BCH\USD

@ExratesmeHere is a daily chart BCH against USD

All three moving averages haven't held the price and we continue to stay in this consolidation between $270 and $350 but now it looks more bearish because of those MAs. In different words, we've lost the perfect moment to buy when MAs, RSI, and MACD were bullish and we could to suppose that we are going to go up from the consolidation. Now RSI went to the bearish area but MACD still shows a divergence.

On the 4 hr scale, RSI already is overbought but MACD signal line is not separated yet. Also, we can see how those bearish candles are aggressive, so we met supply here and it is significant.

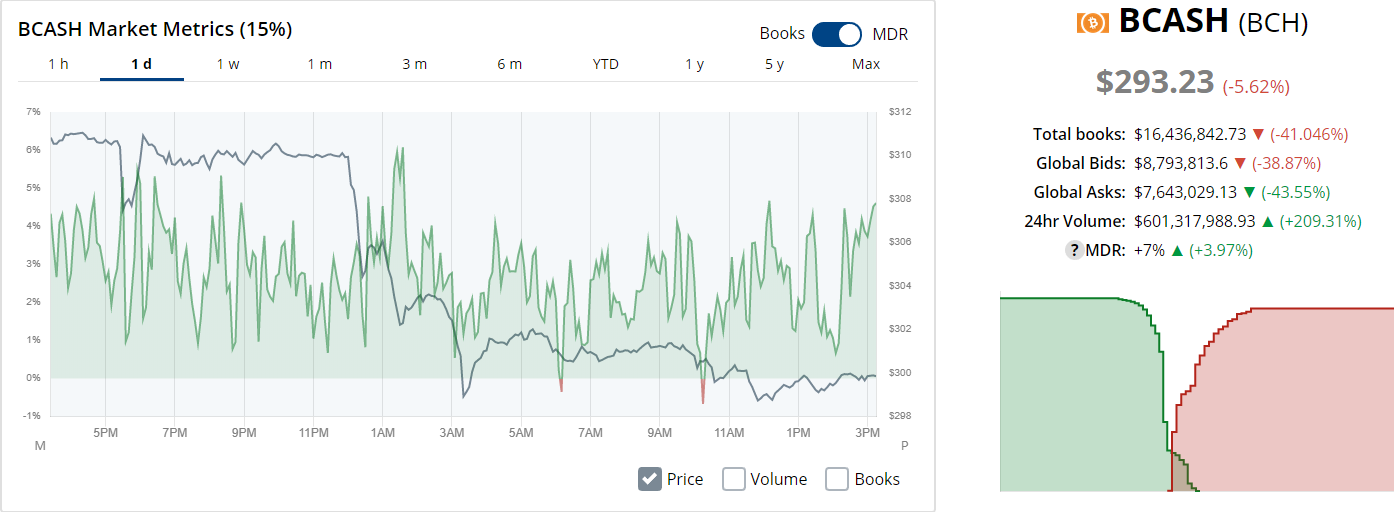

Market depth shows 'Bids' advantage and it looks bullish which is strange in the framework os the day.

Weekly MDR looks bullish too. And just take a look at this surge of volume when the price went down. In general, the situation is ambiguous and the llast thing what is better to check is order book in each exchange case.

Order books in numbers show that 'Asks' advantage has Bitfinex, Bitstamp, and Kraken $200k total.

Conclusions:

If you are bullish

Entry - $275 (a false breakout), stop - $237 (below the false breakout), take - $257

If you are bearish

Entry - $270, stop - $307, take - $233