Crypto Exchange

tongkolCrypto Exchange

exchange that combines deflation with all cryptocurrency

Crypto Exchange has developed instruments to take advantage of the ownership of crypto resources but they are far from without their pitfalls. Exchanges, as integrated retail locations, do not fit the possibility of a decentralized monetary framework: they are the only goal of disappointment, but this is not the main problem.

Another type of exchange copy and adopts new developments from the first type of exchange. This is certainly a great way to increase exchanges, but we prefer to be one of the first types of exchanges because we think this is how exchanges should act in the first place. Therefore, the progress and success of exchanges in the future depends on the development of exchanges and the industry itself.

Like the incipient market, there is no liquidity in the crypto market which makes it difficult for them to get out at the right cost. The development of reuse has been supported by large liquidity, but expansion in exchange has no desired effect in the end. In the Bitcoin market, for example, this lack of liquidity is intensified by the way many BTC holders survive as value increases and are reluctant to return their available Bitcoin.

Those who hold crypto and believe that their profits will arrive at a certain level of benefits in this way flood the market, which represents the instability and the great value changes we see in the crypto market.

So with your help, we need to arrange a primary deflation exchange called Deflex; Exchange of deflation. With large deflationary exchanges, we will not only have the choice to support digital currencies, but also networks and clients, who will not only observe more points of interest for themselves because of the destruction created in a misleading manner, but will also speak in a way that is progressive about it and in this way make cryptographic forms of money very well known.

This is an undeniable problem that compromises the decentralization and confidentiality of digital forms of money. This form of digital money is created to stop and change the current fiscal situation. KYC procedures are required by specialists and exchanges regularly need to request this from their clients because of universal law. From one perspective, exchanges can meet certain administrative needs and enter into different associations, and clients can also feel much safer because KYC extends account security. Then again, this expands the impact of experts on exchanges and fewer clients go for exchanges that require KYC.

The ambiguity and foundation of Deflex's decentralization not only guarantees the security of benefits and other information, but is also immune to a single specialist. Deflex will not require any KYC from its clients and will also protect the opportunity and confidentiality of cryptographic money in return.

Deflex coins provide an alternative alternative holder for profits at that stage. By using Deflex Coin when exchanging, it allows clients to set aside half the cost. Another option is Peg Deflex Coin onstage and win a portion of your expenses for yourself. Consumption from month to month will also occur, which will reduce the Deflex Coin inventory and in this way reduce the size of DEF available for use.

Additional exchange devices will be included after some time and we will ask if they need all the more exchange devices and which ones. This democratic will occur in our exchange in the survey segment. Deflex will also increase the ERC20 Token exchange and TRC20 Token exchange.

We will give our token, called Deflex. As many as 91,000,000 of the most severe DEFs will be made, never expanded. DEF will run locally on the Ethereum blockchain with ERC-20. DEF is also a form of deflationary cryptographic money, because DEF supply does not increase and we focus on consumption days, which also includes consuming DEF.

Problem

● Poor technical architecture

Without the right infrastructure, Exchange will not exist for a long time. Today, many exchanges use cloud services or third parties that can offer them the computing power they need and can provide them immediately. However, this creates a problem because dependence on these service providers and third parties is increasing. This raises the problem that in the event of a third-party server failure, Exchange itself also fails. This can also increase the risk of a hacker attack, because the infrastructure is not available.

Deflex exchange

● Exchange of deflation

Every month at Deflex there is a burning day where the collected cryptocurrency is burned out of the fees collected during the one month period. This happens with every cryptocurrency collected and anyone can check the burned address where currencies are collected on the blockchain.

● Exchange Decentralization

Due to the different server locations and the increasing number of locations, Exchange will cross country and hence is also available throughout the world.

● Transparency

With Deflex Status Platform (DS-Platform) you can see all internal company balance and wallet activities. The DS platform will also display the latest news, statistics, such as server status and exchange performance, and more.

the features

● Low trade costs

Deflex's allows you to trade with a maximum trading fee of 0.1%. Additional 50% discount if you use Coins.

● Financial stability

Deflex is based on a sophisticated multi-layer and multi-cluster architecture, which not only provides greater security for users, but also maintains platform stability.

● There is no KYC

Because of decentralization, KYC is not required to use the platform

● Lower costs

For withdrawal transactions, we charge a maximum fixed fee, where we credit the remaining amount back to the account.

● Suitable machines

Our machine is able to maintain 900,000 orders per second. This value will be at the beginning. Over time we will improve our machines.

● Customer Support

Deflex will provide a 24/7 support team so users always have a link if there is a problem.

DEF value

● Costs

You can use DEF to pay for any fees on our platform, including but not limited to:

1. Exchange fees

2. Withdrawal fees

3. Registration fee

4. Other costs

When you use DEF to pay fees, you will receive a fixed discount of 25%.

● Strike

The DEF token allows the holder to claim part of the costs generated by the exchange and payment service. With that, Token holders who bet DEF Tokens benefit directly from the success of the exchange service.

● ICO

ICO will be conducted in ETH. Unsold tokens will be burned after ICO.

● ICO schedule

All times below are Universal Time Coordinated (UTC).

Our tokens

● 50% trade discount

● Deflation

● Passive Income

Coin Deflex gives holders various options to benefit from the platform. By using Deflex Coin when trading, this allows users to save 50% of the cost. Another option is to bet Defleks Coins on the platform and get some of the costs for yourself. Monthly burns will also occur, which will reduce the supply of Deflex Coins and thus reduce the amount of DEF in circulation.

Token Sale

● Token Symbol: DEF

● Total Token Supply: 91,000,000 DEF

● Total Token Supply Sold: 54,600,000 DEF

● Token Exchange Rate Offered: 1 ETH = 1595 DEF

● Public Crowdsale Date: Starting: 20. March 2020 End: 10. April 2020

● Hard Cap: equivalent to 4,500,000 USD in ETH

● Soft Cap: equivalent to 1,700 USD in ETH

● minimum contribution: 0.1 ETH

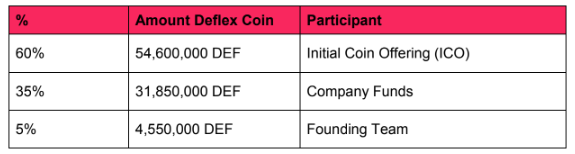

Allocation

● 60% - Initial Coin Offer (ICO)

● 35% - Company Funds

● 5% - Founding Team

Use of Funds

● 65% of the funds will be used to build Deflexchange and

infrastructure, which includes team recruitment, training, law

support, administrative costs and development budget.

● 25% will be used for Deflex branding and marketing, including

promotion and continuing education from Deflex and Blockchain

innovation in industrial media. Adequate budget for various things

advertising activities, to help Deflex become popular among people

investors, and to attract active users to the platform

● 10% will be stored as a backup for emergencies or

unexpected situations that might arise.

Allocation

● 60% - Initial Coin Offer (ICO)

● 35% - Company Funds

● 5% - Founding Team

Use of Funds

● 65% of the funds will be used to build Deflexchange and

infrastructure, which includes team recruitment, training, law

support, administrative costs and development budget.

● 25% will be used for Deflex branding and marketing, including

promotion and continuing education from Deflex and Blockchain

innovation in industrial media. Adequate budget for various things

advertising activities, to help Deflex become popular among people

investors, and to attract active users to the platform

● 10% will be stored as a backup for emergencies or

unexpected situations that might arise.

Roadmap

August 2019

● Development and concept development

● International teams start working on the platform.

December 2019

● Launch of technical documents

● Website launch

January 2020

● MVP launch, ICO planning and preparation begins

● Our MVP will be available on our website

March 2020

● Launch of coin offers from

May 2020

● Launch of Deflex Beta ● Beta

The test will be open to the public.

● Open deposits and withdrawals. Trade begins.

Q2 2020

● Deflex 1.0 released

● Network expansion

Server computer

Ron Bennett, CEO Deflexchange

Daniel Stein, CMM and Deflexchange

Information:

● Website: http://www.deflexchange.com/

● White paper: https://drive.google.com/file/d/1m2JDtqHLpmUHfy795EWBQu7VYIoACnTJ/view?usp=sharing

● Twitter: https://twitter.com/deflexchange

● Telegram: https://t.me/officialdeflex

● GitHub: https://github.com/deflexchange

● Reddit: https://reddit.com/r/deflexchange

● Disputes: https://discord.gg/QUyd4Ph

● Ann Thread: https://bitcointalk.org/index.php?topic=5227059

Username: COB

Link: https://bitcointalk.org/index.php?action=profile;u=1929500