The Infrastructure Megaproject

HSBCCurrently some 900 projects are planned or under way benefiting more than 80 countries

The Infrastructure Megaproject

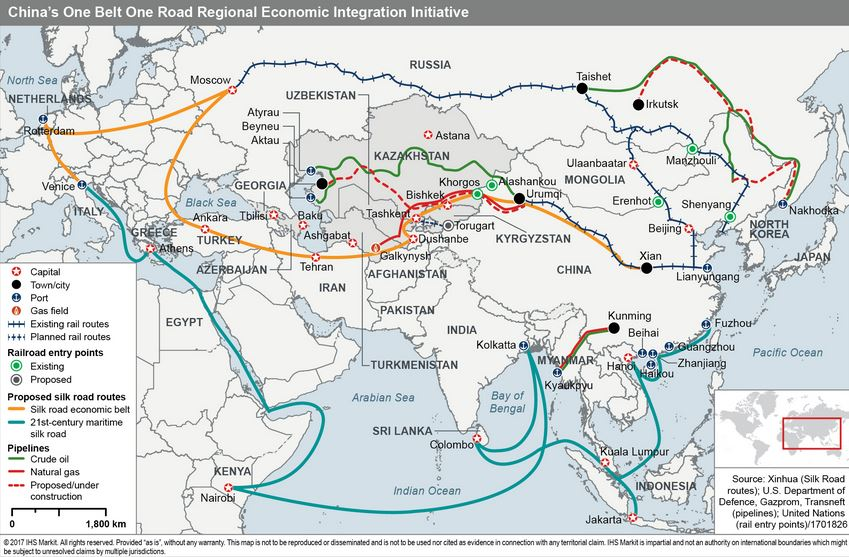

- To help simplify and increase cross-border trade, the top priority of BRI is infrastructure development

- While infrastructure development is focused on transportation, particularly railways as well as highways and ports, it also includes the telecommunications and energy sectors

- BRI projects will benefit infrastructure development specialists in China and around the world, create jobs for local people along the Belt and Road and help global distributors of a wide variety of goods reach new and existing markets faster

China’s Belt and Road Initiative is creating enormous business opportunities throughout Asia, Africa and Europe. Estimates indicate that Belt and Road infrastructure projects in Asia alone will require investments of US1.7 trillion a year through to 2030.

The Asian Infrastructure Investment Bank (AIIB), Silk Road Fund and the New Development Bank have between them already committed approximately US$1.1 trillion to developing the infrastructure networks under the Belt and Road Initiative.

Improving efficiency and productivity, particularly in trade flows, is essential for sustaining the growth many Asian economies have seen in the past decade. Investing in infrastructure – ports, roads, railways and airports as well as power plants and telecommunications – throughout the region is the best way to make that happen. It’s just this infrastructure investment that the Belt and Road Initiative (BRI) is all about.

With a goal of simplifying and increasing cross-border trade across Asia and beyond, China has already made significant investments to build new or upgrade existing infrastructure to meet international standards to support BRI. By the end of August 2016, Chinese companies had signed nearly 4,000 engineering contracts along key trade routes with a combined value of nearly US$70 billion. As of September 2016, some 170 projects across 14 sites in Asia Pacific with US$206 billion investment cost were either in planning stages or in progress.

The Belt and Road Initiative is vast encompassing countries that account for 29 % of global GDP

For BRI to realise its development potential and to address climate change-related challenges, about US$1.7 trillion is needed annually. Reaching these levels will require outside investment. Historically with Chinese overseas investment, however, Chinese companies partnered with other Chinese entities. BRI is laying the groundwork for companies to partner with both Chinese and non-Chinese local enterprises – creating opportunities for organisations around the world to invest in the region’s growth.

While the headlines around BRI focus on large investment flows, there are downstream opportunities for a wide variety of industries. At the outset, those most likely to profit will be infrastructure providers who can play a role in building cross-border railways, highways, ports and airports as well as oil pipelines, electricity grids and telecommunications networks. Longer-term this will extend beyond engineering, architectural and construction firms to include real estate, logistics, financial services, advisory and more.

Along the Belt & Road

According to Anderson Chow, Head of Industrials and Infrastructure, Asia-Pacific at HSBC, the rate of new investment in China’s roads and high-speed railways has started to slow after years of growth. As a result, the country’s major construction companies and train manufacturers are looking overseas for new demand – including along the Belt and Road. As pollution has become a political factor in China, China has become a leader in carbon reduction technology and will also be looking to export their knowledge along the Belt and Road.

China’s government expects its trade with countries along BRI routes to exceed US$2.5 trillion a year within the next decade

There are opportunities for non-Chinese firms as well. Major global manufacturers of heavy duty machinery will be needed to provide excavators and other equipment necessary for these types of projects. And although many of the infrastructure projects will involve big industry players, Mr Chow believes there will be a significant local impact in cities and towns along the Belt and Road. “China’s railway firms might provide a few hundred project engineers for a new railroad, but the 30,000 workers who do the manual work will be hired locally – and that means the local economy will get a boost.”

With its focus on improving connectivity, BRI will have a positive effect on sustainability. A greater investment in developing more efficient railway infrastructure to support the supply chain and enhance productivity, for instance, will move materials, goods and people from road to rail – potentially cutting down on vehicle emissions.

Beyond the Belt & Road

BRI and the new railways will also have an impact on economies thousands of miles away from the Belt and Road trade routes. For instance, sheep farmers in New Zealand can use the new infrastructure to get their meat to Europe faster. Slow steaming to European markets can take as much as 70 days, which means lamb only has a couple of weeks of shelf life once it arrives. By shipping meat to China by sea and then to Europe via rail across Eurasia the product gets to its destination up to two weeks faster, potentially helping farmers get a better price from retailers.

Growing Middle Classes

China's middle class could number 1 Billion by 2025

In opening markets up, BRI is expected to accelerate social and economic growth. That means in addition to facilitating trade and capital flows, infrastructure improvements are also necessary to promote urban expansion. As people move into the middle classes, there will be an increased expectation around quality of life – including efficient transportation systems for their daily commutes and holidays and cost effective energy.

As China’s domestic firms shift to higher-margin business, they are open to foreign companies to supply them with high-value goods and services and can tap into the rapidly growing Chinese middleclass.

China’s state-owned enterprises (SOEs) are investing outside China, creating opportunities for internationally minded companies to participate in massive capital projects in Asia, Africa and Europe.