ICO in Legal Terms: An Offering of Securities Tokens

@lawlesstechSecurities tokens seem to be a more attractive investment than utility tokens as they give token holders some specific rights regarding the issuer company, e.g. voting rights, profit sharing rights, a stake in the share capital, etc.

Albeit securities tokens attractiveness, the legal model of the offering constitutes additional risks related to securities legislation. For example, a company may be fined for violations of issuance prospectus or offering securities tokens without observing the legislative rules.

In the “ICO in Legal Terms” series of articles, the lawless.tech team describes the legal peculiarities of the ICO phenomenon. The previous articles covered ICO in general and the utility tokens sale model. Today we will discuss the securities token model.

Howey Test

If a company plans to make a real securities offering, it has to meet strict statutory requirements in most jurisdictions. The securities legislation in the U.S., for instance, is based on the following concept: all investors, whether large institutions or private individuals, should have access to certain basic facts about the investment prior to buying it, and so long as they hold it. Thereby, the Securities and Exchange Commission (SEC) as a securities market regulator will carry out all actions that it would deem necessary to protect U.S. investors and the securities market in general.

Projects which sell tokens to the U.S. citizens should play it safe just not to violate the securities laws. Otherwise, the ICO may be halted, projects may be fined and, in some rare cases, founders can get a prison sentence. Thus, it’s fairly important to keep in line with the laws and abide by all rules regarding the securities offering. The tool that can help one avoid problems is called the Howey test.

The Howey test determines whether a financial instrument is a security or not. The test consists of four components, all of which have to be met to define a token as a security in the U.S. These four components are: (1) investment of money (2) in a common enterprise (3) with a reasonable expectation of profits (4) to be derived from the entrepreneurial or managerial efforts of others.

Let’s go over those components to figure out what does each of them mean. “An investment of money” states that the project’s tokens are being sold for money. The judicial practice suggests that the “investment of money” doesn’t necessarily mean cash. The SEC clearly stated that “In spite of Howey’s reference to an ‘investment of money,’ it is well established that cash is not the only form of contribution or investment that will create an investment contract.” Thereby, tokens purchased for bitcoin or ETH meet this requirement, and nearly any token sale is an investment of money since it’s a sale.

A tokenized system may be considered a “common enterprise” if the reward for any kind of effort contributed to the system (such as mining) has influence on other participants’ rewards. Any tokenized system involving efforts of their token holders to update and enhance the system is likely to be deemed a common enterprise. Moreover, a system may be treated as a common enterprise when an individual contributor’s profits depend on the issuer’s expertise.

In turn, the third component stipulates that an investment should be made “with a reasonable expectation of profits”. It’s important to note that what the SEC means here is the expectations of the project’s investors, and not the project’s team. If investors or contributors purchase tokens expecting to sell them later for profit or hold them to get periodic payments, authorities will have the grounds to qualify said tokens as securities.

The last component states the investors expect their profits “to be derived from the entrepreneurial or managerial efforts of others”, meaning that investors expect a well-known team or a team member to develop a product that eventually generates the profit. The SEC points out the central issue as “whether the efforts made by those other than the investor are the undeniably significant ones, those essential managerial efforts which affect the failure or success of the enterprise.” So, the best way to avoid meeting this criterion is to give investors a right or an option to take part in the final product’s development (offer advice, comment on the development, vote for changes etc.). In case of an ICO, a project may allow its contributors to help develop an open source code or search bugs and exploits, so its success would depend on investors/contributors efforts as well.

Only in case the token meets all four criteria, the SEC will qualify it as a security therefore forcing the issuer to comply with the existing securities legislation. To sum up all aforesaid, prior to distributing their tokens, projects should check their positioning and marketing activities thoroughly, as well as seek professional advice from legal experts. By the way, here you can take the test and determine whether your token is a security. Anyway, the best approach to understand this model is to go in depth and review use-cases.

Blockchain Capital Case

The first case is Blockchain Capital. It is one of the first venture capital (VC) funds that started investing in Bitcoin and blockchain ecosystem. In April 2017, during the third round of an old-fashioned financing, Blockchain Capital has decided to undertake an ICO. According to all sources, Blockchain Capital was selling securities tokens on III Digital Liquid Venture Fund, using Regulation D 506(c) and Regulation S as an exemption from the obligation to register tokens as securities.

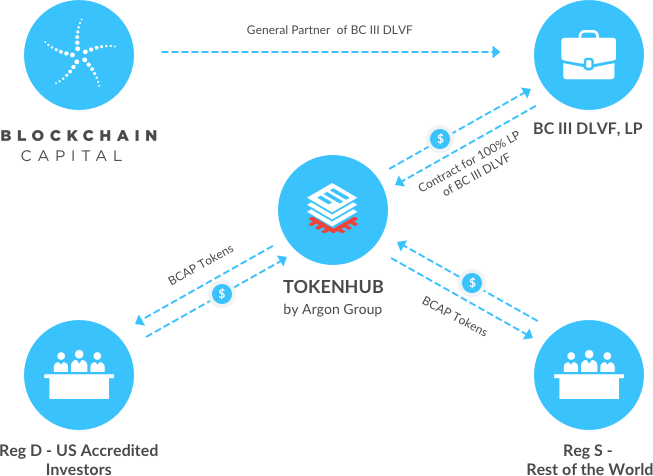

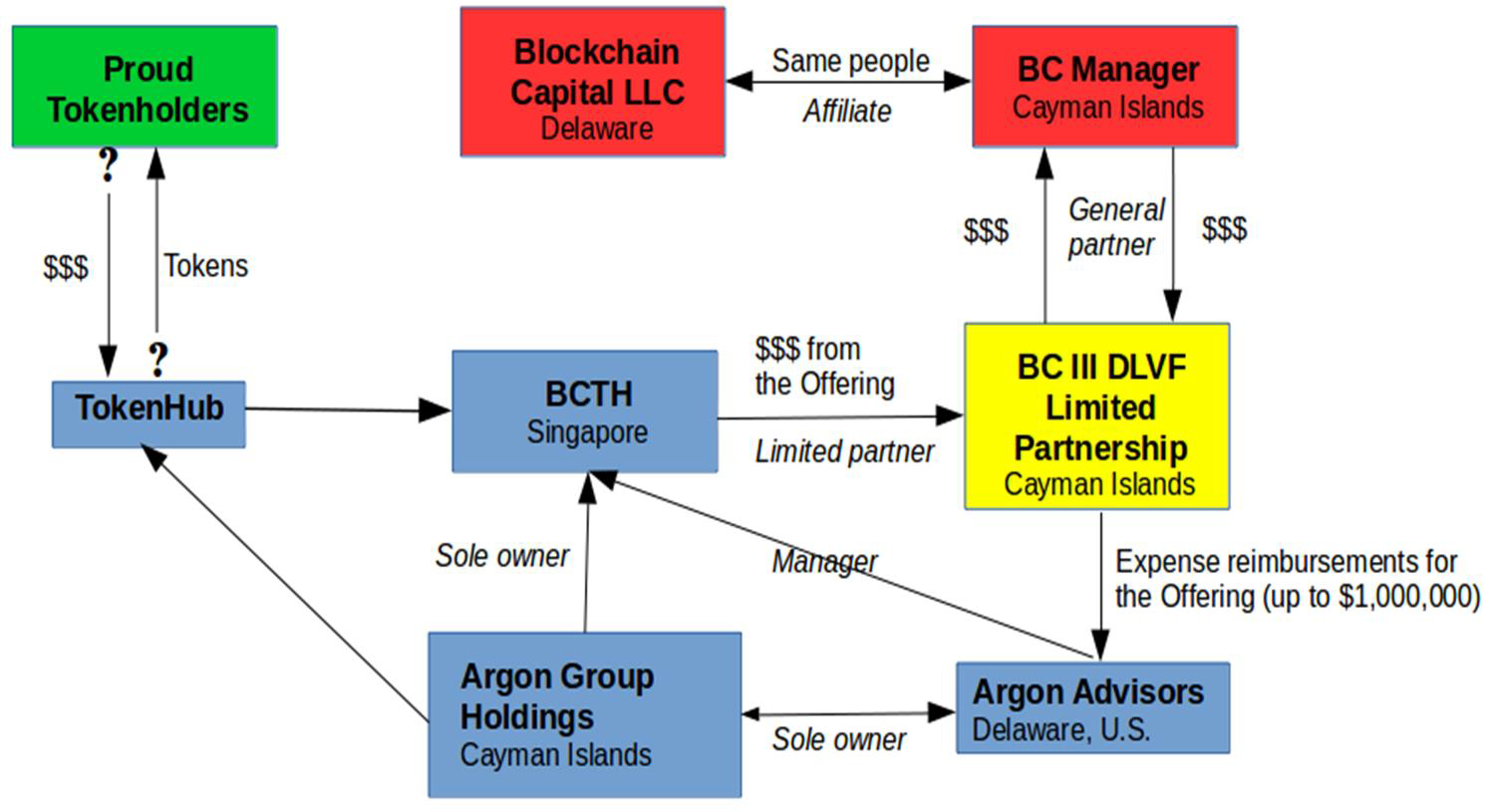

There were rumours that Blockchain Capital allowed several investors to acquire a stake in the share capital, which has given them rights to receive dividends from the fund’s activities. It’s hard to check if it’s true. Anyway, in order to distribute the tokens, BCAP used TokenHub as an intermediary embedded in a complicated tokensale structure as shown below:

This article describes how the Blockchain Capital was structured and what it exactly offered (still, it’s important to note that the lawless.tech team doesn’t share the author’s point of view.)

Was it a success after all? Investors received no warranties, the tokens offered no valuable rights to the investors, and, after all, were listed only on two exchanges: Liqui and EtherDelta. Other exchanges opted to play it safe and refused to list tokens that can be deemed securities.

Sure, it wasn’t a perfect offering, however, it showed that there is another way to raise funds and use tokens. As a result of a complicated but efficient token offering structure and other related work, Blockchain Capital raised $10M in just 6 hours, which is a fairly good timing for the given cap. What is even more important, however, is that it proved that not just software projects but even venture capital funds may raise money via an ICO by offering securities.

The DAO case

The other case is the infamous token sale of The DAO. It was a digital decentralized autonomous organization as well as a form of investor-directed venture capital fund. The DAO’s crowdsale ended in the late May, 2016. At that time it has raised $165M, which was a record amount for any ICO.

However, The DAO hasn’t registered its tokens as securities and hasn’t complied with the existing securities legislation. At the same time, The DAO has promised token holders voting rights as well as profits in the form of dividends from the company's activity thus effectively establishing its tokens as securities.

After The DAO has been hacked and approximately $60M was stolen from the project’s smart contract, the U.S. Securities and Exchange Commission launched an investigation. According to the report, the tokens that were issued by The DAO are considered securities under the Securities Act of 1933 (“Securities Act”), and the Securities Exchange Act of 1934 (“Exchange Act”) and, thereby, The DAO has violated securities legislation as mentioned above.

The fact that the SEC decided not to seek legal action against The DAO seems to be pure luck and should be viewed as a rare exception from the general rule. It’s not quite clear right now whether The DAO will be eventually held liable, however, the SEC is known to have halted numerous ICO’s on similar grounds, and it’s only logical to assume that the share of those held responsible for violating securities laws will grow over time.

Anyway, a securities offering model also includes another major framework that allows one to conduct Initial Coin Offering in a completely legal way and, at the same time, to offer securities tokens to investors. This framework is known as SAFT (Simple Agreement for Future tokens). The lawless.tech team will describe the conception of SAFT and Filecoin case in the next article.

Conclusion

An offering of securities tokens requires meticulous preparations and good lawyers on the project’s side as it’s fairly important not to violate the existing securities legislation. The best practices are to use various legislative exemptions that allow one to offer securities or obtain all required licenses. Still, the latter approach suggests that one uses a complicated corporate structure which is likely to require a large amount of money.

The outstanding case of Filecoin and SAFT Agreements framework will be described in the next article.

Join https://t.me/lawlesstech to keep the finger on the regulatory impact of lawless technology and learn more about the legal side of ICOs with this series of upcoming articles.