Bmt Private Equity

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Enterprises make acquisitions in order to – after holding it for a few years and, more often than not, restructuring – resell the acquired company at a profit. Unlike the strategic investor, the private equity entrepreneur is primarily concerned with cost-effective acquisition funding and expeditious resale, ideally by launching the acquired company on the stock market. While transactions of this nature used to be characterised by financing where the acquisition loan is redeemed out of the current revenue of the target company, and, in so far as possible, secured with the latter’s assets, this form of financing has by now clearly become more difficult to implement, not least due to the financial crisis. Therefore, private equity firms these days need to analyse the financials of a target company much more carefully to achieve a favourable forecast for the transaction. Our lawyers have assisted with countless acquisitions (see mergers and acquisitions), as well as structured finance solutions of this nature, applying the necessary specialist expertise. They have a high degree of experience in solving specific problems pertaining to this industry.

Telecommunications technology, biotechnology, the pharmaceutical industry, medical engineering and Internet-based commerce and services are typical growth industries in which the traditional bank loan is usually not available to start-ups and their founders. Oftentimes there is a lack of banking collateral. As an alternative, project financing by means of venture capital is the way to go. The venture capitalist usually receives shares in the financed company, and, in return, provides equity, without being given any securities.

Four complex questions are central to financing by way of venture capital: How can adequate control over the company be guaranteed even in the position of a minority shareholder? How can the venture capitalist’s risk be limited in the case of the business developing unfavourably? How can the founders of the company, upon whose personal co-operation the success of the company depends in most cases, be motivated, and if necessary compelled, to continue working for the company for a stipulated period of time? And finally, how can contractual provisions for the venture capitalist’s exit from the company be made in advance at the time of establishing the engagement?

From the perspective of the company founders, when it comes to designing the participation agreements with sufficient foresight there is also and in particular the issue of countering excessive demands for securing risks and exercising control posed by the respective venture capitalists, and thus preserving sufficient room to act and attractive yield potential for the company. Targeted advice will lead to the best solution for clients in this sphere of interest. This is where BMT has been assisting both founders and venture capitalists for many years.

© 2021 Büsing Müffelmann & Theye Lawyers and Notaries

WSFS Financial Corporation to Combine with Bryn Mawr Bank Corporation, Solidifies Position as the Premier Bank

and Wealth Management Franchise in the Greater Philadelphia and Delaware Region – Read Full Release

BMT Updates on COVID-19 – Learn More

Posted in Podcasts on October 26, 2020

BMT Chief Investment Officer Jeff Mills provides an overview of the private equity asset class. In this podcast, Jeff covers what private equity is and why some investors may want to consider it within a diversified portfolio. Listen as Jeff discusses why now might be a particularly interesting time to consider private equity, highlighting that the pandemic has created opportunities to invest in certain middle-market private companies.

Introduction:

Welcome to the Bryn Mawr Trust Wealth Management podcast, providing commentary on what’s moving the financial markets, financial planning, and other timely business and monetary topics. Please welcome your host, Jeffrey Mills, chief investment officer at BMT Wealth Management.

Jeff Mills:

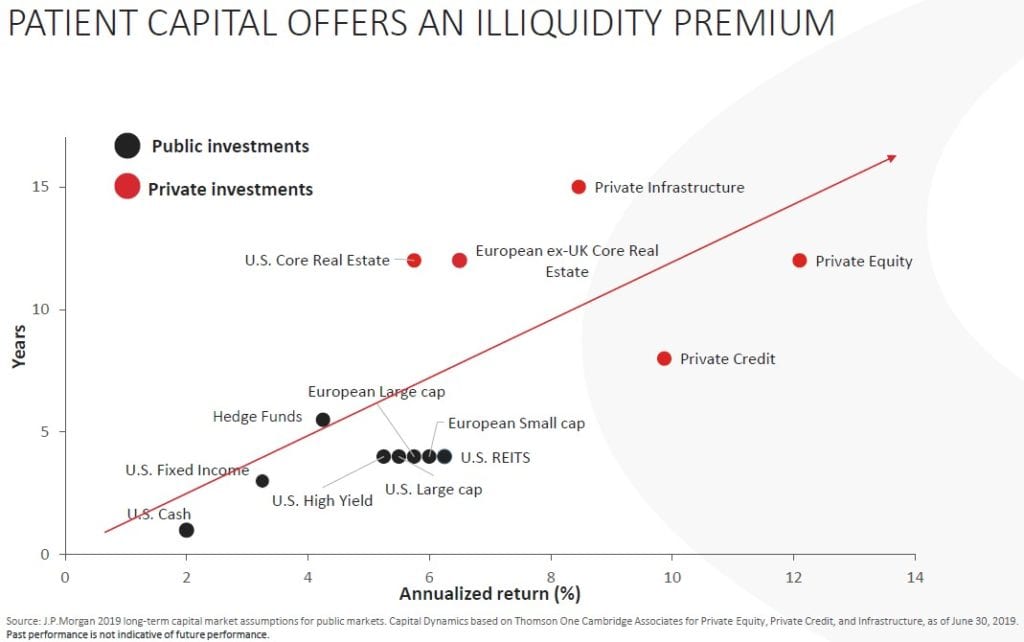

Hello, thanks so much for joining us again for our quarterly podcast series. We’ve been looking forward to this one just because it is a little bit different than our others in the sense that we’re not doing a market outlook or diving into something related to the economy, we’re doing more of a deep look into a particular asset class. And in this case, we’re looking at alternatives and we’re looking at private equity. I think for our clients, a better understanding of private investments and, in this case, private equity, I think it’s going to broaden the opportunity set to those looking beyond traditional stocks and bonds. I think at a time when you have expected returns in traditional, publicly traded stocks and bonds, that at least in our opinion are going to be below historical averages looking forward. I think it makes some sense to look at private equity as a potential component of a diversified portfolio.

Jeff Mills:

Now, I’ll be the first to say that private equity is not appropriate for every investor, but I do think having that clear understanding of what private equity is, what private equity isn’t will facilitate a more thoughtful and educated decision-making process. And I also think that there’s some shifting dynamics in the public markets that we’ve seen over the past number of years that make this a particularly interesting conversation. And I also think that the dislocation created by COVID-19 makes this particularly timely in terms of considering private equity as a potential for your portfolio. So let’s dive right in and just start at the beginning and talk about what private equity is. You know, it’s a very basic point. Private equity is a type of alternative investment and we use the term alternatives all the time. It’s really a blanket term that we use to describe all kinds of different investment options that really don’t fit neatly into the equity, fixed income or cash asset class buckets that we’re all familiar with.

Jeff Mills:

And I think you can, you can come up with all kinds of different examples of alternative investments. Obviously all things in the private markets, including equity debt, real estate infrastructure then you have hedge funds which are more in the public market space, but there are all sorts of different hedge fund strategies, long short equity merger, arbitrage, macro event driven and down the line. There are, there are different commodity strategies thinking about industrial and precious metals, things of that nature, and then even collectibles fine art, cars, coins, stamps. It can be a long list in terms of things that fall outside of that traditional asset class framework that we often refer to as alternatives. But private equity specifically you have firms that specialize investing in private companies and we refer to them as the general partners and the general partners are tasked with raising pools of capital.

Jeff Mills:

So often known as funds from investors, and then they subsequently take that capital and they invest in private companies at various stages of development investors that allocate capital to these private equity funds are called limited partners. So they generally consist of institutional investors and individuals that meet certain accredited investors standers, and the limited partners really abdicate all of the operational oversight of the portfolio companies to the general partners and the general partners often become actively involved with those portfolio companies in order to unlock value for those businesses, and then subsequently the investors in those businesses. There’s all kinds of different styles and private equity. It’s often the portfolio company stage of development that determines the label that we put on it within private equity. So you have venture capital and angel investing, which is the very early stage of investing in private companies.

Jeff Mills:

There’s a growth equity, which is a little bit further along, but still quite early in a company’s development. You have distressed and special situations. So as the name implies certain companies that are dealing with particular issues or special situations really are anything that can fall outside of the more traditional buckets that I’ve mentioned. But the one I haven’t mentioned is buyouts, and that’s really the largest component of the private equity world. If you look at the private equity funds that are raised globally, most of them fall into that buyout category. So when you see private equity firms invest in companies in this category, they usually take a majority stake in the business. They play a very, very active role in managing the operations of the company. And the company is usually fairly established. It’s not, it’s not a very early stage investment like venture or even growth equity would be.

Jeff Mills:

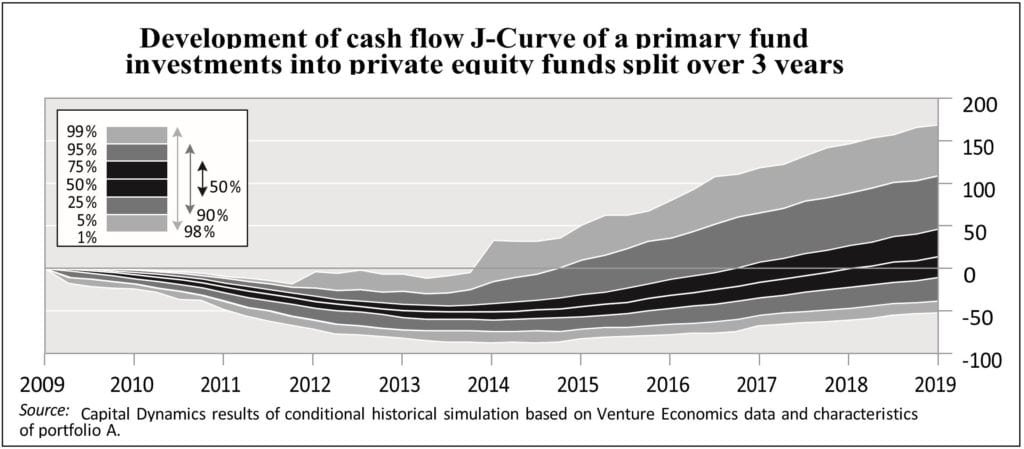

So just shifting gears a little bit in thinking about, you know, now we know what private equity is at a very basic level. Now let’s think about, you know, why we think it could be an opportunity and why there is the opportunity to deliver out performance. If done well when investing in private equity. So as we’ve said, when these general partners take an ownership stake in a company, they typically purchase most and, in some cases, all of the equity in the outstanding company, and therefore the general partners get really actively involved in running the day to day operations. And that’s clearly not a scenario that’s commonly found in, in investing in publicly traded equity portfolios. So that’s certainly part of it. They also have a longer time horizon than the typical stock market investor. And I think they have a clearly defined exit strategy for each investment that’s made.

Jeff Mills:

You have skilled managers within this buyout cohort that we’re talking about, and they really can augment future value by getting in there and making management changes, controlling costs, improving operational efficiencies, potentially identifying new customers in an effort to grow revenues. So there are lots of ways that these managers can get their hands in these businesses and make positive changes that can ultimately impact the value of the company. You know, you have, you have companies with founders that are often very innovative and they have a considerable amount of technical expertise, but often they aren’t as adept at running the day-to-day operations of the business. And this is where a skilled private equity operator can come in and really have a big impact. And I think the willingness of these investors to make decisions that are in the best interest of the shareholders of these companies and in the, in the company’s interest for that matter for the longterm, as opposed to trying to manage to these quarterly earnings reports that you often see in the public markets.

Jeff Mills:

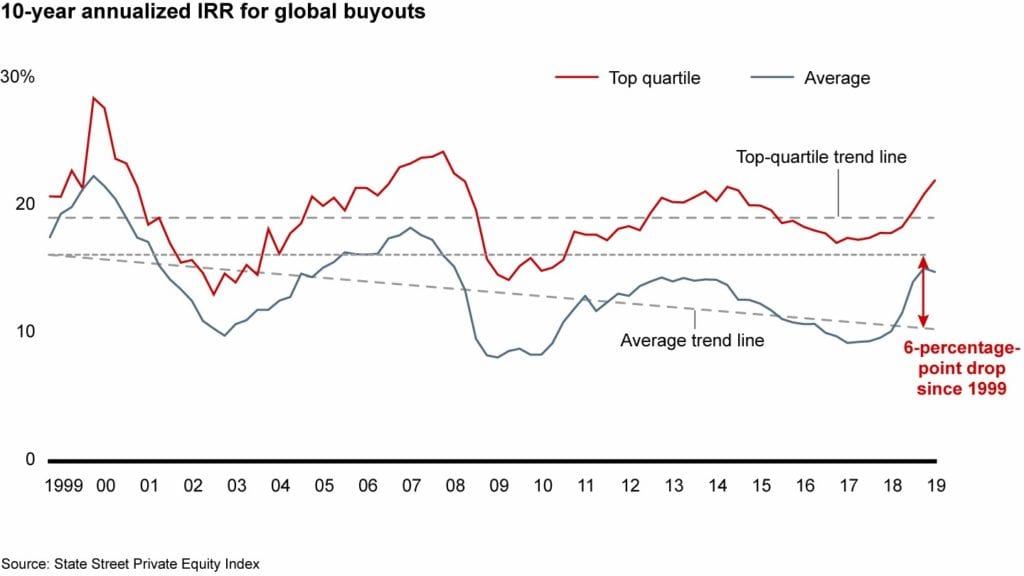

I think that’s also a key reason why you can deliver out performance. Again, if you are investing with a skilled private equity manager who has, you know, the ability to, to make the proper changes to unlock value. We think that looking in the middle market space is one of the more attractive areas in private equity. When we say middle markets, usually targeting businesses with enterprise values, so equity plus debt minus cash between a hundred and $500 million. We think that it’s this segment of private equity that really offers the, the biggest opportunities for significant improvement. We also think there, there is more opportunity in terms of the number of investments in this space. You don’t, you don’t have the kind of mega mega buyout, mega private equity funds chasing as many opportunities in the middle market space. You can often, and I think because of that, you can often get more attractive entry multiples when looking at companies in this space as well.

Jeff Mills:

And therefore the possibility for that multiple expansion or valuation expansion is more possible there when the investment is ultimately exited. So, so why now, why do we think private equity is particularly interesting? Now I alluded to that earlier, so I’ll go into two reasons. One is, is really just a shifting market structure that we’re seeing. And the other is more related to what’s going on specifically right now with the business cycle and the current challenges that have been created by the pandemic. But first the changing market structure. So you have this world where interest rates have been suppressed for a very long time. You’ve seen moderate economic growth over the past 10 years or so. And what you’ve seen in the public markets is investors really willing to pay top dollar for public companies that are able to demonstrate strong and consistent growth characteristics.

Jeff Mills:

So you’ve had this slow GDP expansion in recent decades throughout the U.S. And really most the developed world. So investors have piled into stocks like Amazon and Microsoft and Apple desperately searching for this above average growth in a below average growth world. And I think as a result, these street, these three stocks, just as an example, now, account for almost 20% of the S&P 500, and they carry an average price to earnings ratio of over 45, that’s compared to about 22 or so for the overall S&P 500. So you can see the, the value discrepancy there and investing in high growth companies in the public markets, you know, it’s become more expensive because I think the opportunity set is smaller. For example, we have a chart in the paper that we wrote, which I hope everyone takes a look at.

Jeff Mills:

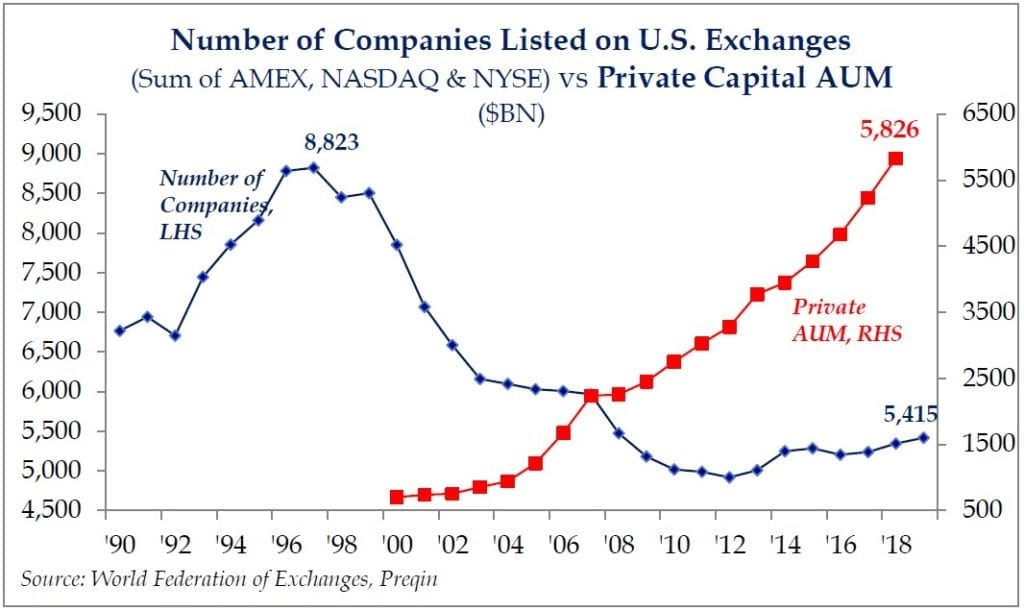

We’re seeing fewer technology IPO’s as an example, and the IPO’s that do come to market they’re happening much further along in the company’s life cycle. So you’re not getting that initial growth phase, which can often be the most exciting and, and the most robust in terms of the speed at which the company is adding value, growing revenues and ultimately growing earnings. And just as an example, so the number of stocks in the S&P 500 with sales growth above 15% on an annual basis has dropped from almost 225 in the early 2000s to only 66 today, if that puts into context here, what I’m talking about. And even if we pull back our lens further, we see that the pub, the number of public companies in general has significantly decreased. So there were over 8,000 publicly listed companies in the mid 1990s.

Jeff Mills:

That number has fallen to under 5,000 today. And this compares to the universe of companies that are backed by private equity, which stands at over 26,000. So I think when you’re expanding your investible universe to include private equity, it not only increases and investors opportunity to invest in high growth companies, but it just increases the opportunity set in general to find good companies where value can be added and multiples can expand, and investors can ultimately earn a return. So I mentioned the opportunity created by COVID-19, what’s going on with the economy, and specifically here, what’s going on in that middle market space. So I’ll reiterate, but just in general, we think that a focus on these middle market companies has the opportunity to create the best performance results within private equity. Like I said, I think the opportunity set is larger. You have less big funds chasing these deals in that space and private equity.

Jeff Mills:

And then these private equity managers, they really do have the opportunity to have a material impact on the growth trajectory of these smaller companies. If they have a true operational expertise, which is really where we want to focus our efforts and where we want to point our capital in the private equity space. So today I think investors have this opportunity to allocate to the middle market within private equity at the inflection point of this current economic cycle in the aftermath of the pandemic. And hopefully the recovery as we move forward here through 2021. So private equity managers are already taking advantage of decreased valuations in the space. I think more private companies are seeking investment capital during this current market dislocation, so that therefore makes the prices of a lot of these deals more attractive. And middle-market companies were the engines of economic growth during recoveries from past downturns.

Jeff Mills:

And because of that, you saw outsized returns for private equity investors. And I think, you know, using that period or that vintage of investment during, and just after the financial crisis, is a perfect example of that. You saw that vintage year of private equity funds produce significantly above average returns specifically, because I think skilled PE managers can point the capital to companies who are going to be able to recover and re-accelerate at that inflection point in the business cycle. I think in this environment and in environments like this in the past mid-market companies are increasingly receptive to outreach from potential private equity investors. I think especially when capital can be scarce from traditional sources, you know, banks are dealing with the same issues that we’re all concerned with, and they’ve taken large loan loss provisions, and they’re being very careful about the credit that they do put out as the economy continues to heal.

Jeff Mills:

So that’s when I think private equity managers can step in and provide that needed capital to companies that aren’t necessarily broken, but need that capital to get through this particular period of time before they can again start growing. So I hope that was interesting. It was a very brief overview of what we believe private equity is, kind of the opportunities that we see now and, and some of the ways that we’re choosing to approach getting exposure to the asset class. So as always really appreciate you listening, we’re always available for questions be well, and thanks so much.

Closing:

This has been a production of Bryn Mawr Trust. Copyright 2020. Visit us online at BMT dot com forward slash wealth. The views expressed herein are those of Bryn Mawr Trust as of the date recorded and are subject to change without notice. Guest opinions are their own and may differ from those of Bryn Mawr Trust and its affiliates and subsidiaries. This podcast is for informational purposes only and should not be construed as a recommendation for any product or service. BMT Wealth Management provides products and services through Bryn Mawr Bank Corporation and its various affiliates and subsidiaries, which do not provide legal, tax, or accounting advice. Please consult your legal, tax, or accounting advisors to determine how this information may apply to your own situation. Investments and insurance products are not bank deposits, are not FDIC insured, are not backed by any bank or government guarantee, and may lose value. Past performance is no guarantee of future results. Insurance products not available in all states. Any third p

Husband And A Wife I

Webcam Lazyasses Fuck Show

Tit Xxx Free

Pov Handjob Anal

Curvy Girl Strip Ass

Private equity, venture capital | BMT

PODCAST: Private Equity - BMT

Private equity, venture capital, corporate finance | BMT

BMT Private Equity - tadviser.ru

BMT Private Equity - TAdviser.ru

BMT Private Equity Investor Profile: Portfolio & Exits ...

BMT Private Equity Последние новости

Новости по тегу BMT Private Equity - Интерфакс

venture capital · private equity | bm|t › next level funding

Основным владельцем BelkaCar стала структура основателя ...

Bmt Private Equity