FLUTTERWAVE

Adewumi Sanni

Picture this! You are in a local store to get some much-needed appliances for your new home, and after a few minutes of shopping, it is time to pay, so you proceed to the cashier’s desk and produce your Visa debit card or probably Mastercard, the only form of payment you have on you, only to be told by the cashier that the store’s POS (point of sale) machine only accepts Mastercard and not Visa debit cards, or vice-versa. This is a typical scenario that plays out constantly across Africa, both in small and large scale businesses. Most times, in order to solve this problem and provide full-service payment options, business owners and payment service providers tend to integrate with each form of payment (debit card, credit card, and mobile money) individually, and this problem is what Flutterwave has come to solve in the African business market.

So, what then is Flutterwave?

Founded in 2016 by Iyinoluwa Aboyeji (co-founder of Andela), and Olugbenga Agboola, Flutterwave is an API that lets individuals or businesses process credit card and local alternative payments, like mobile money and ACH, across Africa, making it possible for Africans to build global businesses able to make and accept any form of payment, from anywhere across Africa and the world at large, through its mobile payment gateway.

It is considered a complete payment solution for African businesses to thrive in the global economy, providing an integrated payments platform and digital payment infrastructure for Africa, ready for your business growth, and ensuring reliable and secure payment at all times.

Flutterwave offers two major products namely ‘Rave’ and ‘ Barter’.

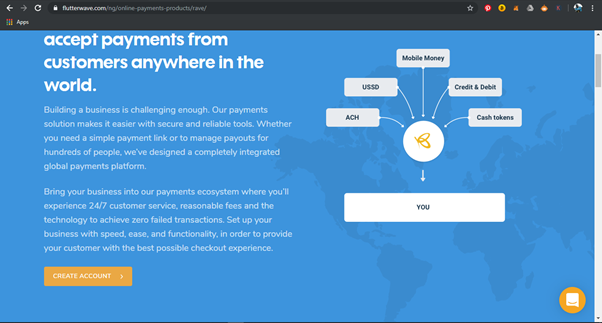

RAVE

Rave is one of Flutterwave’s main products which provides a service enabling merchants to accept global payments from cards, bank accounts, and USSD. As merchants, rave’s service could be adopted in three major ways, and these are through integrating Rave on your website and accepting payments using Rave’s JS libraries, integrating rave’s e-commerce plugins in your online stores, and also by integrating rave’s IOS and Android SDKs in your mobile apps.

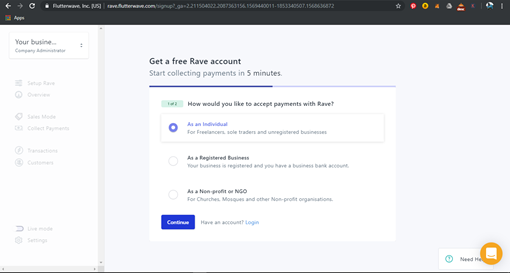

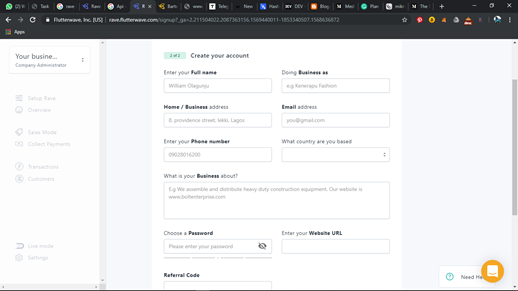

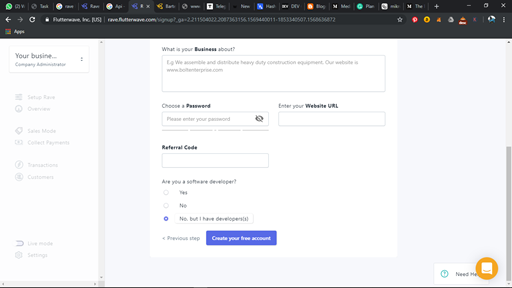

Registering for this service is quite as easy as the whole setup itself, and involves five basic steps;

Step 1: is to visit https://flutterwave.com/ng/, click on ‘Products’ and select ‘Rave’.

Step 2: On the next screen, scroll down and click ‘Create Account’.

Step 3: Select your category.

Step 4: Provide the required details.

Step 5: Create Your Free Account!

Quite simple, right?

BARTER

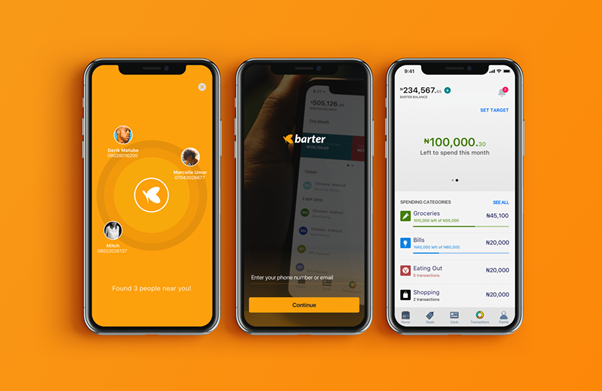

Barter by Flutterwave is another awesome product in the form of a digital payment solution designed specifically for individuals aimed at simplifying personal and small merchant payments within countries and across Africa’s national borders. With the Barter app, existing VISA cardholders have the ability to send and receive funds at home or internationally on GetBarter, while non-cardholders but with accounts or mobile wallets on other platforms could create a virtual Visa card to link to the app.

Equipped with the Barter app, individuals can;

1. Manage funds in their local currency.

2. Transfer money to friends near and far away quite easily.

3. Have full control over how much they spend.

4. Get detailed reports that show their spending patterns and insights

5. Apply for repayable short-term loans

To register for the Barter services, simply download the mobile app from Google PlayStore for Android users, or IOS App store for IOS users.

Over the course of its approximately three years of existence, the Flutterwave payment platforms has racked up quite an impressive list of clients, some of which include Uber, Facebook, Booking.com, Quickbooks Jumia.com, Wakanow, and Y-combinator, just to mention a few.

According to the company data based on the 2018 review, Flutterwave has also processed over 100 million transactions worth $2.6 billion since inception, raising $20 million from investors, a list of which include Greycroft, Green Visor Capital and Mastercard.

Flutterwave added operations in Uganda in June and raised a $10 million Series A round in October that saw former Visa CEO Joe Saunders join its board of directors.

The Flutterwave payments platforms have truly revolutionized and changed the way payment processing is viewed in Africa, providing a seamless payment technology able to bring all the available payment options to the merchants, enabling them to pay and get paid from millions of cards, mobile money wallets and bank accounts in several African countries almost immediately.

So, if you are a small or large scale business owner anywhere in Africa, and you have been troubled with the thoughts of where and how to go about incorporating a seamless payment technology that would enable you to process credit card and local alternative payments for your customers/clients, then look no further! Flutterwave is here for you.