About me

Andreas Schmidt

Hi, my name is Andreas. I'm a bloc expert, we have https://safetrading.today/bots/crypto-trading-bots/ you'll find everything you want and much more - a crypto wallet. Dealers can receive signals in the service account, in messengers and social networks on the internet. The most well-known signs are now those supplied by the services in Telegram.

How to analyze trading signals? After receiving the information from the provider, it may be examined through fundamental and technical analysis. This way, you'll be able to filter out poor or absurd trading signs of stocks, and in exactly the exact same time, you'll receive useful experience which you may use in the future.

The research will allow you to understand the trading approach which the data provider uses. The source of signs is not likely to show the gist of the plan itself. Particularly if it provides advice on a paid basis.

As an analyst, in time you will have the ability to form a trading plan on your own without any help. You may find a wide array of info on exchange trading from the world wide web. Some signs are provided free of charge, others - to a compensated basis. In the event you pay for getting information, it doesn't guarantee its accuracy or reliability.

There are a great deal of swindlers operating from the network, distributing trading signals, assuring users enormous gains. In actuality, they just earn on expecting beginners.

we don't advise working with little-known portals. Before paying cash for their solutions, ensure that their supply has a great reputation. This way you are able to protect yourself not only from unnecessary expenditures, but also from serious losses.

You should not blindly believe all sorts of stock exchange information. The majority of the signals distributed on the community are either the fruit of crude technical analysis or frank nonsense.

There are exceptions too. There are services that provide relatively correct information. But, you'll find quite some of them. In any case, no one could possibly tell you a signal that is totally reliable. In any situation, there'll be a plus on some deals and a minus on the others. The most important issue is to produce a gain as a result. It is theoretically possible to use information from a third-party resource. However, if you do not find out how to execute technical and fundamental analysis, you should not use other signs. You need to comprehend the mechanics of the creation and make adjustments that correspond to your plan.

The data you are going to utilize in trading must be confirmed. Be certain your preferred source of distribution for the stock trading signals is trustworthy. Only then will you get started utilizing the info from the source for trading at the stock exchange. Most frequently, traders receive trading signals from these sources: Specialized Portals. A lot of them publish data on a paid basis. There are also portals that distribute their signals absolutely at no cost. Closed classes in social networking sites.

Not everybody is admitted into such communities. In classes, they share different data (like insider info ) and analytics. Professional platforms. Here you can always find the most recent stock exchange reviews and analytics for various stocks. Trading robots. Able to accumulate information simultaneously from several resources. Forums. In them, experienced stock market players share with every other their eyesight of the present situation from the stock market.

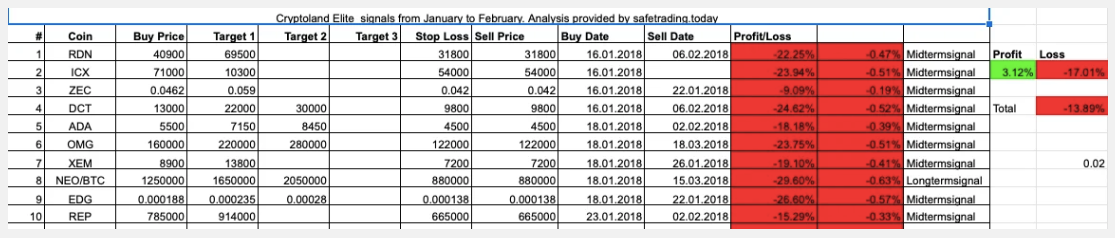

It is not possible to assert that any of these sources is much more dependable. Combine the info obtained from different resources. Approach the choice of trading signs of stocks very carefully and cautiously. The information ought to be submitted in a particular format. By way of instance, the message that you will need to" buy Sberbank shares" is not a signal. As it's totally unclear when to open a position and when to close this, and what possible profit we are talking about. Trading signals must incorporate these elements: Asset and strategy. The sign is printed for a specific financial instrument and plan. As an instance, the market - shares of" Gazprom", strategy - hourly.

Point of entrance. The cost of the asset, at which a trader must make a transaction. Volatility of the industry. It means a variety of price changes for a certain period. Stop-loss. The level at which a dealer should exit a deal to avert a negative situation. Level of risk. Distance from the entrance point to the stop-loss. Calculated in issues or financial units. Shows the level of prospective loss at an unfavorable development of the circumstance.

First entry goal. Price calculated on the basis of volatility indicators, expressed as a proportion of their risk level. By way of instance, 100%, 120%, 150%, etc.. Time of look. Date and time of sign formation on the graph. When it seems, it generally comes with a recommendation -"delay ". Breakdown time of the input level. It means that the cost has overcome a particular value, which is a signal on purchase or SELL.