Teens And Their Money

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Credit Counseling and Debt Management Services

Budgeting & Savings

The Scary Truth about Teens and Money

Around this time of year, we usually do a blog post about “How to Save Money on Halloween Décor” or “Halloween Costumes on a Budget” and so on. We wanted to do something a little different this year. We’re going to take a closer look at teens and their money management skills because let’s be honest, that can be pretty darn scary. Whoooaaa! This could be even scarier than that super creepy zombie costume you made last year!

Teenagers need to learn the right financial lessons when they are young. Otherwise, they are unlikely to develop the level of financial intelligence that they need to succeed in life.

It’s not always easy to manage money. Basic financial concepts are not intuitive for most people. The plus side is that there are some simple methods that can be used to teach children about money.

“Our kids should have an allowance. It teaches them to appreciate money, to learn how to budget, and how to properly manage their money”. This is the rationale that parents use when arguing as to whether or not children should receive their own spending money.

Today, teenagers certainly catch on quickly to the concept of spending money. In the United States alone, almost $259 billion dollars was spent last year by teenagers on “non-essential items”. However, teenagers aren’t quite as good at saving their money. Poll results in one study showed that less than 30% of American teenagers had a savings account or set aside money, not seeing a need to do so.

If you're ready to get started, try our FREE mobile-friendly online credit counseling system. It's the most comprehensive and innovative tool in the industry. Click the link below to get started.

It’s easy to dismiss this lack of thrift as an age thing. Truthfully, when you were fourteen years old, did you spend much time planning long-term financial strategies? But children don’t remain that way for very long. Cavalier attitudes that they adopt towards spending and money management as teenagers often accompany them into adulthood. That is why it’s best to start them out young and explain the importance of Save, Spend, and Share (or Give).

The results of an international study on teenagers and their financial knowledge were recently released by the Organization for Economic Co-operation and Development. The study tested 15-year-olds from around the world (18 different countries total) to gauge their “financial literacy”. Chinese teenagers were the stars of this study, but American parents may be relieved to know that their children are not the only ones who have trouble grasping basic financial concepts.

However, the fact that American teenagers know more about money than Russian and Italian teenagers isn’t anything to brag about, either. The study authors indicated that given financial uncertainties and a shrinking middle class on a global scale, teenagers should be more financially aware. Otherwise, future generations might find themselves compounding the financial crisis of their elders.

One of the recommendations of the study was more financial training as part of educational curriculum. Despite the fact that the United States boasts more than 800 classes on financial topics, experts are stymied on how to streamline this into a digestible curriculum for American schoolchildren.

However, parents can help their teens learn how to become more financially literate on their own. While experts say there’s nothing wrong with providing a child with an allowance, budgeting concepts should be taught at an early age. Teenagers and their money should be closely monitored by their parents.

Stick to your “If you spend it, it’s gone”, guns. Teenagers should be introduced to the “with ownership comes responsibilities” concept. Do they want a car or a Smartphone? Then explain that they will be expected to pay for gasoline or a calling plan from their own income. If they are too young to join the American workforce, they can always do side jobs or “odd” jobs around the neighborhood like babysitting or dog walking to gain their own income.

Despite what they might say, teenagers watch and follow the examples set by their parents and other adults in their lives. So, set a good financial example by NOT spending beyond your means, limiting credit card use around them, and save money with a sound financial institution like a bank or credit union.

Your teenager is watching you more closely than you think. Many kids will develop their money management skills based on how their parents handle their money. It’s important to teach your children early on the basics of money management. Teach them these basics by using age-appropriate themes that cover four practical topics: budgeting, saving, shopping, and credit.

The biggest lesson that young people need is to spend less than they earn. Adults know through experience that you can’t overspend for too long or you will become completely broke and end up in debt. It’s not as easy for kids to learn this information.

When a child has a regular allowance every week and can spend it however they want, it gives them bad financial habits. Imagine that the child spends their full allowance in the first two days of the week. They may be sad or angry that they are out of money, but they don’t really learn a lesson. Sometimes parents will even “cave” and just give them more money.

An adult’s consequences for running out of money are much more severe. The importance of money management becomes clear if a person is struggling to pay their rent. Homelessness or lack of food are both extraordinarily bad circumstances that people in poverty worry about every day, but teens don’t understand that.

Teenagers need to learn how to take care of their finances while they are young. Otherwise, they will end up deep in debt and struggle to make ends meet. This is true regardless of whether the child comes from a middle class, poor, or even a wealthy family.

There are simple ways to start teaching children how to handle their money. One method is to have the child split his or her earnings into three categories: Spend, Save, and Give. The child learns that they should only spend 30% of the money they earn in the short-term. This is a far cry from the child who spends all of their earnings in the first few days of the week.

As the child gets older, they can obtain their first secured credit card. This is best done while still under their parents’ supervision. They can make one or two small credit purchases each month and build a good credit history.

Talk to your children about the future, whether it’s planning and saving for college or a new home. It helps children to know that you are holding off purchasing a new car because you need a new furnace for winter, or that you are saving for the family vacation to Disney instead of using your credit card to finance it now. Setting goals, along with planning and saving, help you make your vision a reality.

When a teenager learns good money management, their financial IQ goes way up. They develop the habits and monetary understanding that will help them prosper for a lifetime. This is the path towards a healthy and enjoyable financial future.

Lauralynn is the Online Marketing Specialist for Advantage CCS. She is married and has two young daughters. She enjoys writing, reading, hiking, cooking, video games, sewing, and gardening. Lauralynn has a degree in Multimedia Technologies from Pittsburgh Technical College.

Use our credit counseling service to see if a debt management plan is right for you.

Our services have helped over 400,000 consumers become debt free. We want to help YOU!

What Should You Teach Kids About Money?

Money Management Advice For The Whole Family

Do Kids Understand the Value of a Dollar?

10 Tips for Big Back-to-School Savings

What Should You Teach Kids About Money?

Money Management Advice For The Whole Family

Do Kids Understand the Value of a Dollar?

If you're struggling to make ends meet, our team of certified counselors are waiting to help you find a solution that's right for you. No matter what your financial situation may be, remember you're not alone

We are a non-profit 501(c)3 organization that is an industry leader in credit counseling, debt relief, bankruptcy counseling, and housing counseling services. We have been successfully assisting consumers with financial debt for over 50 years.

© 2021 Advantage Credit Counseling Services • River Park Commons • 2403 Sidney Street Suite 225 - Pittsburgh, PA 15203

Bank of America Coronavirus Resource Center See details

The 5 most important financial lessons for teens

Parents with teenagers know nothing comes easy, including money management. But with young adults facing mounting levels of student loans and credit card debt, building a strong financial foundation early on is more important than ever. Learn how teens tend to spend and save, and consider teaching them age-appropriate money habits that can last a lifetime.

While many parents give their teens an allowance or pay for things directly, others earn their money through independent jobs.

The material provided on this website is for informational use only and is not intended for financial, tax or investment advice. Bank of America and/or its affiliates, and Khan Academy, assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional and tax advisor when making decisions regarding your financial situation.

Source: Junior Achievement Teens and Personal Finance Survey, 2019

Most teens save their money, and by putting a little away each month that can grow into big savings over time.

Note: Numbers do not account for inflation or any account interest.

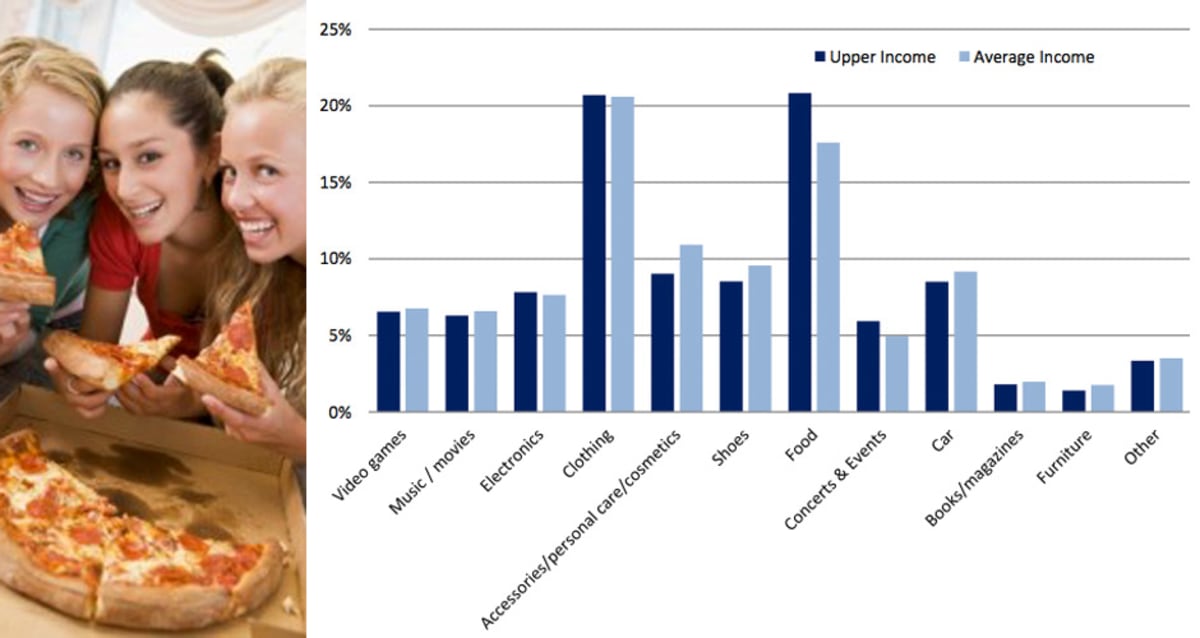

In 2020, the average teen spent $2,150 across a range of categories like food, clothing and entertainment.

The material provided on this website is for informational use only and is not intended for financial, tax or investment advice. Bank of America and/or its affiliates, and Khan Academy, assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional and tax advisor when making decisions regarding your financial situation.

Help your teen understand the risks and responsibilities that come with using credit cards and avoid stacking up debt in the future.

Focusing on the future can help teens start saving their own money and teach them to better accomplish the goals they set for themselves.

Source: Junior Achievement Teens and Personal Finance Survey, 2019

6 steps to help a middle or high schooler budget

What to know about savings accounts for kids

Use Bank of America’s spending and budgeting tool to help spot opportunities to save.

We're here to help. Reach out by visiting our

Contact page or schedule an appointment today.

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.

If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.

Also, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2021 Bank of America Corporation. All rights reserved.

Teen Pov Home

Jena Izminila Muja Sex

24 Teen Com

Voyeur Sex In Park

Anak2 14 Tahun Batman Sex

Teens and their money - YouTube

Money Management and Budgeting Tips for Teens

Consumer Action - Teens & Money - Talking to teens about ...

Teens And Their Money