HOMELEND - IT'S MORTGAGE CROWDFUNDING PLATFORM

Luky147

Mortgage loan is the common method that most people use to own a living place. With this loan, of course, and good financial management, everyone will be able to get one of their primary needs. However, if you see the process from applying the loan to the time when the loan is approved and you get it, it will take very long time. The fastest waiting period is 50 days. This will only give you many problems. However, Homelend has solution for that problem.

What is Homelend?

Homelend is P2P platform that apply the Blockchain technology in mortgage loan process. This platform will become the place where anyone who need mortgage loan can find the loan that they need, apply it and finish the application way faster than the current system. This project will connect many people that have similar need in mortgage loan. Without one monopolizes party, the process will be much transparent, safer and faster.

The Vision and Mission

With Blockchain technology growth that runs faster, Homelend team has vision that the mortgage loan industry will become fully automated. Using the smart contract from this technology, all processes will be managed by the platform itself. In the end, the process to apply for mortgage loan will be much effective, compared what we can find today.

The main mission of this project is creating the accessible platform for anyone who need mortgage loan. With this platform, the mortgage industry will change into much better industry that will give more benefit toward the consumer as well as the loan provider. That way everyone will have better chance to get the mortgage loan that they need.

Why this project?

Here everything is quite simple. The creators of this project are young and experienced people involved in banking. Their main task is to overcome the barrier that the mortgage system has set for us. How can this be done? - you ask. The answer is unequivocal - with the help of innovative technologies, which include blocking. Blocking is a distributed data register that can not be subordinated to anyone, as is done with a mortgage system.

Homelend has two main objectives.

- Upgrade the outdated system of mortgage lending and make it efficient and profitable.

- Expand opportunities for owning property for the modern community.

- How will this work in practice? Here we are helped by the technology of blocking and smart contracts. With the interaction of these two components, borrowers of housing (or buyers) and creditors are combined on a platform. This not only simplifies the process of obtaining a mortgage, but also automates it.

Speaking about the platform, one can not just not appreciate its advantages.

- Simplification and effectiveness against manual labor.

- If earlier everything was done manually, on paper, now the process is simplified to a minimum. Specialists from Homelend have learned to build business logic into clever contracts. This makes it easy to digitize the documentation and eliminate unnecessary processes. All this allowed to reduce the process from 50 to 20 days.

- Transparency against black accounting.

- Many decades, people who intend to get a mortgage, had to constantly ring up bank workers and be interested in the state of affairs. Today, you do not need to do this, just simply check your application online and identify possible deviations. Representatives of Homelendcreated not only a fast, but transparent and fair process of obtaining a loan.

- Economically viable proposal against rabid commissions.

- If earlier, banks were intermediaries, now you can do without them. This reduces not only the time, but also the financial component of obtaining a loan. The process of obtaining a loan from Homelend saves us from vulnerability and makes the platform safe, transparent and reliable.

The HMD token is a platform payment system or fuel that feeds the platform. This coin will be used to purchase services on the platform or pay fees. To receive a token is simple: it is enough to buy it now, at the time of sale, or later, when it will rise in price. I recommend doing this now, while the discount is in effect.

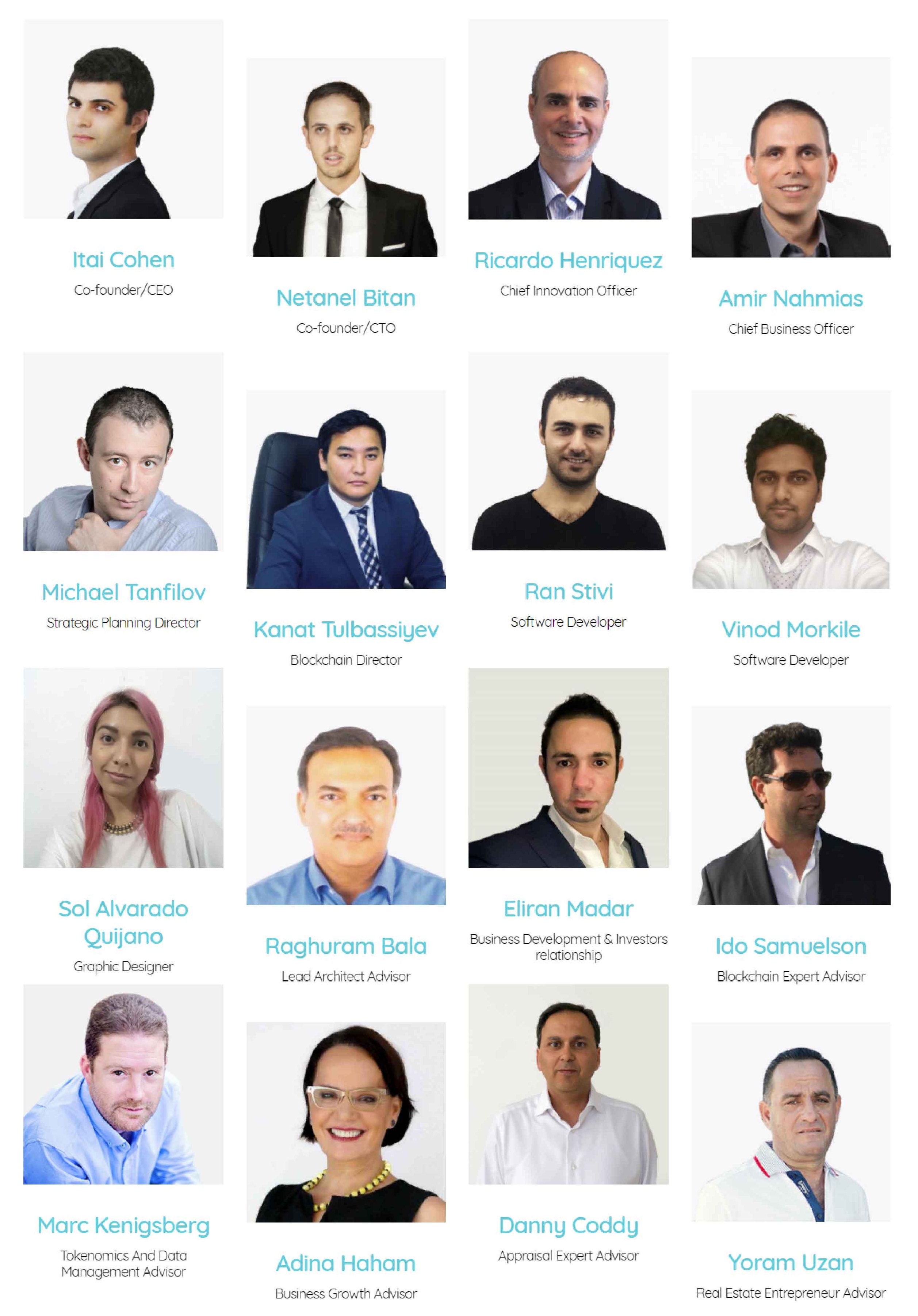

Team

Homelend gathered experts with experience in the mortgage market and other areas required for the project. They can be reached through the LinkedIn profile.

ICO Details

- Token Symbol : HMD

- Total Supply : 250,000,000

- Standard : Ethereum ERC-20

- Token price : 1 ETH= 1,600 HMD

- Accepted Currencies : BTC, ETH, USD

- Softcap : US$ 5,000,000

- Hardcap : US$ 30,000,000

Roadmap

Conclusion

The project Homelend has set itself a complex, but quite feasible task. The main objective of the project is to modernize the system of obtaining loans. I, like many experts, are confident that this task will be implemented with our help. And soon it will be possible to get a loan in a matter of days and for any amount. I advise you to support the project.

For More information follows;

WEBSITE: https://homelend.io

TELEGRAM: https://t.me/HomelendPlatform/

WHITEPAPER: https://homelend.io/files/Whitepaper.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=3407541

FACEBOOK: https://www.facebook.com/HMDHomelend/

TWITTER: https://twitter.com/homelendhmd

MEDIUM: https://medium.com/homelendblog

LINKEDIN: https://www.linkedin.com/company/18236177/

REDDIT: https://www.reddit.com/r/Homelend/

YOUTUBE:https://www.youtube.com/channel/UCPLfMaovZB0Lqc9I3A7V_Rw

Keep Tabs On Me Daily articles about cryptocurrency and blockchain based projects.