What is EQUI Project?

tinhkhuatWhat is EQUI Capital?

EQUI’s vision is to bring venture capital into the modern technological era. It will allow individuals to combine forces and participate in an investment sector that has been traditionally reserved for institutions and ultra high net worth individuals.

The new project is designed to create a link between venture capitalists and the world of cryptocurrencies. Their aim is to provide venture capitalists with the opportunity to invest on a long-term strategy in a series of projects using the power of the blockchain and cryptocurrencies. It has been founded by a company with over 30 years experience in the world of venture capitalism, so they do have a proven track record in this area.The platform will seek to make it easier to take ideas and to turn them into a reality and the transparency aspect means investors can rest assured that their money is going to where they want rather than it being lost in amongst other investments. Furthermore, the platform is also seeking to provide users with a great degree of help and guidance as they go through the process of taking their idea and turning it into that reality.

They state that one of the core issues with venture capitalists is that their normal investment opportunities are restricted to a small number of individuals due to the sums that are often involved. By using a digital currency, it is hoped that it will open up the possibility of encouraging more individuals to become investors with them able to do so on a much smaller scale.

How does it work?

An investor in the EQUI capital blockchain project is not left to make investment decisions on their own. EQUI will provide information on the best investment opportunities in form of assets, upcoming new generation companies which are mostly real world investments to investors. EQUI would also provide investors with the required business knowledge, insights and instructions that would help move their current investment up the scale but in order to buy stakes in any new company you have to do so using the EQUI tokens. This would allow you get your desired return on investment and make you eligible to purchase stakes in the first place

What EQUI would be providing is an opportunity for people with no sales or marketing knowledge, people without finances or no knowledge of how to operate in the world or the local market to invest irrespective. The platform comes in two ways; the EQUI mobile app and the EQUI business. These two forms of EQUI provide the same support for users generally; it gives you the general functionality of a search engine and even more; provides you with all the information you need, provides you with suitable advice and also provides you with help whenever you need it. The EQUI business on the other hand provides you with an additional two way search engine, which means you can either submit a request or review a request and provide answers. It means that you do not have an AI at the back end instead it works with natural intelligence which is more like a forum where a human provides you with answers to your questions and where you can decide to provide answers too.

EQUI is also seeking means to decentralise the venture capital system. Everything is clear to whoever is interested in investing hence their decision to make use of nodes which are human users that review all the questions people ask in order to help them make the right decisions in whatever business they decide to venture in. so far the EQUI capital blockchain project has been transparent in all their dealings and have built trust in the blockchain industry.

Venture capital

VC is a form of financing for early-stage, emerging companies that are considered to have high growth potential but cannot access equity markets. Venture capital investments are considered high-risk, but they can also provide impressive returns.

Different stages of venture capital investment:

Seed stage – The first stage of investment that aims to get a company off the ground.

Early stage – Investment when a company has successfully proven its concept, to accelerate sales and marketing efforts.

Growth stage – Further rounds of investment to provide additional support (usually through enhanced marketing and sales strategies), with the aim of growing the venture to its next stage of development.

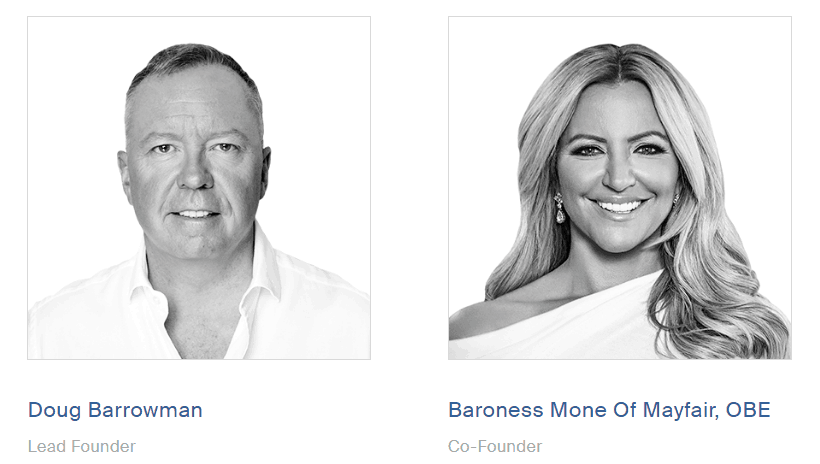

EQUI Founders

Both the founders of EQUI are Scottish with working-class backgrounds, who through hard-work and determination have become the successful business people they are today. They also share a strong belief in giving back to society with both actively involved in charitable work.

EQUI was founded by Doug Barrowman, described as the lead founder of the project.

“Once in a generation a new way of thinking disrupts the workings of an established industry,” explains Doug in the EQUI whitepaper. “EQUI is that disruptor in venture capital investing.”

Doug has been investing in companies for 30 years, including many early phase and startup companies, through his firm Aston Ventures. That firm has a team of investment professionals capable of accurately picking the best companies for high growth.

Aston Ventures was founded in 1999 as Doug’s private investment vehicle. Over the next 10 years, Aston Ventures made 13 acquisitions of old economy businesses with a total turnover of 400 million GBP. In recent years, Aston Ventures has focused on tech investments. In 2017, the company led the acquisition of former tech unicorn Ve Global. Doug has also built the Knox Group of companies since 2008, and he continues to lead that group as Founder and Chairman.

EQUI was co-founded by Baroness Michell Mone of Mayfair, OBE. Michell is one of the most influential businesswomen in the UK. She’s an award-winning entrepreneur who also serves as the appointed “Start-Up Business Tsar” to the UK government. Prior to EQUI, Michelle founded and managed Ultimo Brands International, an international lingerie empire. She exited the business in 2014.

Michell has previous experience in the cryptocurrency industry: in 2017, she made headlines for launching a $250 million development of two residential towers and a retail complex in Dubai. Investors can purchase units in exchange for bitcoin.

Overall, the company describes itself as “a team of established and proven individuals who have experienced success in their field of expertise.” That team of individuals “will evaluate all investment opportunities to offer a carefully selected portfolio for our investors to consider.”

The EQUI Captial ICO

The EQUI pre-sale begins on March 1, 2018 and ends on March 8. You’ll need a minimum investment of $100,000 to participate in the pre-sale.

The ICO begins on March 8 and ends on March 31. A minimum investment of $100 is required for the main ICO

There’s a total supply of 250 million EQUItokens. The tokens will be priced at $0.50 during the ICO. You can contribute using Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), or Ripple(XRP).

Of the 250 million EQUItokens, 65% are being sold during the pre-sale and ICO. 12% are distributed to EQUI founders (6 month lock-in period), 15% for the EQUI team (distributed quarterly, over a two year period, with a six month lock-in), 6% to the advisory board (distributed quarterly, over a two year period, with a 6 month lock-in), and 2% to bounties.

For more details please visit their links below:

website: https://www.equi.capital/

WHITEPAPER : https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

FACEBOOK : https://www.facebook.com/equi.capital/

TWITTER : https://twitter.com/equi_capital

MEDIUM: https://medium.com/equi-capital

TELEGRAM : https://t.me/equicapital

Author: tinhkhuat

ETH: 0xe4992c92072435470746e28d274f67f34047986f

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1885373