Traxia- a blockchain Solution To Disrupt Trade Finance

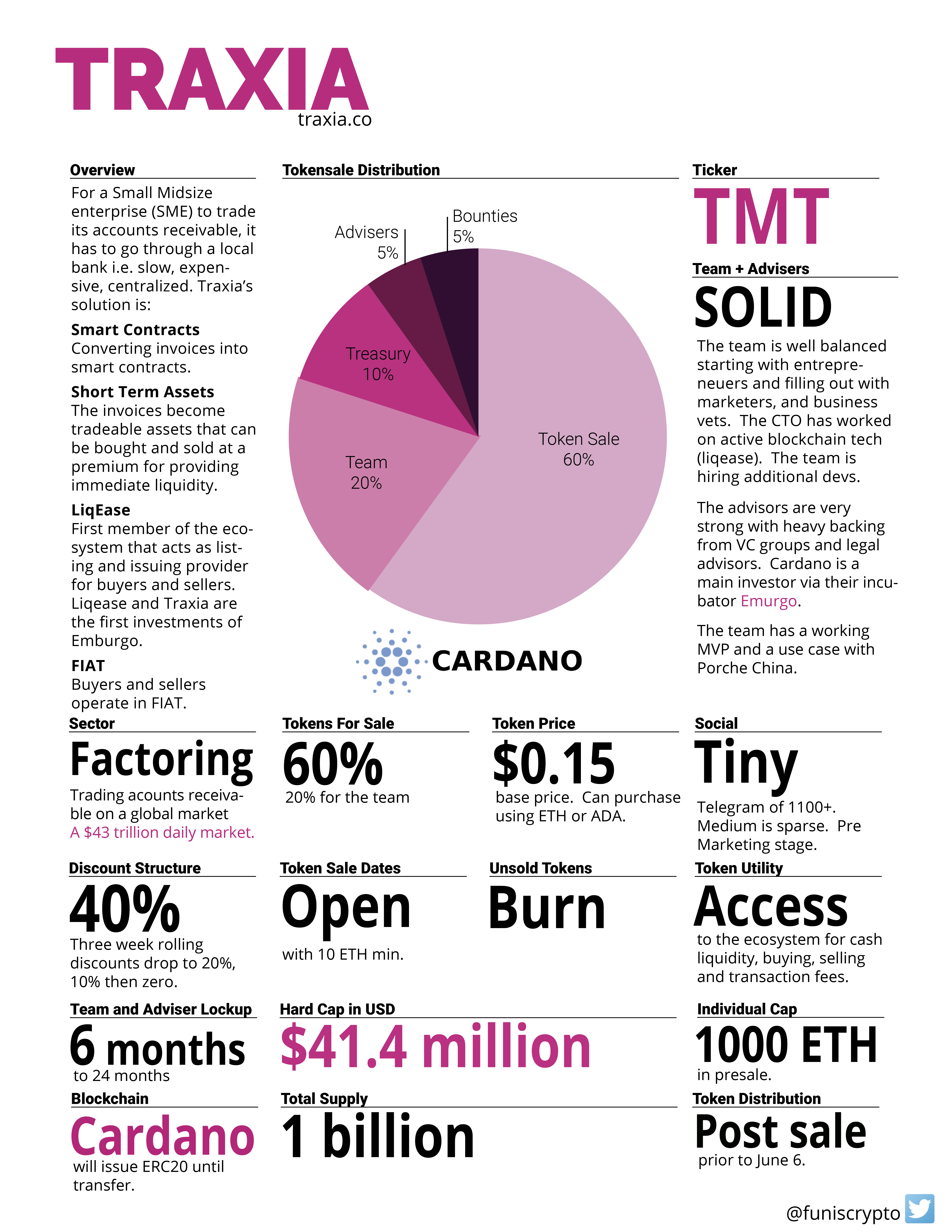

TRAXIA is a new crypto project working on Cardano (ADA) blockchain, decentralized, scalable, fully open source and customizable with smart contracts creation.

Traxia is a fintech platform that aims to guarantee liquidity to Small and medium-sized enterprises (SMEs) that have difficult to access at credits.

The idea comes out by an evident difficulty of real worlds in which Banks finances only the 7% of short-term assets, extremely useful for the expansion of SMEs. So, how SMEs can access shortly to credits disrupting bank ecosystem?

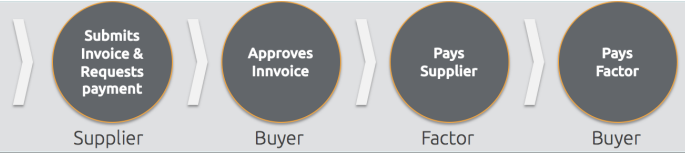

An SME has to digitalize and upload its invoices (to pay for 60/90/120 days) into the system and let professional investors trade them, transforming invoices into digital assets. Instantly and with the only use of the private key, the SME confirm the invoice accuracy and receive Fiat minus commission.

On the other side, who want to be a technological partner of the project streamlining this process, assure the transaction, getting a commission. Upon the technological partner, there is the liquidity provider like a fund (i.e.), that finances the operation in the first place receiving TMT tokens and then re-sell it in a marketplace to smaller Investors, getting a spread. On the same flat, there are professional investors that go to the market trading invoices (digital assets) trying to get margins.

Token Sale

What's up with the ICO?

At this time the ICO includes four presale rounds offering 40% of the total token supply for sale. The base price of the token is $0.15 and can be purchased with ETH or ADA.

The first round of presale is currently open and is offering 22% of the total supply at the maximum discount of 40%. This discount is available until March 18th and requires a minimum contribution of 10 ETH and limits individuals to a max 1000 ETH.

The second round of the presale runs from March 9th to April 9th and offers a 20% discount. The minimum contribution is lowered to .1 ETH (or ADA equivalent). This round is offering 18% of the total supply for sale.

It appears that the third and fourth rounds will sell any remaining tokens from the first two rounds at a 10% discount followed by no discount. If needed, round 4 would end on June 2nd. The max individual cap is lifted for round 4.

The hardcap of the token sale is $41.4 million and there is no soft cap.

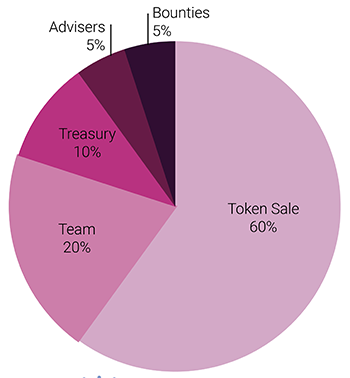

According to the whitepaper a total of 60% of the total TMT tokens will eventually be sold to the public. According to the CMO Bruno Botelho the additional 20% will be sold to create additional capital if needed and they are unlikely to be sold within the first 3 years.

Unsold tokens will be burned.

The token distribution and fund allocation is as follows:

Tokens will be distributed at the close of the crowdsale, either when hardcap is reached or by June 2.

Team member, early investors, advisers and strategic partners will have 60% of their tokens locked for 12 months and the remaining 40% locked for 24 months. The treasury fund will also be locked for two years.

Marketcap & Token Supply

The project at hardcap would have a marketcap of approximately $41.4 million (400 million TMT) if no additional tokens are released at the time. In the current ICO environment the calculated marketcap is on the high side. The high amount of funding is required to properly fund the loan warehouse that Traxia is implementing.

The loan warehouse will allow Traxia to purchase accounts receivable and hold them until they are repurchased by a buyer. In the intial stages of the project the warehouse will play an important role in matchmaking and the prevention of bottlenecks for the ecosystem.

The total token supply is 1 billion TMT.

Exchanges

Traxia is one of the few projects that has announced a date for their token to appear on exchanges. TMT is scheduled to be available on exchanges starting June 5th.

Social and Hype

The TMT Telegram group has 1100+ members and reflects that this project is in the early stages of marketing. The Telegram is increasing in activity and team members including the CEO Tobias and CMO Bruno both appear to answer questions.

This crowdsale is not highly hyped at this time but it is expected to increase as the token sale builds momentum. This is the first project to build on Cardano and is backed by Emurgo, both of which should help to increase interest.

ICO Info Sheet

You came here for ICO information. Here it is in an easy to read format.

Conclusion

The project is good structured and well thought, supported by Cardano community through its investment arm Emurgo, winner of Slush Shanghai 2017 Edition prize. The development team, called LiqEase, has a lot of records in launching and executing digital projects successfully for large corporations or independently and with deep knowledge of fintech world. Finally, Miguel Solana from Santander Bank and Mr. Kapron from Citibank, support the project, guaranteeing a long-term investment and big future success.

Disclaimer: this is my personal article within my personal opinions so please don’t consider it as a financial advice.

For more information visit:

Wibesite: https://www.traxia.co/

Whitepaper: https://docs.wixstatic.com/ugd/baba69_30f719c55f344ab7ae44715a4d287811.pdf

Telegram Group: https://t.me/traxiafoundation

Official Bitcointalk thread: https://bitcointalk.org/index.php?topic=3019695.new#new

Bounty Bitcointalk thread: https://bitcointalk.org/index.php?topic=3021679.0

Author: Vario hitam

My Profile Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1624712

ETH Address : 0xB2d70D6535e16EE25c26f96530254d1f0d73812F