Blockchain

Zakharov NikitaMany people know it as the technology behind Bitcoin, but blockchain’s now is spread more widely. "potential uses extend far beyond digital currencies."

Business mans like Bill Gates and Richard Branson belive that banks and insurers are falling over one another to be the first to work out how to use it.

So what exactly is blockchain, and why are evryone so excited about it?

What is blockchain?

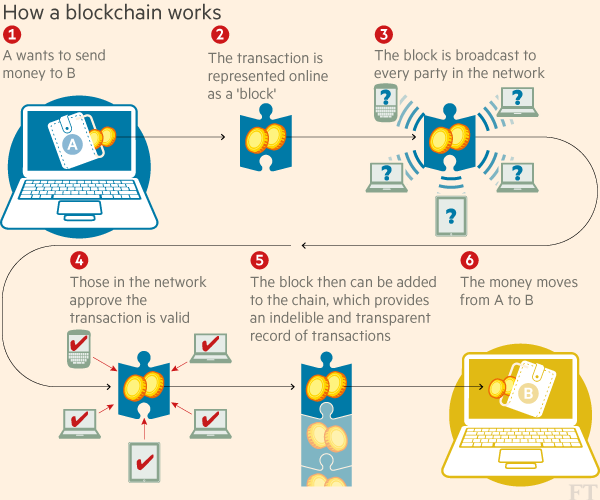

Currently, most people use a trusted middleman such as a bank to make a transaction. But blockchain allows consumers and suppliers to connect directly, removing the need for a third party.

Using cryptography to keep exchanges secure, blockchain provides a decentralized database, or “digital ledger” (цифорвая книга), of transactions that everyone on the network can see. This network is a chain of computers that must all approve an exchange before it can be verified and recorded.

How does it work in practice?

In the case of Bitcoin, blockchain stores the details of every transaction of the digital currency, and the technology stops the same Bitcoin being spent more than once.

Why is it so revolutionary?

The technology can work for almost every type of transaction involving value, including money, goods and property. It s potential uses are almost limitless: from collecting taxes to enabling migrants to send money back to family in countries where banking is difficult.

Blockchain could also help to reduce cheating and stealing because every transaction would be recorded and distributed on a public ledger for anyone to see.

Who is using it?

In theory, if blockchain goes mainstream, anyone with access to the internet would be able to use it to make transactions.

Currently only a very small proportion of global GDP (around 0.025%, or $20-40 billion) is held in the blockchain, according to a survey by the World Economic Forum’s Global Agenda Council.

But the Forum’s research suggests this will increase significantly in the next decade, as banks, insurers and tech firms see the technology as a way to speed up settlements and cut costs.

Companies racing to adapt blockchain include UBS, Microsoft, IBM and PwC. The Bank of Canada is also experimenting with the technology.

A report from financial technology consultant Aite estimated that banks spent $75 million last year on blockchain. And Silicon Valley venture capitalists are also queuing up to back it.

The promise of the blockchain

Even from the early days of Bitcoin, it was believed that the blockchain could be used for much more than recording Bitcoin transactions. What the blockchain does is record a set of details that include a time, a cryptographic signature linking back to the sender and some data that can represent almost anything. In the case of Bitcoin, it is the number of bitcoins being sent but it could be a digital cryptographic signature, called a “hash”, of any electronic document.

One of the earliest demonstrations of the potential of using the blockchain in this way was “proof of existence”, a website that allows a user to upload any document and have its signature recorded for ever on the Bitcoin blockchain.

What this does is prove that the person who uploaded the document had that specific document in their possession at a specific time. It can also be used to prove that the document had not been altered in any way from that time.

The risks and challenges of the blockchain

One of those is the fact that Overstock has chosen to make the information stored on the the blockchain ledger accessible by anyone, so investors may have concerns about the privacy of their holdings.

However, the main risk is one that is a general issue with all blockchain applications, including Bitcoin. This is the fact it is still not known exactly how secure the system is and whether it has any flaws that could be exploited by hackers.

One potential issue around the use of the blockchain is the fact that there are now a large number of different implementations, all based on different technological approaches. IBM, JP Morgan, Intel and a group of other companies have just launced the “Open Ledger Project”. Open Ledger does not use the Bitcoin blockchain but implements a different scheme that is more suited to companies wanting to restrict access to the blockchain ledger.

There is no doubt that the ideas behind the blockchain are clever ones and were critical to enabling a digital currency like Bitcoin to operate with many of the same properties as cash does in the physical world. When the technology is used for other applications, though, it is not absolutely clear that it actually does anything that can’t be achieved with other, more conventional technology.

The social issues are harder than the technological ones

It is not the technology that is stopping shares from being settled instantly. It is regulators and the issues they are dealing with in terms of this type of settlement are social and legal ones, not technical.

In the hype that surrounds companies that are working on blockchain products, the real challenges facing the actual use of these products are often glossed over, with the main objective being to get rid of third parties but without necessarily replacing all of the positive things those third parties may actually have been doing.

It is inevitable that blockchain technology will become a mainstream technology. The level of interest being shown in this technology demonstrates its potential for enabling the development of applications that will bring new approaches to old business problems. It is the social, legal and financial challenges that these changes will surface that may prove a much harder problem to solve.