Hada Dbank is the 1st digital bank

Raising StarsCONTENT DETAILS

1.INTRODUCTION

2.MEANING OF HADA DBANK

3.WHY ISLAMIC BANKING

4.ADVANTAGES OF HADA DBANK

5.TOKEN DETAILS

6.TEAM

MEANING OF HADA DBANK

As i mention above Hada Dbank is the first Digital Bank to fuse Islamic Banking Module with Blockchain Technology, to create an ethical and responsible banking ecosystem. Hada dbank is troubled with the current mistreatment by banks and financial institutions towards their customers. Existing players create money out of thin air from debt and interest. This is why the global economy has collapsed time after time, evidently since the 1st century. The lack of responsibilities bore by banks is simply audacious. This is why we chose to be a part of the current financial revolution through establishing a Bank, a caring and personal bank.

WHY ISLAMIC BANKING?

Our reason is simple. We aspire to be a ‘just’ organization in the financial industry. The financial crisis of 2007–2008 serves as a grim reminder how several irresponsible players can capsize an entire industry, putting millions in financial ruins. Islamic banking, due to its transparency, profit and loss sharing concept, will minimize market manipulation and eliminate another domino crash.

Islamic Banks are less risky and more resilient than their counterparts, due to the aspects of their bank capital requirements and mobilisation of deposits. As opposed to Conventional Banking, depositors to Islamic Banks are entitled to be informed about what the bank does with their money. They also have a say in where their money should be invested. Islamic banks also strive to avoid interest at all levels of financial transactions and promote risk-sharing between the lender and borrower.

There are two basic principles in Islamic banking. One is the sharing of profit and loss; and two, significantly, the prohibition of the collection and payment of interest by lenders and investors. Collecting interest or “Riba” is not permitted under Islamic law. In the case of profit, both the bank and its customer share in a pre-agreed proportion. In the case of a loss, all financial losses will then be borne by the lender. In addition to this, Islamic bank cannot create debt without goods and services to back it (i.e. physical assets including machinery, equipment, and inventory). Hence savings, deposits and investments with our DBank will be backed by physical assets such as precious metals and gemstones.

You might think that Islamic banking is only for Muslims. It is not. In June 2014, Britain became the first non-Muslim country to issue Sukuk; the Islamic equivalent of a bond (the word itself is the plural of Sakk, which means contract or deed). In September 2014, the governments of Luxembourg and South Africa as well as the Hong Kong Monetary Authority made issuances. But Sukuk is not limited to sovereigns: in September 2014, Goldman Sachs issued a USD500 Million Sukuk and Bank of Tokyo-Mitsubishi Malaysia raised its 1st USD50 from its USD500 Million issuance. All of these entities want in on the USD2 Trillion Islamic financial market.

ADVANTAGES OF HADA DBANK

Free Encrypted Account & e-Wallet

a. Smartphone — Banking App

b. Non-smart Mobile phone — SMS / USSD Code

Saving & Withdrawal

a. Minimum 5% Savings Return per annum

b. No withdrawal fee

Transfer, Remittance & Exchange

a. Free Transfer / Remittance of funds (FIAT & Cryptocurrency) between personal savings accounts and e-wallets

b. 0% fee on exchange transactions via HADA Exchange (between cryptocurrencies). No charges on major FIAT currencies during FIAT <> Crypto exchanges.

c. Connect with partners or open APIs for better rate for other currencies

Loan & Investment

a. 0% Loan Interest

b. 10% minimum investment return

Cashbacks & Discounts

a. Cashbacks & Discounts are rewarded when using Hada’s physical and/or virtual Debit Cards (1st year of signing / opening of account)

b. Additional Cashbacks & Discounts when paying using HADACoin, indefinitely.

c. Additional Discounts from Partners & Affiliates

HADA DBANK TOKEN

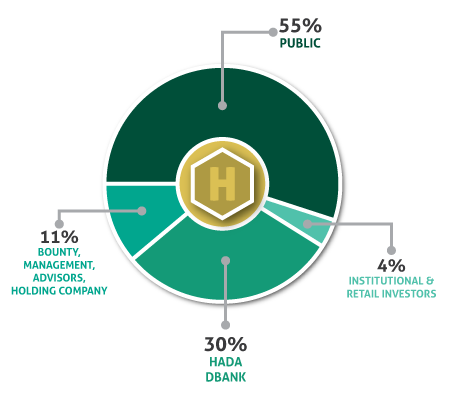

HADACoin Distribution

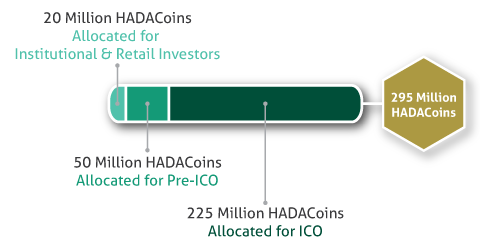

A total of 500 Million HADACoins will be issued. 295 Million coins will be offered for sale. Out of the 295 Million coins, 20 million will be allocated for private investors and institutional buyers. 50 Million of the 275 Million coins will be released during PRE-ICO exercise and the remaining 225 Million coins will be released in our ICO exercise in the near future. 10 Million coins will be allocated for the bounty campaign.

HADACoin is a ERC-20 coin created using Ethereum platform. A total of 500 Million HADACoins will be created. HADACoins will have 6 decimal units. Further info about HADACoin as stated below:

- a. Perform financial activities and services on our Banking Platform

- b. Pay for services using our Debit Card

- c. Receive Monetary Profits such as Dividends, Returns and anything of equivalent by keeping it in your Savings Account or utilize our Investment Solutions

- d. Act as collateral when you apply for our Unsecured and Term Loans

- e. Trade it on Crypto-Exchanges and make more profit by increasing HADACoin’s value!

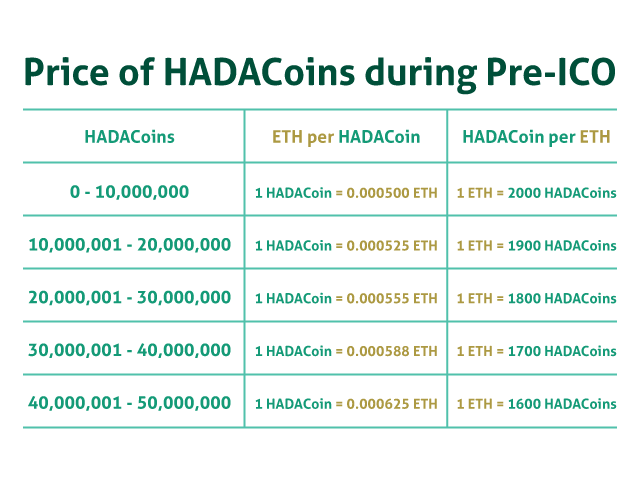

PRE-ICO (50 Million HADACoins)

Pre-ICO will begin on 20th December 2017 (00:00 EST) and Ends 31st January 2018 (00:00 EST).

SOFTCAP = 5,000 ETH

HARDCAP = 20,000 ETH

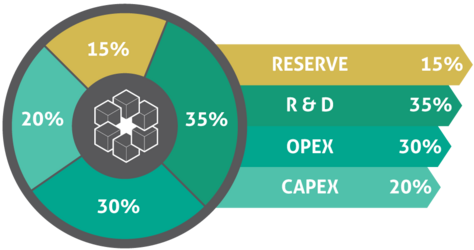

35% of the capital raised through our PRE-ICO exercise will be allocated for R&D (Research & Development). We plan to hire and retain at least 50 computer programmers, coders and IT personnel to further develop our banking platform and system, as well development of future products. 7 labs will be established in 5 years in which the 1st and 2nd lab will be based in Switzerland and Estonia respectively.

OPEX (Operation Expenditure) will make up 30% of the budget. Hiring of management executives will be our main activity under this sector, to ensure that the best partners and talents from related industries join HADA DBANK management and operations. We plan to market aggressively and are currently partnering with an experienced Marketing Partner, to help us put our name to the targeted markets, globally.

CAPEX (Capital Expenditure) will receive 20% of the capital raised. Among activities will be the acquiring of offices, investments in hardware for our R&D department, necessary business assets, and precious metals and gemstones (gold, silver and diamonds), to be used as collateral for future customers’ savings, investments and HADACoin’s value.

The final 15% will be kept as RESERVE. This Reserve will not be used unless for utmost necessity and strict rules will be set. The decision to utilize this reserve will be determined by the top management collectively and unanimously, to ensure there is no mismanagement and excess usage of the Reserve. We will increase HADA DBANK’s Reserve to 30% of the total capital, in the nearest future in accordance to Islamic Financial Laws.

TEAM

MOHD AL-SHAZANOUS

CEO / CFO, CO-FOUNDER

JUAN MAHUSSIN

CTO, CO-FOUNDER

MARCOS MACIAS

COO

ERNEST LOH

PR & SPOKEPERSON

ADVISORS

Prof. Emeritus Dr. Barjoyai Bardai

ISLAMIC BANKING &

FINANCE

Yousuf Ikram

RISK MANAGEMENT &

CONSULTANT

Guan Seng Khoo (PhD)

RISK &

DATA SCIENTIST

Alan Kong

BANKING INNOVATION

Robby Schwertner

BLOCKCHAIN ECONOMY EXPERT

Darrell Emmanuel

INVESTMENT & ASSET MANAGEMENT

Faiz Ahmed Faiz

MARKETING &CRYPTOCURRENCY

Kevin Koo S.K.

LEGAL

Col. Loc Hamaka Nawi

SECURITY

For more information please click the links below:

Author-Raising Stars

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1930778