Nervos ICO Review

@IvnKir

Brief description:

“Nervos is a network of scalable and interoperable blockchains built on top of an open network — which they call the Common Knowledge Base (CKB). CKB is built as a security anchor for all blockchains (and layer 2 protocols such as state channels) in the Nervos network.”

There is a certain dilemma between public and private blockchains. The permissioned chains choose transaction throughput and speed sacrificing security and decentralization. Public chains maximize security and decentralization, which limits their scalability potential.

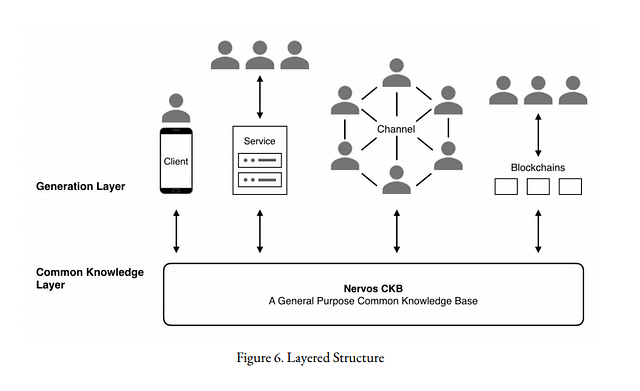

Nervos strives to become a bridge between these two worlds by introducing two-layered architecture. Integrating a secured public chain as a Layer 1 and a high-performance application chain as Layer 2, the project aims to make blockchains easy usable for enterprises and end users.

Common Knowledge Base (CKB) — will literally act as a knowledge database for other blockchains (that is why interoperability) and other “generators”, such as local generators on the client, state services and state channels (like lightning, raiden, celer).

Through CKB the Dapp developers can get decentralized security with custom defined validation rules, and utulize various blockchains that will connect to CKB including Ethereum, EOS, Cardano, etc.

Also, one of the design principles of the Nervos CKB is mobile friendliness. The dapps, developed on Nervos will be able to run on mobile devices and seamlessly integrate with mobile platforms.

Other technology features:

Independent transactions in Nervos can be processed in parallel in many ways, such as on different CPU cores or sent to different shards. Parallelism is the key solution to blockchain scalability problems.

Nervos combines Nakamoto Consensus and the traditional BFT consensus, it allows its system to retain openness and availability and takes advantage of the performance of traditional BFT consensus.

Team:

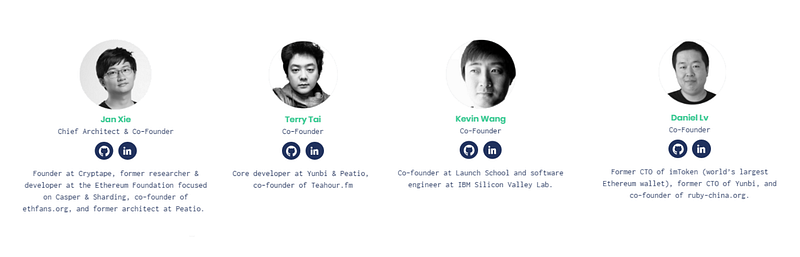

In contrast with many other ICOs, where the team may have come from big corporations but doesn’t have any blockchain experience, the Nervos team has years of track record in the cryptospace.

The co-founder and the chief architect of Nervos — Jan Xie has worked with Vitalik Buterin on sharding and Casper. He has contributed to the Ethereum for several years.

He and his friends and co-founders have built such crypto software projects as Peatio Exchange. Spark Pool — the world’s second largest ETH mining pool, and imToken — the world’s largest Ethereum wallet. Also they worked on a software development podcast — Teahour.fm, started Cryptape and created a permissioned blockchain called CITA.

The Nervos team can definitely be called qualified for starting such a project. It is a pleasure to finally see competent ICO team.

Tokenomics (the most important part for any long-term project):

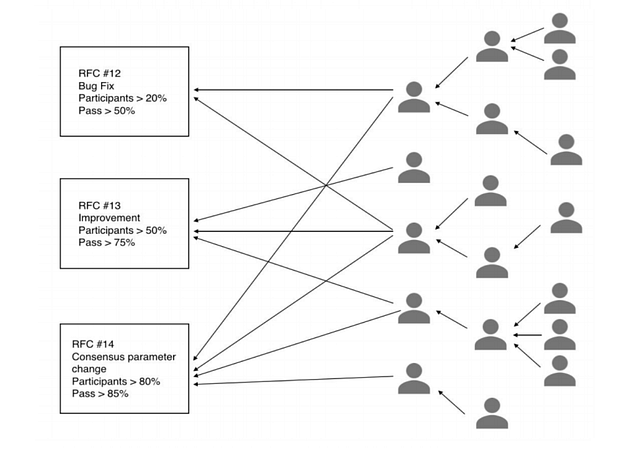

The crucial part for investors is that the CKB token gives governance rights, which is very important and will have a tremendous impact on the token’s valuation. Liquid voting will have different participation rates and support ratios for various decisions. Also, the users will be able to delegate their voting power, and the delegates will be able to redelegate their power to the next delegates.

All this opens possibilities for pretty complex models of governance ( the simple ones as well).

One of the other important features of Nervos tokenomics is the allowance of freemium payment models.

With them, the dapps will be able to pay the network for their customers. This removes the great amount of pain for the end users and makes the widespread adoption of cryptocurrencies a lot closer.

The subscription model removes the pain of many single payments and makes the user experience much more enjoyable. To feel the difference you can, probably, remember how you feel, when you pay for a one-way underground ticket many times a month, or just buy a monthly pass and forget about it for the time being.

With such feature the dapps developers can accept ETH, BTC or even fiat from their customers, so the end users may even not know that they are using a dapp.

Of course, the CKB token will also be used to make payments for the network resources and you will need to lock up a some amount of coin in order to perform a certain actions in the network.

Roadmap:

Jan 2018 — the development started;

Q3 2018 — the appchain release (beta is released), blokchain browser Microscope and dApp wallet;

Est. Q4 2018 — testnet;

Est. Q2 2019 — mainnet.

Programming Language:

Developers can use any language they would like to create applications on Nervos.

The investors:

In this section I want to attract your attention not to the usual tens of new crypto funds that emerged in 2017, but the several well-known and respected partners.

Sequoia Capital — one of the most famous VCs in the world

Huobi Capital — one of the best crypto exchanges and can ( and surely will) list the project.

Polychain — one of the most decent funds in crypto, which places its money bets pretty carefully. It has one of the highest betting average (proportion of coins that doubled their value) in the portfolio.

The best investor (for me) — Multicoin capital. In my opinion, one of the most professional funds in the industry now. I highly recommend you to visit their website for educational materials and to listen to multiple podcasts with the managing partners.

Metrics:

Currently unknown, but the project has risen $28m from its investors.

Given the ambitions of the project, the cap up to $100m should be absolutley fine.

Short-term prospects — Neutral (will be updated):

The project fits into the infrastructure category and has a great upward potential. The community is increasing and influencers start to produce more and more positive reviews.

However, based on the answers of the admin in the Telegram group, the team seems not to be oriented for the short-term gains. Besides, thetoken metrics are still unknown. Quite the possibility that the hardcap will be pretty high.

Long-term prospects — Positive:

The team, tokenomics and investors are superb. There is a good combination of a crypto-building experience, institutional support and token with decent utility. The subscription option can significantly lower the barriers for entrance for the end users.

The project has all the chances to succeed in the long term. One of the safest bets among the recent ICOs.

Please, remember that I’m not a financial advisor. The material for educational purposes only. DYOR!

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

If you liked the review feel free to join the announcements channel to get more of them and check out the spreadsheet table with summaries of all previously reviewed projects:

If you have questions or want to participate in a discussion you can join the chat group:

All information about previous reviews can easily be found in my ICO table: