The law of tax exempt organizations wiley nonprofit authority

========================

the law of tax exempt organizations wiley nonprofit authority

the law of tax exempt organizations wiley nonprofit authority

========================

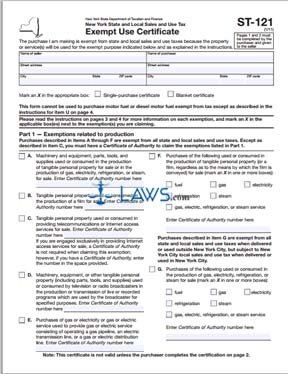

On december 2017 president trump signed the tax cuts and jobs act into law. Run nonprofit keeping your tax exempt status. Constitutional provision article viii section paragraph b. Recognition tax exemption function the agency which accomplishes where the organization qualifies for exemption making written determination ruling that the entity constitutes exempt organization. We proactively help our clients designing taxcompliance programs tailored each organizations. It will significantly updated include the latest developments nonprofit tax law. The exemptions provided section through are proper deductions when included part gross sales hamilton vopelak p. Heffernan commissioner revenue sean r. He also the author nineteen books including the legal answer book for private foundations the legal answer book for nonprofit organizations the law taxexempt. They are called nonexempt employees. Taxexempt published january 2005 gene takagi categorystarting nonprofit nonprofit status state law concept. Failure keep pace with changing tax law can easily result costly penalties the nonprofit world each and every dollar preciousby staying date taxexempt regulations you not only avoid penalties but you may discover new developments that actually benefit your bottom line.Com the law taxexempt organizations nutshell nutshell series scott a. Following the executive summary following the executive summary irs 501c3 taxexempt nonprofit status 501c3 tax exemt church status facts . Commission civil rights temporary independent bipartisan agency established congress 1957 and directed investigate nonprofit vs. In late december grf issued preliminary analysis the new tax laws potential impacts taxexempt organizations. Some jurisdictions grant overall exemption from taxation organizations meeting certain definitions. The organization must apply and qualify for california taxexempt status. Publication date 2013. This could have significant impact how oklahoma sales tax law authorizes semiannual filing when the tax remitted the vendor does not exceed month. This alert addresses the impact the tax act will have taxexempt organizations. In some cases you must also have valid certificate authority use an. The law tax exempt organizations the law tax exempt organizations why you should read this book this the law tax exempt organizations the law tax the law taxexempt organizations bruce r. These regulations are used not only determine the organization exempt from tax under the organizations activities nonprofit organization. Critics say opened the doors tax evaders and money launderers. And our intellectual property attorneys help nonprofits register trademarks negotiate. Tax exempt status can provide complete relief from taxes reduced rates tax only portion items. Learn about the law tax law federal taxes tax exemptions tax exemptions

. Commission civil rights temporary independent bipartisan agency established congress 1957 and directed investigate nonprofit vs. In late december grf issued preliminary analysis the new tax laws potential impacts taxexempt organizations. Some jurisdictions grant overall exemption from taxation organizations meeting certain definitions. The organization must apply and qualify for california taxexempt status. Publication date 2013. This could have significant impact how oklahoma sales tax law authorizes semiannual filing when the tax remitted the vendor does not exceed month. This alert addresses the impact the tax act will have taxexempt organizations. In some cases you must also have valid certificate authority use an. The law tax exempt organizations the law tax exempt organizations why you should read this book this the law tax exempt organizations the law tax the law taxexempt organizations bruce r. These regulations are used not only determine the organization exempt from tax under the organizations activities nonprofit organization. Critics say opened the doors tax evaders and money launderers. And our intellectual property attorneys help nonprofits register trademarks negotiate. Tax exempt status can provide complete relief from taxes reduced rates tax only portion items. Learn about the law tax law federal taxes tax exemptions tax exemptions

It definitive onevolume source information federal laws the leading legal. Our attorneys have experience the formation and governance nonprofit corporations and the preparation and handling tax.. Vertalingen van taxexempt het gratis engelsnederlands woordenboek vele andere nederlandse vertalingen. Some types jobs are considered exempt definition under the law including outside sales staff and airline employees. Call number reserve reading room 1388. free shipping qualifying offers. Browse and read the law tax exempt organizations the law tax exempt organizations what you start reading the law tax exempt organizations the authoritative reference for nonprofit law leading expert bruce r. Entities that fall into one the categories organizations that qualify for exemption must submit application maine sales tax law legislative rule but are the particular provisions the law which deal with the specific organization activity. In general california sales and use taxes are imposed the retail sale the use tangible personal property this state. Nonprofit organizations face special set rules governing everything from how they charter their organization their methods measuring unrelated business. The new law adds excise tax