POST-ICO analysis of Crypto.com (Monaco)

TokenLunchReport date: 06.07.2018

Crypto.com (Monaco) - is a platform for cryptocurrency debit cards based on Visa payment system, which allows users to make purchases, exchange fiat and cryptocurrency by inter-bank rates.

Summary

ICO period - May-June 2017,

Following the results of ICO $54,3M was raised

Ticker: MCO

Token type: ERC20

Exchange entry date - 07/03/2017

Capitalization as of 07/05/2018 - $131,8M

Daily returns - $24,5M

Maximum daily returns were recorded on 09.04.2018 in the amount of $750,5M.

Listing on exchanges: Binance, OKex, Bit-Z, Upbit, Bittrex, Huobi.

ROI USD (from the ICO date) - 2.2х

ROI BTC (from the ICO date) - 1.74х

ROI ETH (from the ICO date) - 0.85х

Product and its real use on the market

The Crypto.com (Monaco) project model is based on the idea to provide users with the opportunity to spend their cryptocurrency buying products or services at any time and at any place where Visa bank cards are accepted.

The project founders state that each time when a purchase is paid with cryptocurrency using Monaco Card, the user will be provided with inter-bank exchange rates without extra charges and fees. This means saving 30-40 euro for each spent 500 euro. However, it isn’t specified due to what saving will be achieved in practice.

In theory, the card holders can immediately and for free replenish their account in ETH and BTC, with a bank transfer or a debit/credit card. Also, it will be possible to file an application for credit limit in the future. The replenishment of credit limit virtually turns the Monaco debit card into a credit one.

On August 31, 2017, Monaco developers released a mobile app Monaco Visa Card, which allows booking Visa Monaco future card. And within 2 weeks the team received 10K applications. The same day, August 31, the project founders planned to send the cards to early clients, but due to ongoing negotiations with Visa about cooperation, sending of cards was moved to October 2017. However, the deadlines were failed again and for today the date of card issue is not known.

Literally on some of these days, on July 4, 2018, the project team began long-expected testing of Monaco card. One of the founders promised that the card will be available for all clients in Singapore and Europe this summer and for USA citizens, probably, in Q4, which will make it possible to satisfy about 70 000 applications of users. Currently, all Visa transactions are limited by fiat currency.

On May 16, 2018, Monaco Wallet app was added to Monaco Visa Card app in Google Play Store and Apple App Store. Currently, Monaco Visa Card & Wallet app is an open beta-version and is being tested. The app was installed over 100 000 times over the last 1,5 months and evaluated by users at 3,8 scores.

To get Monaco VISA® Card the user needs to download the app for Android / iOS and pass registration, including KYC. However, from September 2, 2017 about 30 complaints were posted that users cannot pass verification in the mobile app because of an error. The last release of the version was published on 06/26/2018, but the verification error isn’t finally eliminated.

Clients’ problems and their feedbacks: the main part of feedbacks on the Monaco (Crypto.com) project is negative, sometimes users accuse the project founders of fraud because of several deadline failures in relation to card delivery to users and the error in the app when passing the KYC procedure. There are many gaps in the project model description and the team gives vague answers to specific questions:

- When will I get my card? – The exact time of shipment for each country depends on the number of clients-subscribers and local laws.

- What fees and charges will be when making transactions using the card? – The size of fees and charges will be specified later when your card will be ready for shipment.

- What rate will be used for cryptocurrency exchange? – The algorithm is quite difficult, besides, we don’t want to reveal it. Our stakes will be very competitive.

- Who will pay gas fees / charges when paying cryptocurrency using the card? – Cryptocurrency will be turned into fiat. All Visa transactions are currently limited by fiat currencies and are outside the network.

- In what countries the Monaco card is available? – The card will be available worldwide. The market expansion will be carried out according to a plan: the first step – Asia, the second – Europe, and then North America.

- Why is the app unavailable in Google Play Store of some countries? – The app will be available when the clarity in relation to local laws will be achieved.

Project wallet analysis:

https://etherscan.io/token/Monaco

100% MCO tokens has 17718 wallets, but 75% of all tokens are placed only on 4 wallets.

In all the time 167595 transfers were made through the wallet of smart contract’s owner: out of them 900 transactions were made from July 2 to July 5 in the amount of $10M.

Data on Monaco profits aren’t reported.

Roadmap

The current version of Road Map is posted on official resources Crypto.com (Monaco), but there are no dates of plan completion, and the plan stages have general formulation.

We failed to find the early version of the project as of 2017 in open sources, however, according to icoholder.com data, 2 items were fulfilled after ICO:

- August 2017 - token listing on Bittrex and Binance

- August 2017 – the launch of Monaco Visa Card app for pre-registration of future card owners.

The key item of Roadmap – issue of cards and their shipment to users – is not fulfilled yet.

Among the plans of the project founders, except the issue of cards and modification of Wallet app, there is the launch of additional services to manage user’s investment portfolio and granting credit limits, which will be provided by user’s cryptocurrency.

GitHub

The platform source code isn’t posted on GitHub, and the team doesn’t plan to make it public.

Site traffic, dynamics

From December 2017 to January 2018 a growth of traffic to 650K sessions is observed, but from February the number dropped to 200K and stays relatively stable during the last 4 months. For today the number of sessions reached 246K, and bounce rate is 51%.

The site traffic for the project is not relevant and doesn’t meet the plan for market seizure, which should be actively completed in Asia and Europe.

The dynamics of visiting from the majority of countries is negative and the number of sessions in terms of countries dropped from 4 to 27% over May 2018, although the traffic from Canada increased by 75%.

The main source of traffic is search and direct entries, which generate over 60% of all site traffic. Referral traffic is 21,5%, in which Coinmarketcap.com (86% sessions from referral traffic) is the main resource.

From 07/06/2017 due to company’s rebranding, the project site mona.co moved to a new domain crypto.com, which is estimated by the experts at $10M.

Social activity, community development dynamics

Facebook - 4,96K followers

The signs of audience cheating in the official group in Facebook aren’t detected. The response of users to posts is low – on the average 19 (0,4%) likes and 2 reposts per post. Post frequency - 2-3 times a week.

Twitter - 65,6K followers

The dynamics of the number of Twitter channel followers generally grows, although the reaction of the audience to posts is low – on the average 130 (<0,2%) likes and 20 retwits per twit. Post frequency - 2-3 twits a day.

Telegram - 7,5K members. The activity in the group was observed until 07/06/2018. Following the rebranding, a new group was created on 07/06/2018 with 420 participants. There is no other information except messages on the addition of new members.

The information on the project is posted on many news sites and blockchain resources.

Medium - 1K followers. On the average 430 claps and 2 comments per post.

Reddit - 140. readers. On the average 4 comments per post.

Bitcointalk Forum - the topic was read 345K times. The posts with the project news are regularly posted at the forum. The main topic of discussion over the last 3 months – STORJ mining low effectiveness and the absence of payments for space rent.

Project partners

According to the project founders, Crypto.com (old name is Monaco) is an approved manager of VISA programs (Foris Limited) and an owner of Card program, which allows managing marketing, distribution, KYC / AML, client support and all other operational aspects of card program, including working with the processor of authorization and transaction processing. Wirecard company is an issuer of Monaco card. The program manager differs from the card issuer, since the latter is responsible for the correspondence to local regulations and settlements with VISA.

Gemalto company is a manufacturer of metallic card.

Competitors and market

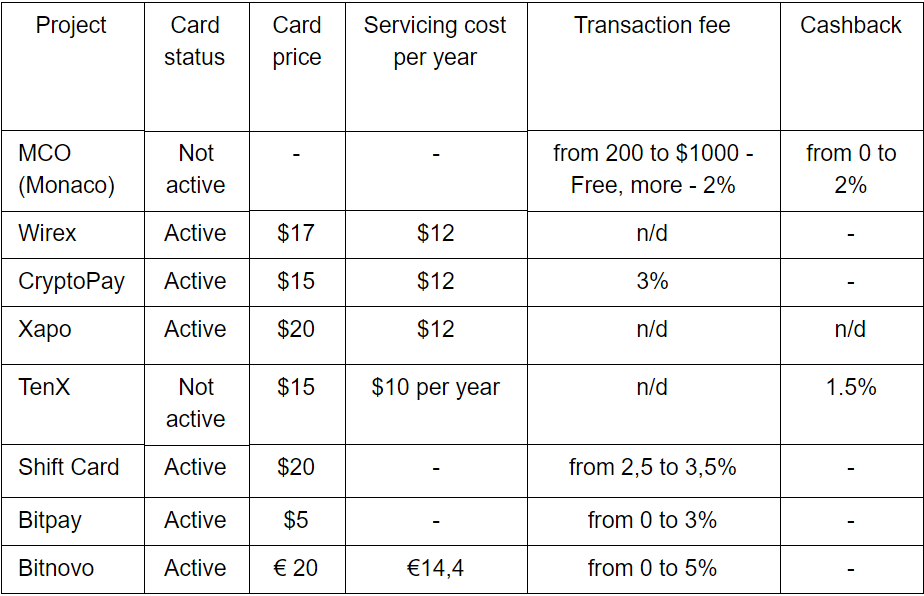

There are dozens of projects, which issue both virtual and physical cards, on the market of cryptocurrency debit cards:

Based on the carried out analysis it can be concluded that MCO card has significant advantages in the form of free issue of metallic card and the absence of fees for card servicing. Cashback to 2% is also an additional bonus for card use. The only substantial shortage of the project is its relative youth and unreasonable delay in card issue. Due to this competitors seized the significant part of the debit cryptocurrency card market.

The significant risk for the entire market of cryptocurrency cards is a high volatility of cryptocurrencies, the lack of a transparent legal framework and prohibition of cryptocurrency circulation.

Conclusion

The MCO (Monaco) project is still at the early stage of development and due to the failure to produce debit cards in time, the trust in the project significantly decreased. However, the loyal conditions of receipt/use of MCO cards, the launch of new credit and investment services of the platform, as well as keeping of promises to issue cards by the end of 2018 will help to restore the shattered condition of the company and occupy its niche on the market of cryptocurrencies.

Final metrics

Real use of the product — 6,5 of 10 / Social metrics — 7,5 of 10

Roadmap maintenance — 6 of 10 / Updates on GitHub — 1 of 10

The final evaluation of crypto.com (Monaco) potential: 5.8 of 10

---------------------

TokenLunch — an independent analytical agency. Post analytics of ICO projects, evaluation of their development and use in the real sector of economy. Only fundamental analysis and only business indicators.

Official group - https://t.me/TokenLunchChat

Official channel - https://t.me/TokenLunch