Kora Network : an infrastructure for inclusive, community owned financial systems.

S3rj0The Kora is a West African harp of the family of bridge harps or harp-lutes but also a new Erc-20 based cryptocurrency.

Kora born to avoid barriers between people and financial service providers developing a low-cost platform to solve this.

Due to the high cost to serve, lack of identification documents and financial literacy many people all over the world cannot grow and accumulate wealth: so Kora is trying to solve these problems.

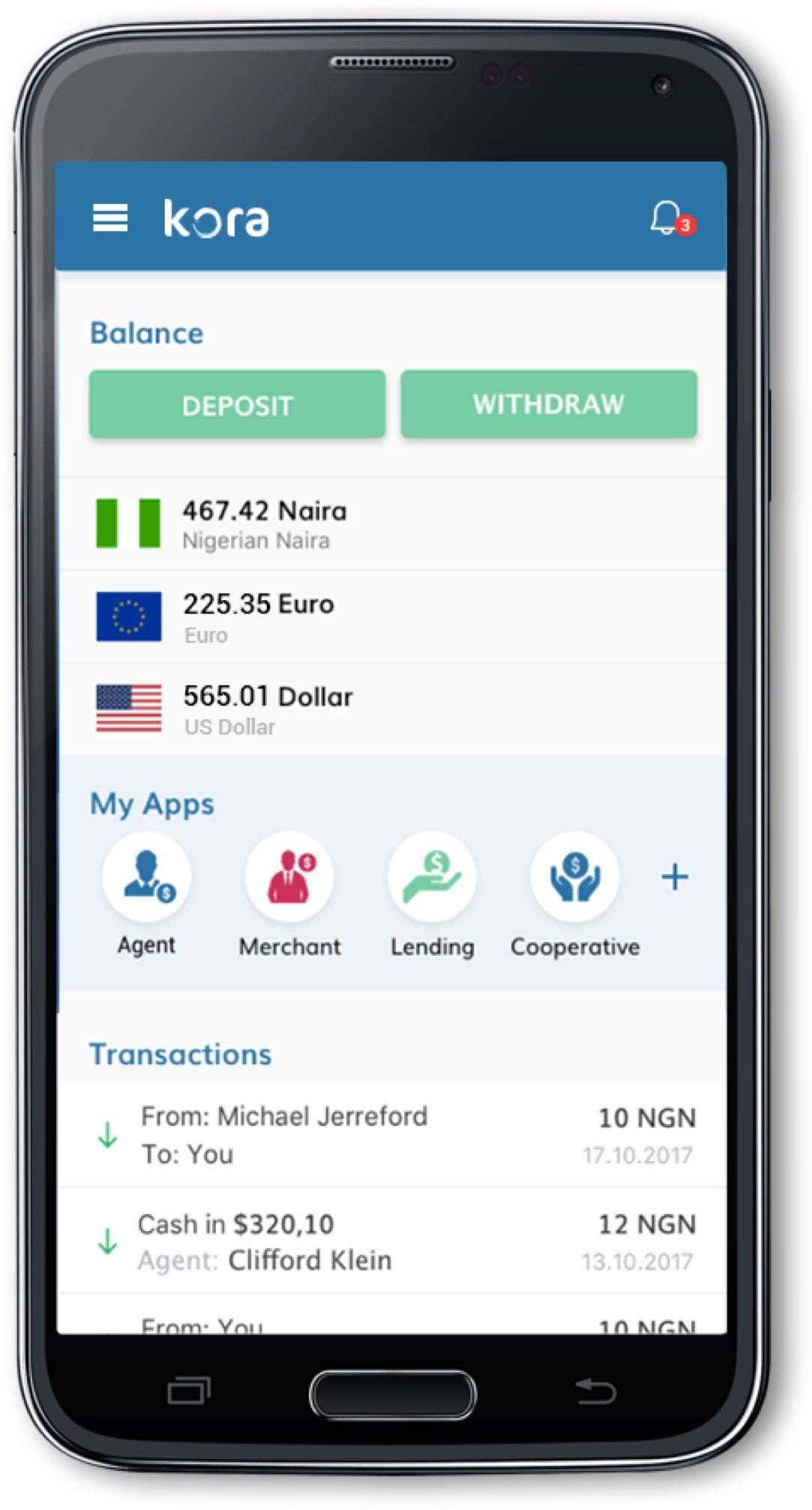

Kora team is working hard to build an ecosystem where users will be able to transfer money easily and faster with low fees, ask for a loan, lending or simply receive money all over the world.

Nowadays using blockchain technology all these awesome features will be a real dream that becomes true.

Advantages of Kora

- Low cost

- Universal access

- Engagement with existing communities

Let’s see some use cases from kora’s Whitepaper…

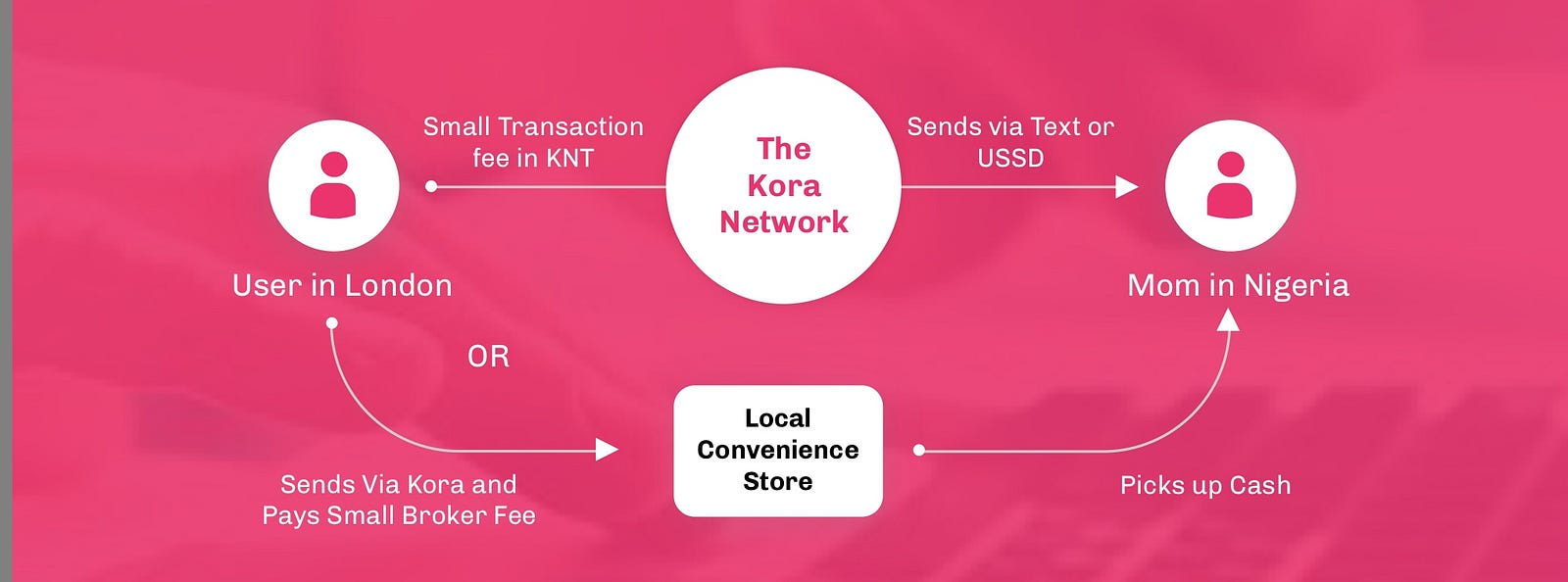

Transfers and payments

Today, if someone living in London wants to send money back to their mother in a village in Nigeria, they have to go to a local money transfer company (i.e., Western Union, MoneyGram, TransferWise, etc.), which normally takes about 5–8%+ fees. Then, their granddad has to go or send someone to travel two, three hours to the nearest place to pick up the cash. With Kora, users will also be able to purchase mobile airtime and data subscriptions, pay bills, merchants and third-party services for energy, education, micro insurance and other services.

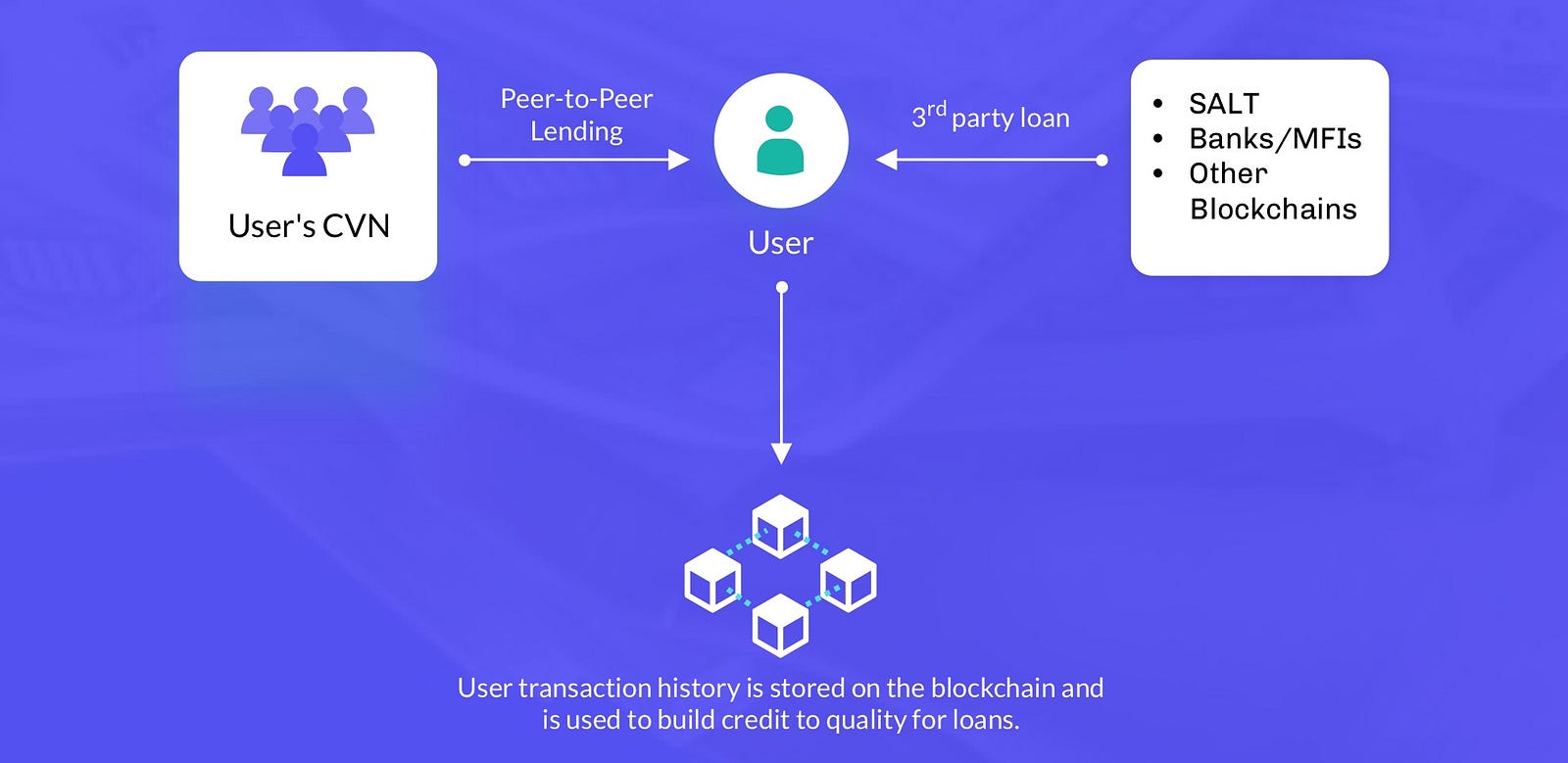

Lending and loaning

Today, if a citizen of Botswana wants to take out a loan from a local bank or other lender to start a business, they need to, among other things, provide multiple forms of ID that is acceptable to such lender, meet the educational standards set by such lender, provide previous statements of accounts for a minimum of one year, must provide valid business registrations from a centralized operator and provide signed referrals from parties who have sufficient and verified balances with such lender. They must also provide collateral worth more than the amount being loaned, and if they’re acquiring property, it must be located in major cities where the land can be easily used as collateral in case of a loan default. Essentially, the user needs to prove that they don’t need the loan in order

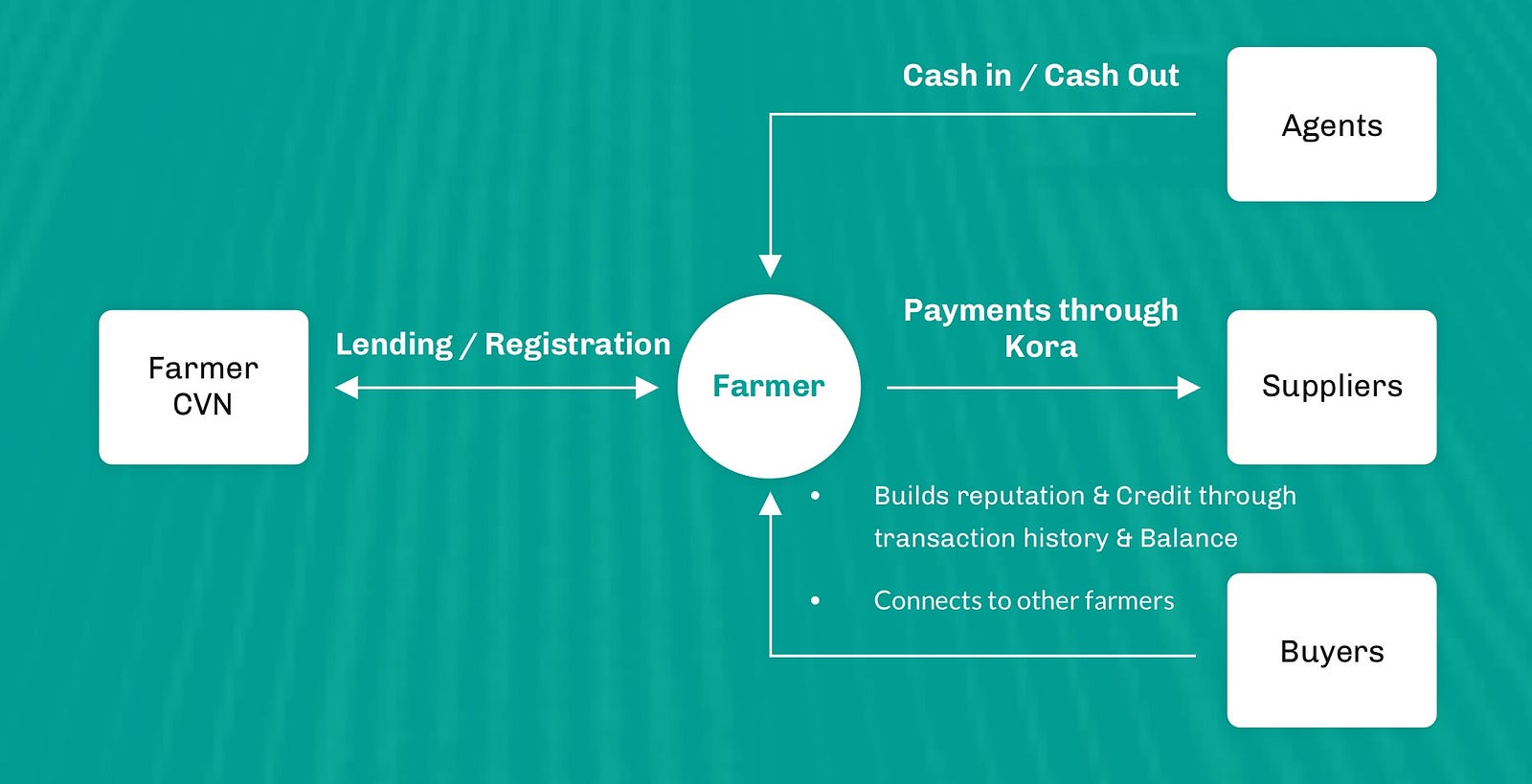

Agriculture

Across Africa, agricultural activities are conducted in rural areas, which are characterized by a high density of unbanked people. Large corporations receive their agricultural supply and raw materials from local farmers, but the farmers are not paid until after three to four weeks of supplying due to the widespread lack of financial identities or bank accounts. Most transactions are cash-based through every step in the supply chain, facilitating the use of middleman and corruption which result in farmers not being able to receive full payment.

Kora network token (KNT) details:

Hard cap token sale: $ 24 million

KNT Supply: 755,007,338

Presale: Start Date: March 5, 2018 (minimum 5,000$)

Crowdsale Start Date: March 26, 2018 (no minimum)

Token distribution:

- 45 % Sold to raise funds and increase liquidity of KNT.

- 20 % Locked up for a minimum of one year and released as necessary. Used for establishing partnerships, onboarding users, and expansion into new markets.

- 20 % Locked up for minimum of two years and released as necessary. Used to develop protocol and shared infrastructure.

- 15 % Team Token Grants that will be locked up in a two year vesting period with a 6 month cliff.

Learn more about kora

Intro Video: https://www.youtube.com/watch?v=c6QM0-7pZF0

Website: https://www.kora.network

Whitepaper: https://kora.network/downloads/Kora%20White%20Paper.pdf

Vision Paper: https://kora.network/downloads/Kora_Vision_Paper_US.pdfj

Bounty: https://bountyhive.io/join/Kora%20Network