Applicability of AiX to Cryptocurrencies

James TaborPeople who understand cryptocurrencies and trading know the key to decentralized trading isn’t a new crypto asset. It is an effective crypto broker. But why would brokers exist? Crypto is mainly traded on screen, and originated as a way of disintermediating traditional finance constructs such as brokers? Atomic Swaps will make on-chain transactions seamless. The dawn of de-centralized exchanges is here, why would there be brokers?

Because exchanges become decentralised, does not mean that there will be uniform price and liquidity. To get the best prices you will either be a member of many exchanges, and/or you will use a broker.

AiX is not an exchange. It is an Artificial Intelligence broker that acts across all your accounts at the same time.

Why are brokers are coming to crypto? At time of writing are 230+ crypto exchanges, with more appearing every day. There are over 2,000 tradable cryptocurrencies, tokens and assets. The market is very complex. Differences in fees, rates, and prices are so large, that some traders profit from the difference. Private, “Over the Counter” (OTC), trades are happening on Telegram, WeChat and WhatsApp. Mimicking the financial markets, where Bloomberg IMs serve the same purpose.

Why do brokers exist? In a word, complexity. They came about because it difficult to buy stocks. There were too many of them, and you often had to have a right to trade on an exchange. So brokers came about; the first recorded ones were in Ancient Rome. Brokers can make markets, identify counterparties and complete trades. They also serve the purpose of shielding market participants from front run by algo, or high frequency traders.

Haven’t computers replaced human brokers? “Voice” broking (Bud Foxx from “Wall Street”) is not “open-outcry” trading (stripey jackets, and hand signals). Even with so much happening “on screen” there are actually more “Voice” brokers than ever before. A 2016 white paper by Credit Suisse stated that AI and blockchain could not replace brokers.

Putting all trading through screens makes it hard for people to get a fair deal. As soon as a “signal” is detected, “frontrunners” can get in the way of your trades, making fractional gains at your, and the market’s expense.

As most of crypto is trade on-screen, it is very susceptible to spoofing, and manipulation. Brokers can act on behalf of those looking to avoid these situations. By knowing other participants likely to take the other side. They put together trades that are not picked up by front-runners or arbitrageurs.

So they are a good thing? While in some respects a good thing; brokers add a layers of opacity and expense to the markets. They are slow, and can only go to their contact book to fill demand. To trade well you need many brokers, and much patience. Plus there is always the chance information gets out, and you should always ask “how am I getting screwed?”

What does AiX do better? AiX will let you interact with the markets as you would with a broker. Instead of checking a myriad of apps, websites, or having coding algorithms. You deal with AiX the same way you would a human – by talking (via an Alexa / Google Home style interface) or texting (via any IM). AiX then finds market data, or executes trade from exchanges, and platforms on your behalf. Even with a team of brokers you would be unable to match the speed and consistency of AiX. There are several implications to this:

- Trading is an inefficient activity – any minute you spend trading is a minute you could be doing something else

- Trading takes time so you are exposed to additional market volatility – this is a trade off that many take due to HFT and front-running

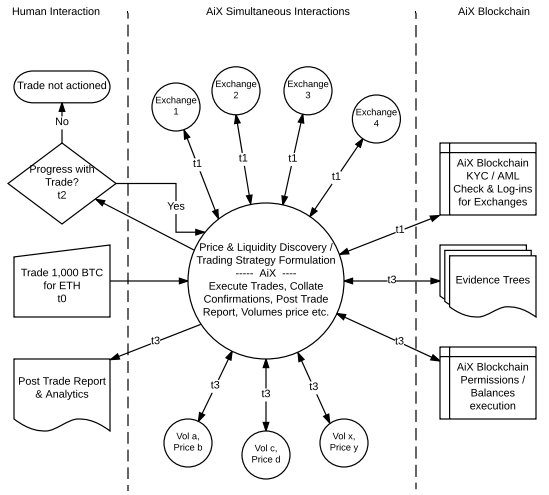

EXAMPLE OF AIX AT WORK

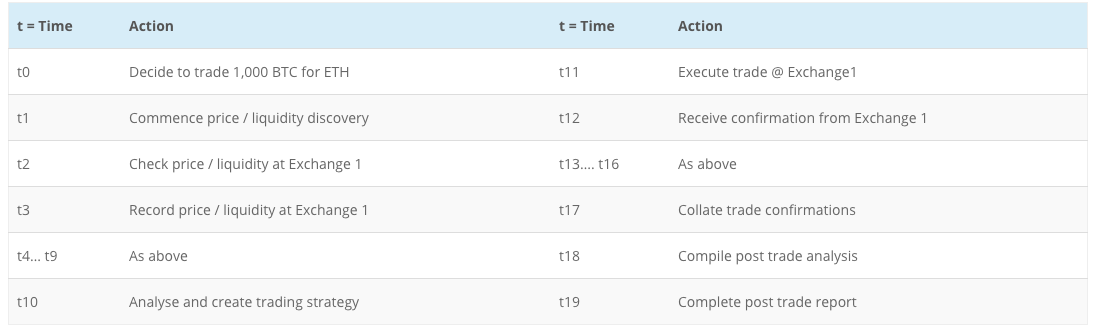

You are looking to trade 1,000 BTC for ETH. While simple enough, there are huge number of factors that will have to be gathered. Each of these takes time. Simply checking 4 exchanges, working out the depth that they could sustain, and then having to manually execute the trade will take a long time. This is complicated if you have to perform additional analysis e.g. that required for an accurate Volume Weighted Average Price (VWAP), strategy.

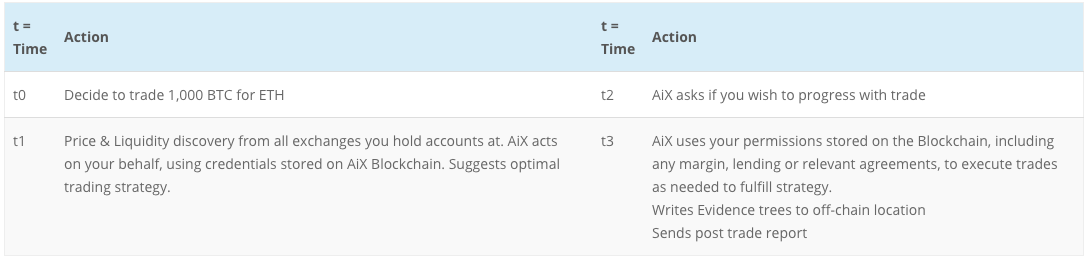

In the below diagrams, “t” represents a unit of time. This is not a uniform amount of time, as some tasks can take more or less time than others.

AiX, is able to perform these individual steps at the same time. This saves time, and money, and reduces your exposure to changing rates. You are exposed to less volatility, fluctuation, and able to get the best outcome for your trade.

This is a very simple example, and AiX will be able to deal with far more complex trades.

HOW CAN I USE AIX?

To use AiX you will have to hold AXT, our ERC20 token. This token will serve two purposes: 1. Store your identity and credentials, allowing AiX to act for you. 2. To generate unique keys for your Evidence Trees. These are records that AiX keeps of the decisions taken during the trade.

AXT will be used to generate unique keys for each evidence tree, allowing you to have a comprehensive record of your trades. As well as serving these functions, AXT will be used to buy additional features and services from other users. These will include – additional data feeds, analytic capabilities, “follow-learning” where other traders rent you access to their Evidence Trees, making your AIX instance smarter.

We are only at the beginning of the Crypto revolution. We have the chance to build a new system, that does not inherit the bloat and mistrust of the old.