BANKllect - First Worldwide Bank Network

funkyies

Hello to all and welcome to my ICO review . For those of you who don’t know me yet, let me introduce myself. My name is Funke and I’m an experienced writer who enjoys what he does very much. I’m here to give you all the information you might need or want about theFirst Worldwide Bank Network that gives all its participants a peer-to-peer possibility to earn .Our Sphere token doesn't depend on other tokens and coins. I plan to make them “easy read, to the point” because what’s important to me is that we all comprehend and absorb the information and actually want to be here learning together about something new.

Today, let us all learn and experience together all about BANKllect. If you don’t know anything about them, don’t run away, that’s why I’m here, to change that within the next few minutes. Before I begin, I just want to quickly mention that I will be including LINKS so that YOU can do your own research or whatever you feel you need. I feel it’s best to have all of the information in one place, in an organised manner, rather than dotted about the page making what you want hard to find or confusing. All these links will be put at the BOTTOM of this page to keep things easy.

BANKllect is a decentralized shared bank organize. Its primary assignment is to make an exceptional and new age bank environment where every it member will have a probability to pick a required bank benefit and win on it. The key distinction from as of now displayed crypto bank arrangements (Bankera, Polybius, Datarius, Crypterium, Change, and so on.) is that BANKllect proposes a progression of bank-centered administrations in the path not quite the same as what the conventional banks do.

At the heart of BANKllect network is a participant. The participant is an individual or company with or without initial financial capital (fiat money, coins, tokens). Our own technology «Proof of Participation (PoP)» allows the participants to earn money by a degree of its activity in BANKllect network.Vision

As for our strong team’s certainty there are two main direction of bank services development in crypto market. The reason for this classification is effected by the fact that the majority of current bank-oriented crypto projects don’t focused on methods of client collaboration which are different from traditional bank methods.

In contrast to innovative approaches which crypto market can give to their users 99% of projects simply copy the traditional bank’s functionality. This kind of projects is incapable of transforming and improving the global bank system because of its initial commitment to traditional bank system through licenses.

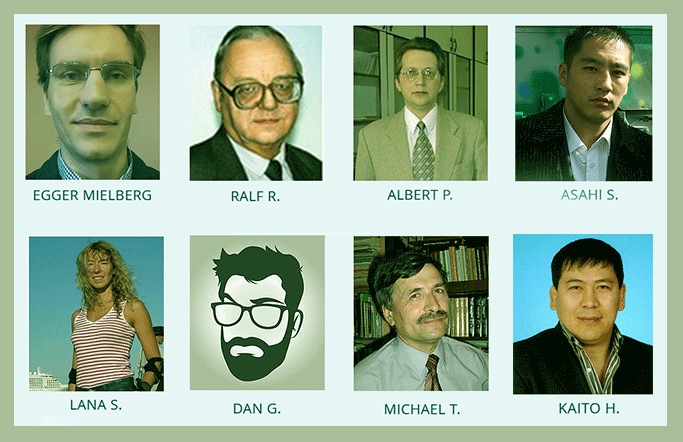

I am going to get straight to the point of who they are since this is such an important factor, as I like to put it, “The Brains behind BANKllect ”. If the team behind the product or service in question haven’t the resources or knowledge, then we know the product or service delivered will possibly not have the quality it should have. We need to know two very important things when we look at a new starting up company:

Who are the people/team behind this?

What experience and knowledge do they possess?

Okay, so, because I’ve already done all the research needed beforehand and thoroughly BANKllect I can very happily confirm that this company has a fabulous team onboard. Here they are:

BANKllect SOLUTIONS

MICRO LOAN SYSTEM (MLS)

MLS is specifically designed for participants of BANKllect network who, first, would like to earn some money using own cryptocurrency, second, would like to get some money for own needs.

VENTURE CAPITAL PLATFORM (VCP)

VCP is, first of all, designed for development of crypto market. VCP connects both sides, venture capitalists and professionals for a single goal – «Creation of Innovative Products in Crypto Market».

PROGRAM OF COLLECTIVE DEPOSIT (PCD)

In compared with Program of Individual Deposit, PCD connects two or more participants of BANKllect network for the purpose of sharing risks between each participant involved in deposit contract (smart contract). PCD also gives an opportunity for earning extra money through mechanism of collectively accumulated crypto tokens.

PROGRAM OF INDIVIDUAL DEPOSIT (PID)

PID connects one single participant to another single participant of BANKllect network for the purpose of signing a deposit contract (smart contract).

SYSTEM OF ASSET ASSESSMENT (SAA)

SAA is a modern IoT-based methodology of assessments of fiat assets. An object of the assessment can be a property of as an individual as a company. The main goal of SAA is tokenization of the assets.

MULTICURRENCY EXCHANGE SYSTEM (MES)

MES will let do an exchange from any cryptocurrency that is presented on crypto exchange. The exchange can be done as for other cryptocurrency as to fiat.

IN DEVELOPMENT

Individual Credit Program

Collective Credit Program

Client Insurance Program (for participants of BANKllect network)

Currency Exchange System

THREE WHALES OF BANKllect

A. Self-regulated Intellectual System (SIS)

At the heart of SIS lies three core principles:

Equal conditions of collaboration between participants of BANKllect network.

Inviolability of participant data.

Transparency of participant activity.

SIS determines a series of rules of participant collaboration. SIS gives an unique possibility for participants of BANKllect network to themselves establish norms and rules during the process of signing (accepting) of a single-side or multi-side smart contract. The participants will be able to themselves track and control as the activity of BANKllect bank as the execution of smart contracts.

Anti Money Laundering System (AMLS)

At the heart of AMLS lies two innovative technologies:

System of analysis of participant activity.

Algorithm of cross-referenced identification.

System of analysis of participant activity is based on an advanced technology of multilayers Rosenblatt perceptron. It allows not to only identify direct actions of participants such as money transfer, debit of participant wallet, credit of participant wallet, loans of any kind, but indirect actions such as relationship to financial bank deals.

Algorithm of cross-referenced identification is based on methodology of directed graph. The algorithm allows to practically identify any participant with minimum initial data about his or her activity.

Client-Guard System (CGS)

At the heart of CGS lies a flexible system of client classification. The system allows each participant of BANKllect network to decide what kind of his or her personal or business information will be public or not. CGS gives an unique possibility for participants of BANKllect network to save their most important information in cryptographic BANKllect bank cell. BANKllect bank proposes an official guarantee of safety of participant cell. Moreover, insurance of cell entry will be included.

PRE-ICO-Bonus Program

EXTRA-PROPOSAL

I hope you have enjoyed today's review and my company along the way. Thanks for taking the time and will hopefully see you all in the next one.

For more information, please visit:

Website : https://www.bankllect.com/

White Paper : https://docs.wixstatic.com/ugd/570870_6692ff2d06f54b4a8f97439650dca001.pdf

Facebook : https://www.facebook.com/bankllect/?modal=admin_todo_tour

Twitter : https://twitter.com/bankllect

GitHub: https://github.com/BANKllect

Author

funkyies

BITCOINTALK PROFILE: https://bitcointalk.org/index.php?action=profile;u=1971452