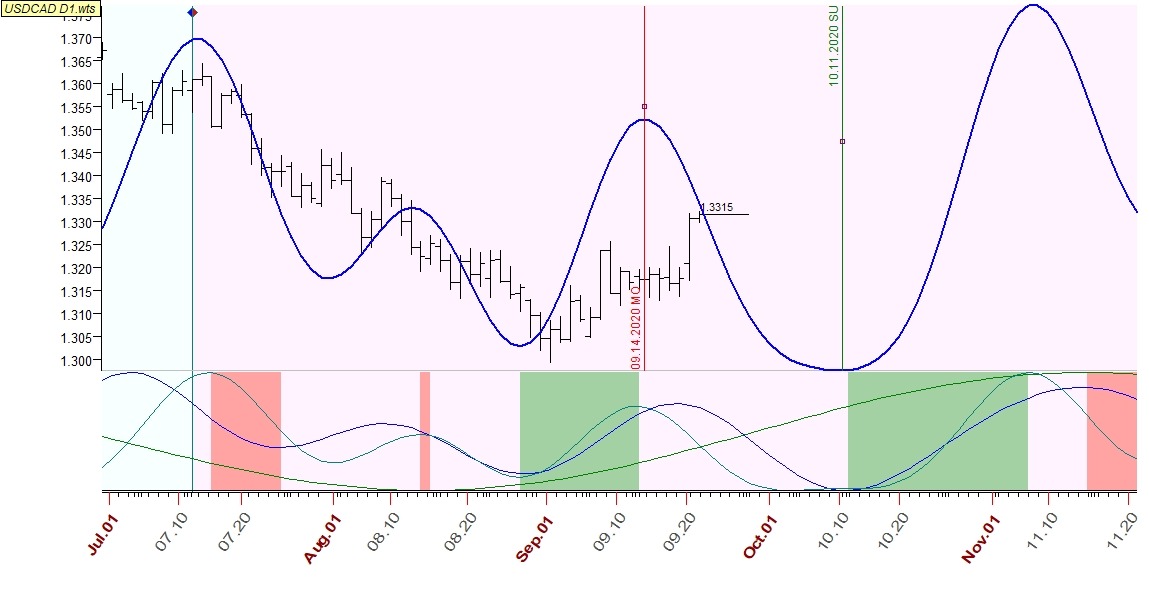

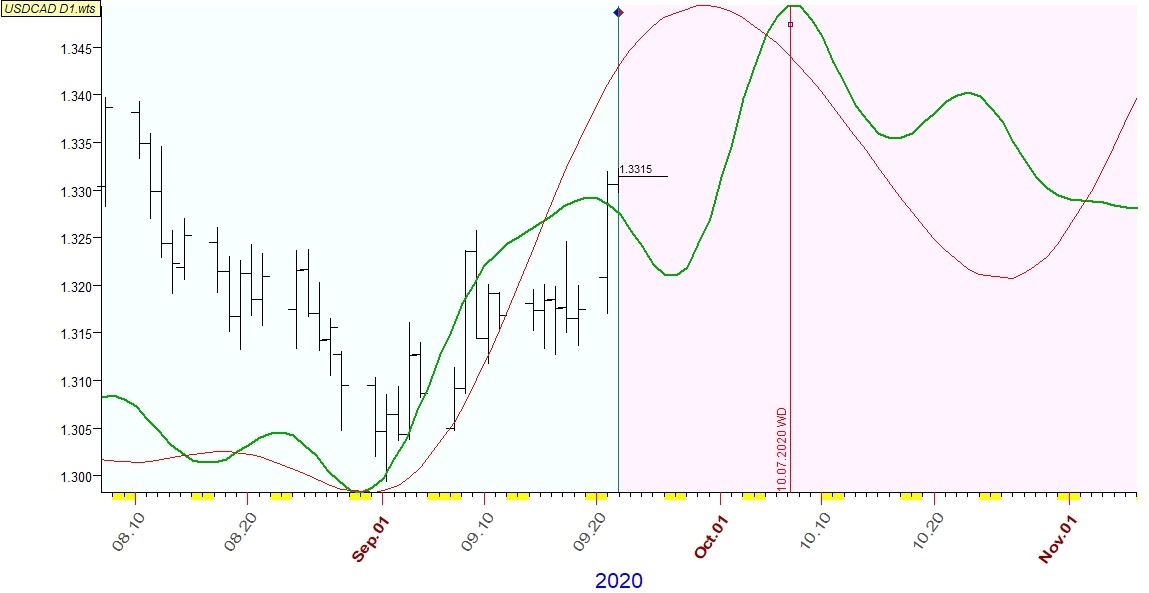

USDCAD

Price still into bearish phase of Q-Sp projection line:

Annual cycle suggest further increase till the 7th of Oct.

Further growth is possible to complete wave A:

It is possible to trade a short-run growth by enter at local high level:

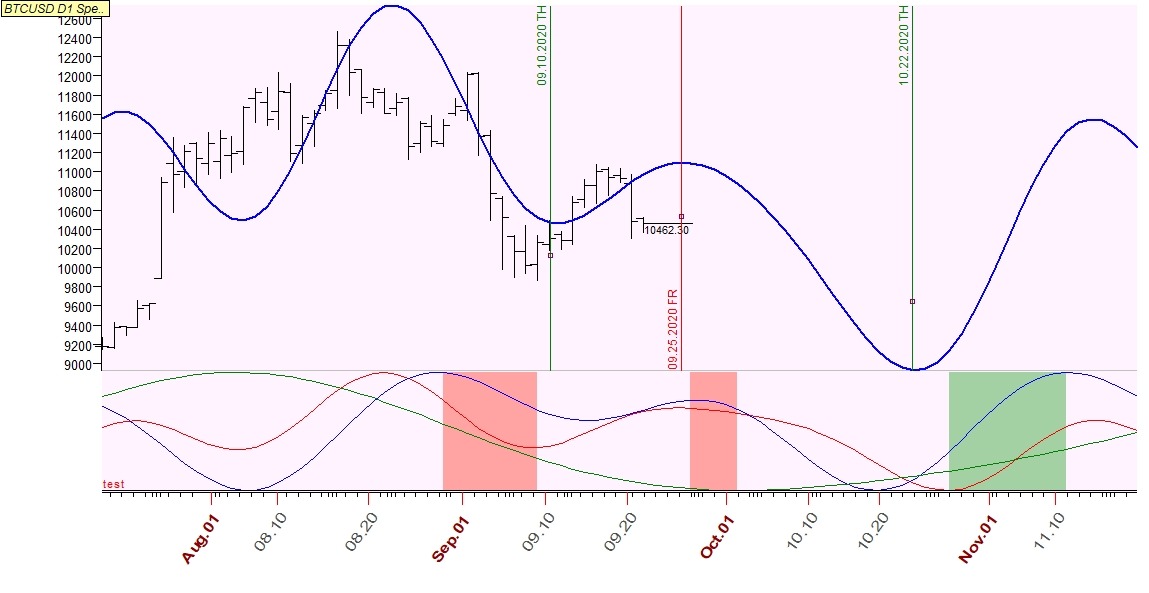

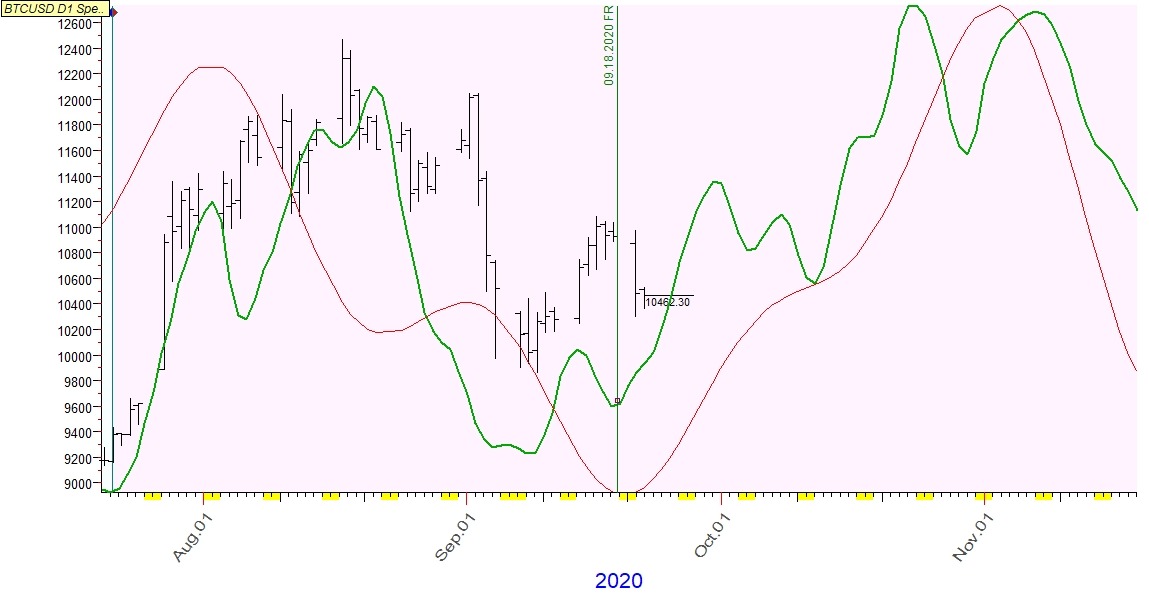

BTCUSD

Bearish turning point is projected to the end of the week only. However price may already started to fall till the middle of Oct at least.

Yet, keep in mind that annual cycle calls for growth:

Hold on current bearish position and/or add new ones with targets at 9820 at least.

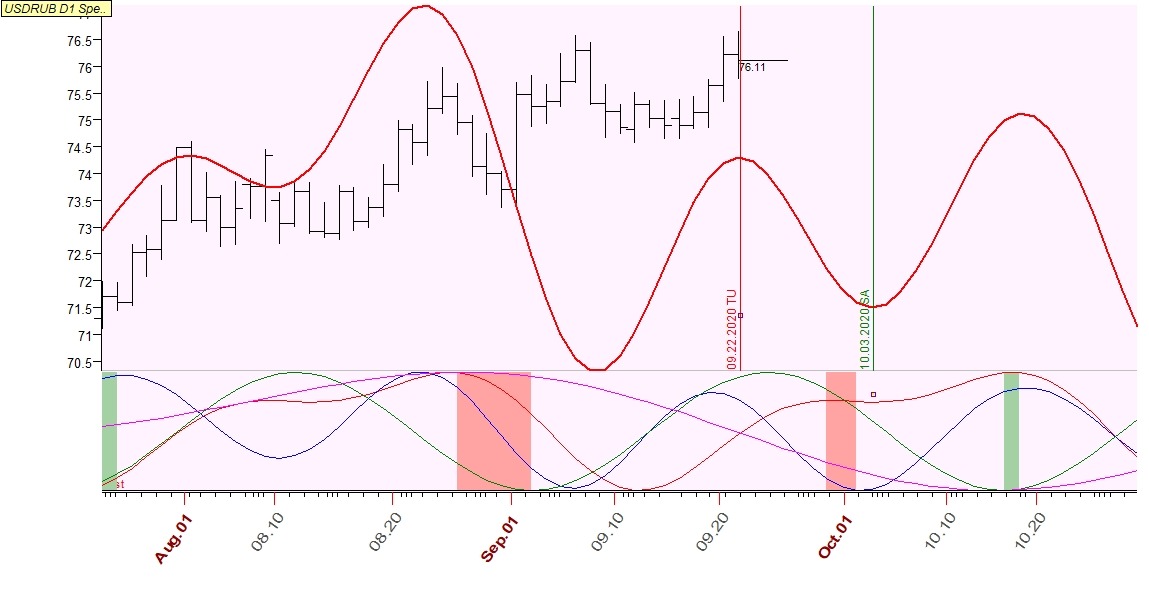

USDRUB

Price reached bearish turning point

Bearish turn is expected