Intraday. Currencies

TS Forecasts. Sergey IvanovDX

We are still in bullish phase, that doesn't mean that we'll have a new high be the middle of the next week.

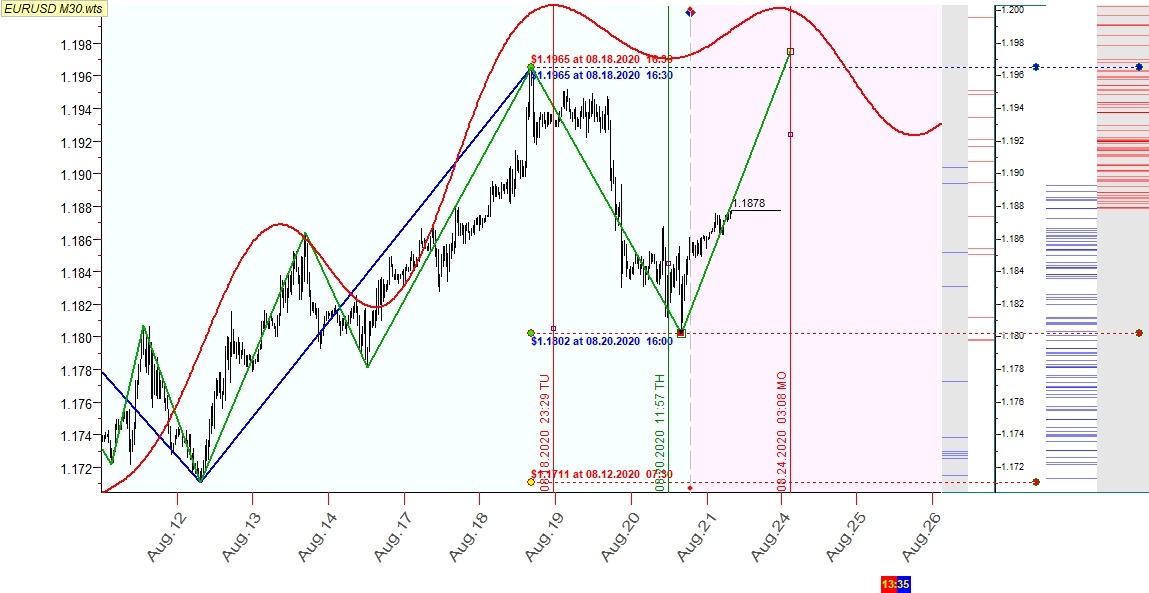

EURUSD

Bullish bounce is going to accomplish by MO. It becomes obvious that currently rising green ZZ will hardly set a new high turning bearish.

So it is reasonable to set sell limit order at 50% cutback from the bearish impulse:

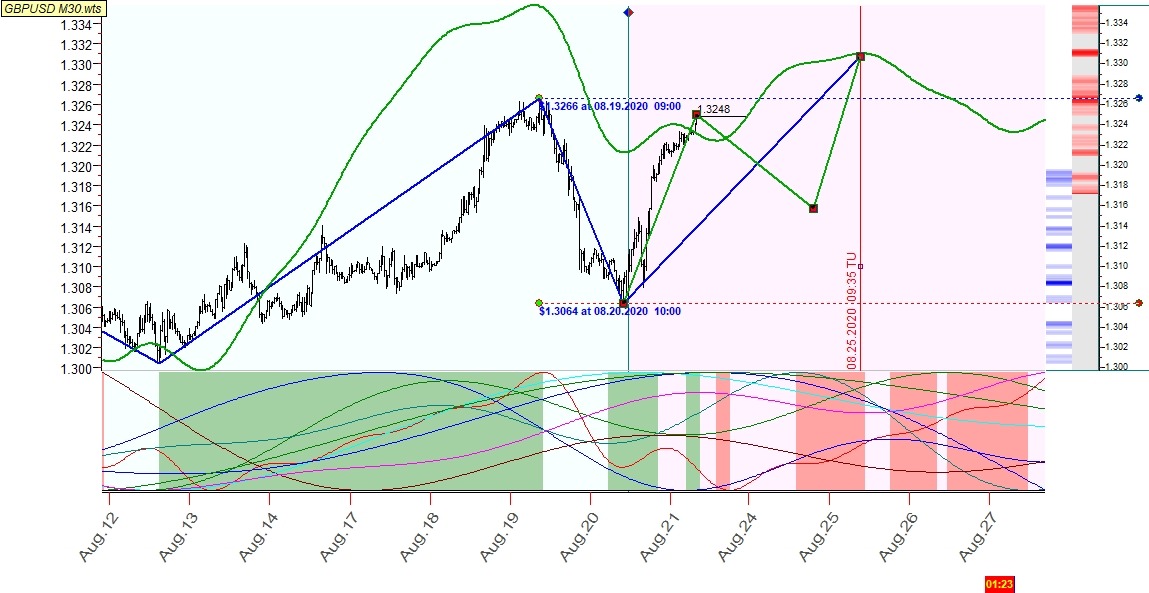

GBPUSD

As it was projected priced turned bullish and is still driven by both green and blue bullish ZZs. There is no any bearish signal yet at least till TU next week.

USDJPY

Projection line was adjusted to catch yesterday's local high. It is resulted into turning points shifting. As you can see TU next week becomes bullish TP in a number of pair, i.e USDJPY.

AUDUSD

TPA module didn't recognize 0.7135 low as a marker for rising blue ZZ. It lefts it bullish, thus, a new high is possible.

So, it is more reasonable to place sell stop order only at low marker of still rising green ZZ level. If price sets a new high then this entry level becomes crucial. If price drops without a new high then this level becomes confirmation for bearish turn for green ZZ at least.

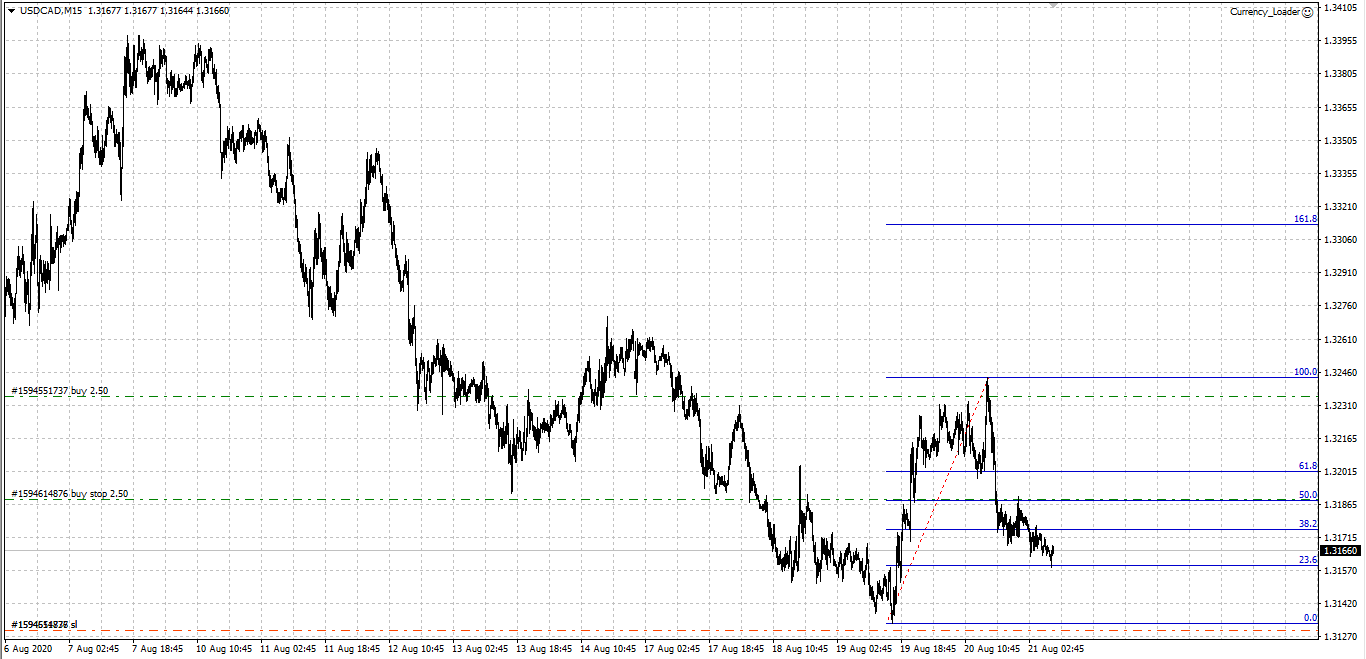

USDCAD

Bullish phase, but still corrective for bearish blue ZZ.

I've got one order placed due to crucial level violation. now I add the second one at 50% cutback level and target at upper marker level 1.3244 (to make the 1st deal risk negligent).

BTCUSD

We are waiting for TU to determine possible bearish trade setup.

USDRUB

Further fluctuated consolidation is expected till the bearish turning point by the start of Sept.