China Is Facing An Epic Deflationary Crash That It Can No Longer Hide

www.zerohedge.com

It has long been understood that most financial data provided by the Chinese government is propaganda designed to misrepresent the country's true economic circumstances. At best, their statistics provide half the truth and the rest has to be discerned through deeper investigation. When systemic crisis events take place in China it usually comes as a shock to much of the world exactly because they expend considerable resources in order to hide instability behind a thin veneer of fabricated progress.

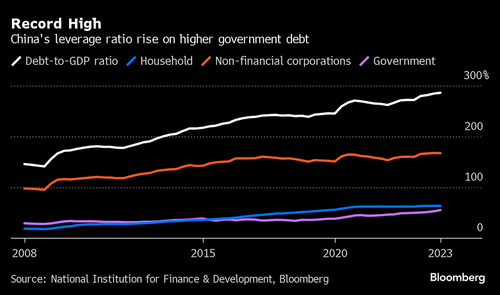

The biggest story in China in the new millennia has been nation's debt explosion. China's debt-to-GDP ratio is currently estimated at nearly 300% (official numbers), with most of the liabilities accrued in the past 15 years. Chinese debt spending accelerated in part because of the global credit crash of 2008, but a lesser known factor is their entry into the IMF's Special Drawing Rights basket. The process started around 2011 and the IMF requires any prospective applicant to take on a wide array of debt instruments before they can be added to the global currency mechanism.

By the time of China's official inclusion in the SDR in 2016 they had nearly doubled their national debt. After 2016 debt levels skyrocketed.

The debt problem is harder to quantify in China because of their communist structure posing as a free market structure. Corporate debt in China has to be included into the national debt picture because of state funded enterprises and the level of government investment in property and industry.

It is here where we find the most blatant warning signs of deflationary crisis, particularly in property markets and infrastructure development. The CCP has put a "great information wall" in place to prevent accurate data from leaving the country, but some reports on China's failing infrastructure still escape. China's export market is crumbling in the past year, in large part because western consumers are tapped out due to inflation. However, what they prefer not to mention is the damage they did to themselves after three years of near constant covid lockdowns. This destroyed their retail sector and things have only grown worse since.

Then there is the real estate market which has suffered extreme deflation over the past decade, with a larger drop expected in the next year. China deliberately popped the housing market bubble as a means to disrupt what officials considered out of control speculation. This led to the now famous "ghost towns" dotting the Chinese landscape; thousands of neighborhoods and high rises left unfinished and empty after development companies went bankrupt.

One of the more disturbing trends in China, though, is the effort to use large infrastructure projects to hide the nation's deflationary decline. China's propaganda machine is pervasive across the world and most people in the west assume that China is on the cutting edge of progress because of videos on social media. In reality, the Chinese have been building cheaply constructed and poorly designed false-front landmarks that look technologically impressive on the surface but fall apart in a matter of months.

China is planning another 1 trillion Yuan ($137 billion) in infrastructure projects in 2024 alone, but the debt cycle and the deflationary spiral seem to be catching up with them. The IMF claims that China's economy has stumbled but is "unlikely to fall", yet, with their global exports falling, property markets plunging and consumer activity in decline it's hard to see how they can continue without a depression-like event in the near future.

Source www.zerohedge.com